Why AT&T Is Currently a Better Investment Than Verizon - Seeking Alpha

Technicals

Which of these telecommunications heavyweights has more go-forward promise for the prudent investor?

Background

These two telecom giants dominate the U. S. market.

AT&T, Inc. has a bigger overall footprint, marking total revenue of $124 billion last year. In addition to traditional wireline and wireless services,AT&T offers Web hosting, application management, security and integration services, customer premises equipment, satellite video, and U-verse television services. The company’'s Advertising and Publishing segment publishes Yellow and White Pages directories and sells directory and Internet-based advertising. Further, AT&T provides collaboration services to businesses in various industries, including retail, financial services, manufacturing, healthcare, and telecommunication.

Verizon Communications Inc. is considered the largest U. S. wireless carrier, boasting over 94 million accounts. Total 2010 revenues topped $106 billion. Verizon Wireless is a 55/45 joint venture with partner United Kingdom based Vodaphone (VOD). Verizon offers voice and data services, and sells equipment in the United States. The Wireline segment provides voice, Internet access, broadband video and data, Internet protocol network, network access, long distance, and other services in the United States and internationally. Verizon has divested significant chunks of its wireline assets: Note recent sales to Fairpoint and Frontier Communications.

Business Outlook and Prospective Stock Action

Of late, Verizon has become a Wall Street darling on the heels of the company's obtaining rights to market Apple's (AAPL) iPhone. In February, Verizon began to market the device, muscling in on AT&T's turf after the loss of its previously exclusive marketing rights. Investors and analysts were buoyant. In addition, Verizon has been ranked as one of the top customer service telecom carriers. Verizon stock had slumped in early 2010, bottoming at about $26 a share in July.

However, upon rumors of the iPhone news, the stock rallied strongly. It reached the current plateau of approximately $36 a share after the iPhone annoucement. Meanwhile, the Verizon / Vodaphone joint venture has been in and out of the news wires. Worries over future Verizon dividend payments to Vodaphone for its ownership interest has created concern about the disposition of VZ's future cash management, debt, and investor dividends. This fueled debate about Verizon buying out Vodaphone's share of the venture.

AT&T, on the other hand, has been dogged by a reputation of mediocre customer service and somewhat stodgy management. The investment community has fretted about future revenues after the loss of exclusivity rights to the iPhone, fearing a mass migration of customers to competitor Verizon. Share prices rallied from a low of $24 in July of last year to a high of $30 each early in 2011. Prices have since slipped to $28 a share, largely on the back of these fears.

Last week, the long-time AT&T CFO retired, further worrying some investors.

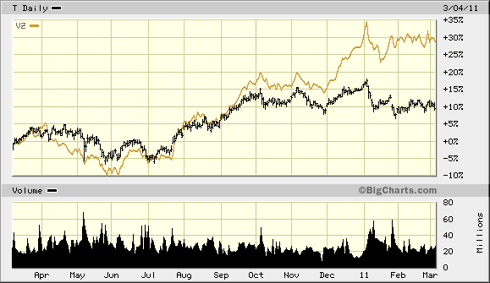

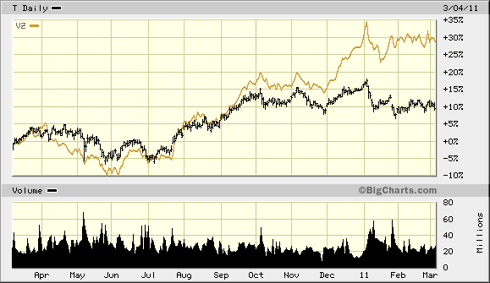

AT&T versus Verizon : One-year chart comparison (Click to enlarge)

Let's move onto some fundamental analysis.

Let's move onto some fundamental analysis.

Fundamentals

AT&T

- AT&T possesses a decent, but unspectacular balance sheet. The Debt-to-Equity ratio of 64% is acceptable for such a quasi-utility company. The respective Return-on-Equity and Return-on-Asset ratios of 18% and 7% demonstrate good financial efficiency. This is somewhat offset by a pedestrian 0.6 current ratio, though outstanding ratable cash flow mitigates this figure. Cash and short-term investments are listed at $1.4 billion, though this represents only 24 cents per share.

- The Equity / Asset ratio stands at 0.4, where renowned fundamental investor Benjamin Graham used a 0.5 or greater E / A ratio as a litmus test for undervalued equities.

Please hold that thought: AT&T stock is undervalued.

- At today's price, AT&T has a 9X Price / Earnings multiple. Its five-year average PE has been 15, roughly in line with the long-term S&P 500 average.

- The Enterprise Value (market cap + debt – cash) is over $39 a share, considerably greater than the closing price of nearly $28 each.

- When a company has a Price / Cash Flow less than 10, it's a positive signal for the value investor. AT&T has a P / CF ratio of 4.3.

- AT&T's five-year forecast EPS growth rate is 6 percent.

- AT&T enjoys a 27-year reign as a Dividend Champion, as compiled by SA contributor David Fish. This means the company has consecutively increased its dividend each year since 1983. The current annualized dividend of $1.72 a share offers the investor a generous 6.2 yield. This dividend payout is safe. Free Cash Flow covers it handily.

Verizon

- Verizon has a softer balance sheet. It is marked by both strengths and weakness. It is notably more leveraged than AT&T.

- The D2E ratio is 144%.

- ROE is 6%.

- The 0.7 current ratio is comparable to AT&T.

- While the Equity / Assets ratio is only 0.2, the company's Enterprise Value is nearly $53 a share. This is above the current trading price of $36. I will point out that when the EV is calculated as a function of current share price, AT&T's is even better.

- The current P / E multiple is 40. This figure has been skewed by a plethora of non-recurring charges that have been booked against income during the past year. A non-GAAP Price / Earnings multiple would be about 16X.

- The P / CF ratio is 3.6; very strong.

- The five-year forecast EPS growth rate is 9%, better than AT&T.

- Verizon has a solid 5.4% dividend yield. It is reasonable to conclude that it will continue to payout or increase it. Free Cash Flow covers it easily. Last year, Verizon generated $6 a share FCF. Even if one assumes that 45% of the total figure must be shared with Vodaphone (overstated), that still leaves Verizon with $2.70 share for payout to shareholders. This is more than ample to cover the $1.95 dividend.

Here is a side-by-side chart comparing some of the key fundamentals for the two companies:

AT&T | Verizon | |

Current Price | $27.91 | $36.08 |

PE (ttm) | 9 | 40 |

Forward PE (est. 2011) | 11.5 | 16 |

Dividend Yield | 6.2% | 5.4% |

Return-on-Equity | 18% | 6% |

Price / Cash Flow ratio (ttm) | 4.3 | 3.6 |

Equity / Assets ratio | 0.4 | 0.2 |

EPS growth (5-year estimated) | 6% | 9% |

Dividend Growth Rate (trailing 5-year average) | 5% | 4% |

Technicals

I favor using the technical charts to confirm or refute fundamental analysis.

AT&T's chart shows nothing to contradict the fundamentals. The stock is below it's 50-day MA and comfortably over the 200-day MA. There appears to be a near-term support base at $27.50 to $28 at share. I found the MACD, Slow Stochastic, and Money Flow indices to be neutral.

Verizon shares are well above their 50 and 200-day moving averages. However, the stock has stalled at the current $36 price level on somewhat lower volumes. The stock looks a bit overbought on the long-term weekly Slow Stochastic chart. For Japanese candle enthusiasts, a doji signal appeared on the current weekly chart, signaling market indecision.

Bottom Line

Despite critics' howls about AT&T's iPhone exclusivity loss, it appears the company offers greater 12-to-18 month investment value than Verizon. AT&T has more upside potential and less downside risk. Verizon is at or above fair market value. The stock has run up too far, too fast. It has future earnings baked into the share price already; perhaps reflecting overenthusiasm over iPhone rights.

Due to their mammoth size and business models, T or VZ should be considered value. Indeed, the genesis of both companies were rooted as telephone utility securities. The wireless revolution unleashed them to work in less regulated businesses. However, I suggest that the U.S. cellular phone markets are now nearly saturated. While new products and rate plans will continue to mark the competitive landscape, AT&T / Verizon will find themselves battling for market share and reducing operating “churn” more than enjoying year-over-year rapid organic growth.

Verizon's acquisition to marketing rights for the iPhone is a key development. However, in the near term, I believe its subsidy to entice customers to buy or switch to the device will dent short-term profits. Over time, this will be offset by ARPU (Average Revenue Per User) improvement for data plans. At the same time, AT&T will not stand still. It will counter punch. It is not clear to me what that will be. However, my thesis is that “nothing” is not a management response. If a rate war ensues it may hurt both enterprises, but I believe that AT&T has a broader business span to weather such a storm.

The iPhone will not lead to Verizon blowing out AT&T. AT&T is not going anywhere. If one wants to cash in on iPhone sales: Buy Apple (AAPL).

Both companies have decent balance sheets, solid cash flows, and safe dividends. However, AT&T has an edge with a better balance sheet, superior B/S financial metrics, and a more generous dividend. Verizon has somewhat better growth prospects.

Verizon's 27% stock burst since last summer has made the share price too rich, whether viewed on an absolute basis or versus an alternative investment in AT&T. Based upon my own research, I accept analysts' consensus midpoint earnings at $2.40 this year and $2.60 in 2012.

Placing a 12X multiple on this EPS, I forecast a 2011 target price of $29 share and a 2012 price just north of $31. Including the $1.72 per share dividend (assume it will be increased to $1.75 in 2011), this represents a two-year potential 24 percent uplift.

The consensus 2011 / 2012 EPS forecast for Verizon Communications is estimated at $2.25 and $2.60 a share, respectively. I place a somewhat higher 14X multiple on these earnings due to Verizon's better potential EPS growth rate.

Nevertheless, this offers an investor a 2011 target of only $32 (below the current $36 price!) and a 2012 target of $37, barely above the listed current price today.

I do not see Verizon stock fetching 16X earnings while investors assign AT&T a 12X multiple.

My thesis is that investors have ignored AT&T stock over the iPhone issue, while piling into Verizon. This has had the effect of undervaluing T and overvaluing VZ. A higher dividend yield and Dividend Champion status further enhances the AT&T thesis.

Risks include AT&T's inability to improve customer service, failure to stabilize growth prospects after the loss of iPhone exclusivity, or igniting a price war over it: thereby harming future earnings and cash flows for both companies.

Risks include AT&T's inability to improve customer service, failure to stabilize growth prospects after the loss of iPhone exclusivity, or igniting a price war over it: thereby harming future earnings and cash flows for both companies.

As a footnote, when picking stocks, I advocate business cycle sector rotation. The current environment is not optimum for Telecom stocks. They tend to perform best at the bottom of the economic cycle. Nonetheless, I encourage investors to diversify their portfolio: While I would underweight AT&T stock versus other sectors, I nonetheless find the valuation and dividend appealing.

Disclosure: I am currently long VZ. However, I have nearly scaled out as I position to buy T shares via cash-secured puts and limit order long purchases

Disclosure: I am currently long VZ. However, I have nearly scaled out as I position to buy T shares via cash-secured puts and limit order long purchases

Please contact me at msoreff@seekingalpha.com regarding Seeking Alpha's Premium Partnership Program.

ReplyDeleteThank you!

Matana Soreff

Please contact me at msoreff@seekingalpha.com regarding this email.

ReplyDeleteThank you,

Matana