"The difficulty of armed struggle is to make long distances near and make problems into advantages."

-- Sun Tsu, The Art of War

Given the market’s current certainty, investors can at least sleep better at night if they have filled their portfolios with stocks that, even on short-term signs of weakness, work as sound long-term investments. It’s no sin to express concern about your holdings’ exposure to risk, considering the avalanche of bad news permeating the 24-hour news cycle. However, investors who sold at the open on the basis of headlines actually sold near the bottom of Wednesday’s trading range. Some stocks, commonly viewed as long-term buy and hold investments, could offer tremendous entry points or an excellent change to add to your current position.

Here are some of the companies I might buy for my retirement accounts. For selection as a long-term hold in my retirement accounts, a stock should exhibit several key characteristics including:

· A first rate management team with a history of performance

· A dividend yield higher than I can earn in a bank account

· Growing revenue year-over-year

· Growing earnings year-over-year

· A book value that demonstrates real assets

· Selling at a discount due to reasons that are likely to be temporary in nature and won't permanently change the way the company operates

· Option trading available for the lowest risk entry possible

· Uniquely positioned in their space

To get lucky in the market, you should know the stocks you track inside and out. For example, some investors sold General Electric (GE) before asking questions like, "what is the risk?," only to realize afterwards that GE's nuclear power business accounts for approximately 1% of their business.

click to enlarge

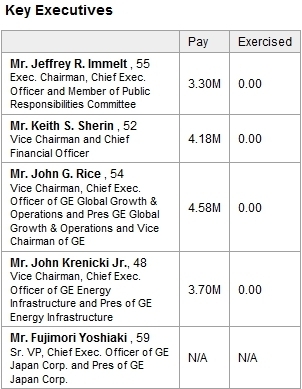

Shareholders who sold GE at the open because of headline risk found that they sold near Wednesday’s bottom. I have held GE more than once for durations of over a year. Trading near its 90-day moving average, it appears to meet all the requirements to make its way back into my retirement accounts.

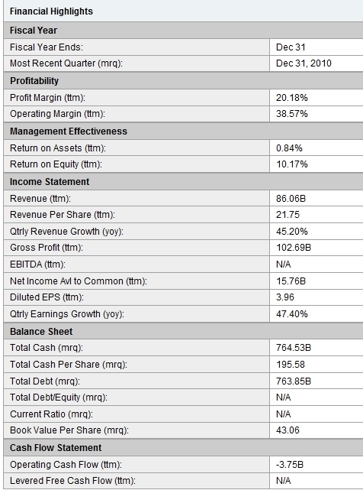

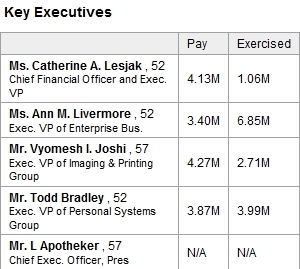

· First rate management team with a history of performance? Check. Jeff Immelt and team are the best of the best.

click to enlarge

· A dividend yield higher than I can earn in a bank account? Check.Current yield is 2.8%.

· Growing revenue year-over-year? Check. Growth is small, but almost 1%.

· Growing earnings year-over-year? Check. Last quarter is 50%, but that is not moving forward.

· Book value that demonstrates real assets? Check. Stock price is $19 and the book is over $11 per share.

· Selling at a discount because of reasons that are likely temporary in nature and will not permanently change the way the company operates?Check. Recent headline news has brought the price down significantly.

· Option trading available for the lowest risk entry as possible? Check.Options trade with high-volume.

· Uniquely positioned in their space? Check. GE is a leader in a multitude of spaces

I may sell short May $19 strike price puts for approximately $1.15 each. This would give me an effective price of $17.85 a share.

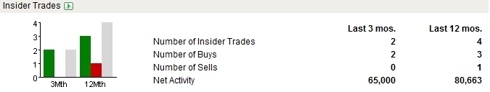

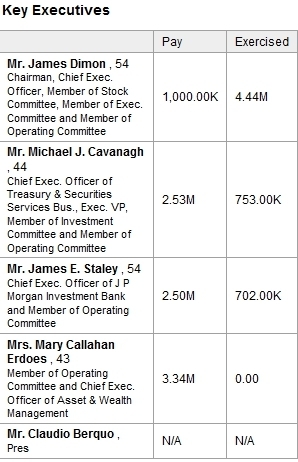

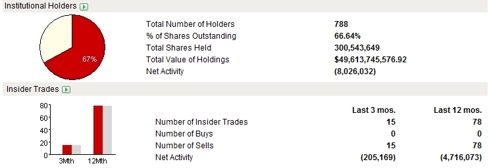

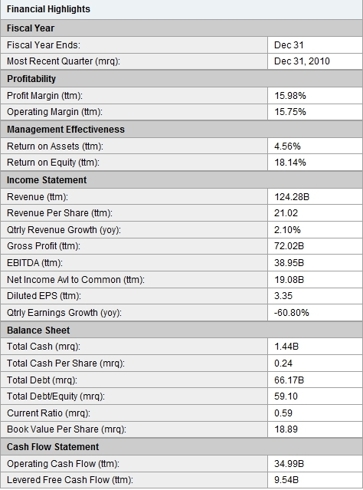

The next stock on my list is J.P. Morgan Chase & Co. (JPM), the $172 billion financial products company. JPM, along with the general market, has traded lower, recently offering a discounted buying opportunity. JPM does everything from prime brokerage to issuing consumer credit cards on a global basis.

· First rate management team with a history of performance? Check. Led by James Dimon, the executive team is first rate.

· Dividend yield higher than I can earn in a bank account? Check. This is a close call. With a yield of only 0.4%, it is higher than some and less than others. Compared to an on-demand, no-obligation account, it beats all local banks for me. Plus, incorporating the stock purchase with option plays will actually generate a higher yield.

· Growing revenue year-over-year? Check. Yes, although at a rate that is not expected to continue.

· Growing earnings year-over-year? Check. Yes, although at a rate that is not expected to continue.

· Book value that demonstrates real assets? Check. With a book value of over $43 per share, it may be possible to buy this company under book value.

· Selling at a discount due to reasons that are likely temporary in nature and will not permanently change the way the company operates? Check.The stock has moved down recently due to news.

· Option trading available for the lowest risk entry possible? Check.Options trade with high-volume.

· Uniquely positioned in their space? Check. In several areas, including professional money management services and consumer level financial services.

I am currently watching the May $42 strike price puts to sell for about $1.65 each. This would give me an effective price of $40.35 per share.

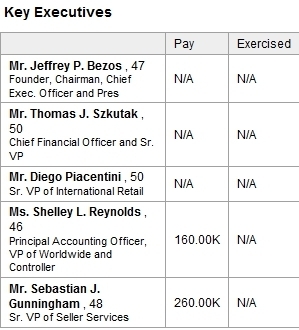

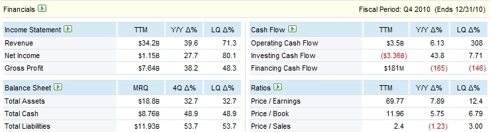

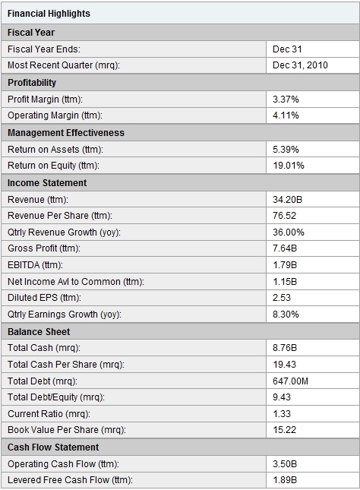

Amazon.com (AMZN), the $74 billion company best known for selling books online, does much more. AMZN offers a marketplace for online sellers with low barriers to entry, giving small Internet retailers a large presence. Amazon also offers cloud computing, with a wide spectrum of services enabling everyone from the smallest customer to the largest customers' computing services.

· First rate management team with a history of performance? Check.Jeffrey Bezos has been with AMZN since the start and knows the space as well as anyone.

· Dividend yield higher than I can earn in a bank account? NO CHECK here. With $8.7 billion in cash and debt of only $647 million and cash building up, it would seem reasonable that a dividend is more a matter of when than if.

· Growing revenue year-over-year? Check. Continuous.

· Growing earnings year-over-year? Check. Continuous.

· Book value that demonstrates real assets? NO CHECK here. This appears to be the biggest concern with buying AMZN stock.

· Selling at a discount due to reasons that are likely to be temporary in nature and not permanently change the way the company operates?Check. Recent headline news has pushed the price of the stock down.

· Option trading available for the lowest risk entry possible? Check.Options trade with high-volume.

· Uniquely positioned in their space? Check. When one thinks of buying a book online, the first thought for most people is to buy it from Amazon.

AMZN is perhaps the weakest in my group, but the positives outweigh the negatives by such a wide margin that I am including it. Because of the relative weakness compared to the other selections, I am going to be more conservative with an entry into AMZN. I am currently watching the July $130 strike price puts to sell for about $4 each. This would give me an effective price of $126 per share.

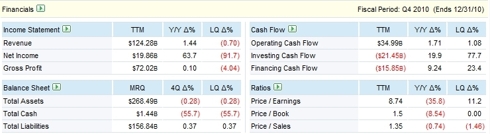

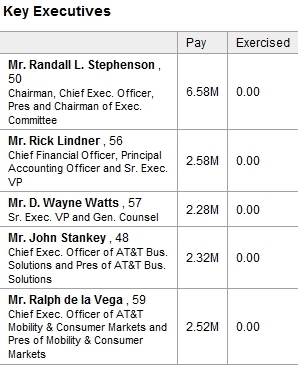

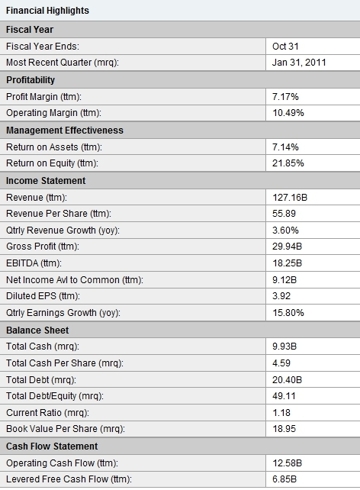

AT&T (T), the $162 billion telecommunications company, has been beat up because of issues with their cell phone division. They recently lost their exclusive contract with Apple (AAPL).

click to enlarge

While the initial impact of lost customers may put some pressure on revenues and earnings, the customers lost were more AAPL’s customers then T’s customers.

click to enlarge

What remains are customers that T can truly call their own. It’s reasonable to expect that their experience moving forward should be better with less demand on T’s network. Because of this reason, I am overlooking the recent quarterly earnings growth number as it appears baked into the current stock price.

· First rate management team with a history of performance? Check. Led by Randall Stephenson.

click to enlarge

· Dividend yield higher than I can earn in a bank account? Check.Currently over 6%.

· Growing revenue year-over-year? Check. Double digits.

· Growing earnings year-over-year? NO CHECK. I believe this will reverse quickly.

· Book value that demonstrates real assets? Check. Book value high relative to stock price.

· Selling at a discount due to reasons that are likely to be temporary in nature and not permanently change the way the company operates?Check. Headline news has pushed the stock down recently.

· Option trading available for the lowest risk entry as possible? Check.High-volume.

· Uniquely positioned in their space? Check. Offers landline telecommunications, cell phone, and internet.

I am currently watching the July $27 strike price puts to sell for about $0.72 each. This would give me an effective price of $26.28 per share.

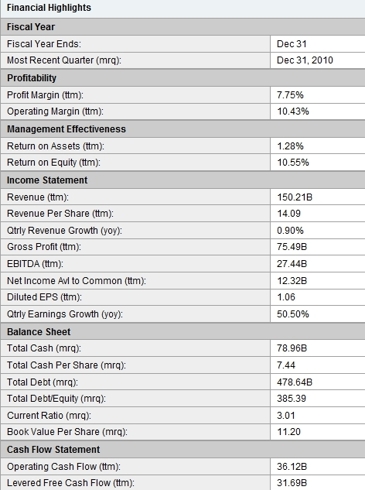

Hewlett-Packard (HPQ), the $88 billion technology company has had some recent positive news coming from corporate headquarters.

click to enlarge

HPQ will increase future dividends to $.12 per share. This represents a 50% increase from the previous dividend. HPQ also announced equally as encouraging news: The company may increase the dividend further going forward. I have increasingly become a fan of HPQ.

click to enlarge

The relatively new head of HPQ, Leo Apotheker, had even more good news for investors. Mr. Apotheker guided earnings to $7 per share by 2014. This amounts to an increase of over 35% in earnings within the next three years.

· First rate management team with a history of performance? Check. Leo Aptheker is the brand-new head and I believe an excellent choice.

· Dividend yield higher than I can earn in a bank account? Check. A close call at .8% yield. With the use of options we should be able to get the yield up above 1%

· Growing revenue year-over-year? Check. Single-digit growth.

· Growing earnings year-over-year? Check. Double digit growth.

· Book value that demonstrates real assets? Check. Not as high as I would like to see, but high relative for the technology space.

· Selling at a discount due to reasons that are likely to be temporary in nature and not permanently change the way the company operates?Check. Headlines have pushed the stock price down

· Option trading available for the lowest risk entry possible? Check. High-volume.

· Uniquely positioned in their space? Check. HPQ makes professional grade computers and servers.

I am currently watching the May $39 strike price puts to sell for about $1.60 each. This would give me an effective price of $37.40 per share.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in GE, JPM, AMZN, MRK, HPQ, T over the next 72 hours.

Additional disclosure: I may short UAL (I have within the last month) and or short AAPL within the next 72 hours.

No comments:

Post a Comment