Dataroma.com tracks investment activities of successful value oriented “super investors” such as Warren Buffett and Bruce Berkowitz. This article examines the top 10 most owned technology stocks by the 49 investors tracked by Dataroma. While General Electric (GE) and 3M (MMM) are not typically categorized as pure technology stocks, I included them as both are significant players in many fields of technology.

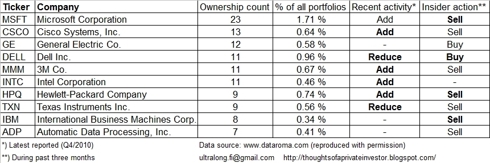

Microsoft (MSFT) happens to be the most owned stock out of all stocks. Cisco Systems (CSCO) is also one of the top 10 most owned stocks. From the chart above you can see the ownership count (as number of the tracked funds holding the stock) and also the value of these holdings compared to all holdings of all funds tracked. In addition, you can see the recent aggregate activity of the fund managers and insider action during the past three months. Significant activity towards the indicated direction is highlighted with bolded text.

It is interesting to see that in many cases insider actions are opposite to those of fund managers. This might be due to the different time period observed or because they simply have different views and investment goals. In most of the cases, insiders are selling. In case of Microsoft, HP (HPQ) and IBM insiders sold $606 million, $59 million and $48 million worth of stocks respectively. At Dell (DELL), insiders bought some $100 million worth of Dell stocks.

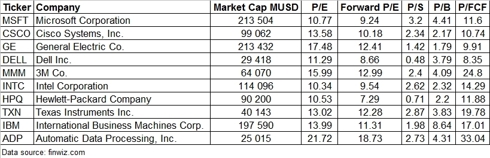

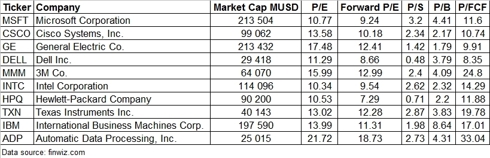

Looking at P/E and forward P/E values in the above table, most companies seem to be fairly valued. In terms of other financial ratios there are significant differences. From my point of view Microsoft, Cisco, GE, Dell, Intel (INTC) and HP seem the most attractive ones. Intel is the clear dividend champion (3.49% yield) while HP pays only a very small (0.77%) dividend and Cisco and Dell do not pay dividends at the moment. Microsoft and GE have yields between 2.5% and 3%.

In terms of profitability, Microsoft, Intel and Texas Instruments (TXN) stand out. They all provide over 20% return on assets, over 25% return on equity and have gross margins north of 50% and profit margins between 20-30%. They are also low on debt.

All things considered, Microsoft and Intel seem to be the most attractive ones out of the examined stocks. Cisco, GE, Dell and HP are also worth considering in my opinion.

Disclosure: I am long MSFT, CSCO, INTC.

No comments:

Post a Comment