"The difficulty of armed struggle is to make long distances near and make problems into advantages."

-- Sun Tsu, The Art of War

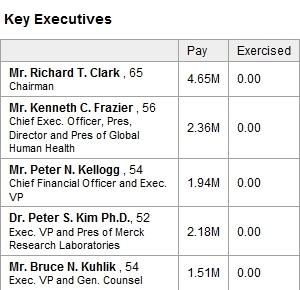

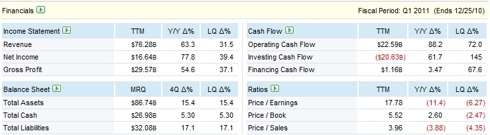

Merck & Co. (MRK), the $96 billion pharmaceutical giant, may not be as sexy as some smaller pharmaceutical companies that are on the cutting edge; however, MRK has the desired stability for a retirement fund holding.

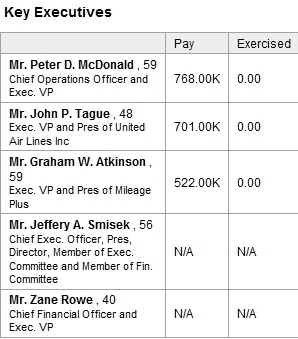

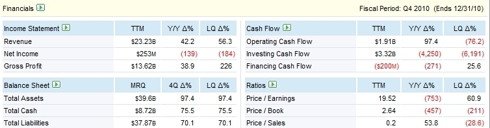

click to enlarge

MRK’s lineup of new drugs started looking like an empty medicine cabinet so the company merged with Schering-Plough. This should aid in getting new products to market and lower reliance on generic sales which have generic level profits.

· First rate management team with a history of performance? Check.Richard Clark is the head of a great management team.

· Dividend yield higher than I can earn in a bank account? Check. Over 4.7%.

· Growing revenue year-over-year? Check. Double digit growth.

· Growing earnings year-over-year? No CHECK. I believe MRK will continue to grow earnings moving forward.

· Book value that demonstrates real assets? Check. Book value of over $17 per share.

· Selling at a discount due to reasons that are likely to be temporary in nature and not permanently change the way the company operates?Check. Headline news has greatly discounted the stock price.

· Option trading available for the lowest risk entry as possible? Check.High-volume.

· Uniquely positioned in their space? Check. One of the leaders in the pharmaceutical space.

I may sell the July $28 strike price puts for approximately $0.90. This would give me an effective price of $27.10 if the options are exercised in the stock put to me.

I don't short companies in my retirement account although I could if I set it up differently. If I was able to short stocks for a longer term than my normal day trades, here are two that I would consider.

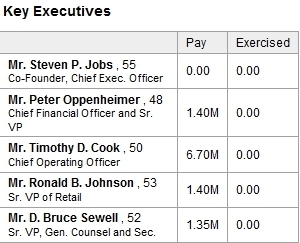

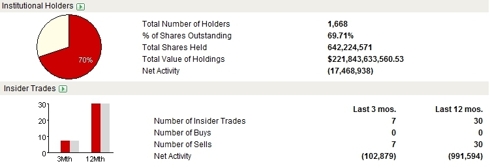

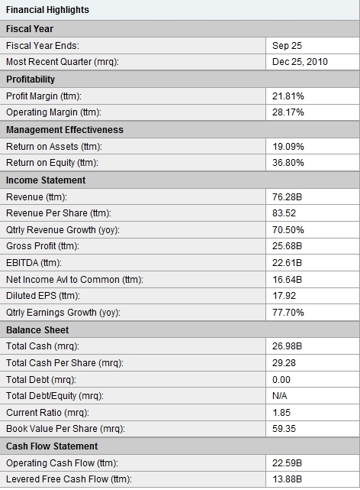

Apple Inc. (AAPL) is billed as “America’s Company” by its biggest fans. The problem is that everybody does love this company and already owns the stock.

For someone to buy AAPL today in hopes of getting a 20% return, AAPL would have to increase their market cap by over $60 billion. The iPad 2 was just released and is doing well in sales, yet the stock is going down in price. I have been watching this stock for well over a month waiting for a time to short.

The signal came when AAPL's stock started moving lower on good news.

· First rate management team with a history of performance? Check.Great management team currently a possible instability and changes on the horizon remove the advantage.

· Dividend yield higher than I can earn in a bank account? NO check.

· Growing revenue year-over-year? Check. Double-digit.

· Growing earnings year-over-year? Check. Double-digit.

· Book value that demonstrates real assets? No Check. Stock prices over five times the book value.

· Selling at a discount due to reasons that are likely to be temporary in nature and not permanently change the way the company operates? NoCheck. Stock is selling at a large premium.

· Option trading available for the lowest risk entry possible? Check. High-volume.

· Uniquely positioned in their space? Check. Unfortunately, while this category has been a net positive for a very long time for AAPL, I believe it is so expected that even when AAPL produces new products, the stock price does not act relatively as positive.

AAPL has recently been beat up like many companies due to recent headline news. While off recent highs if AAPL does manage to get near the $360 price range, I will be looking to short non-front month $400 strike price calls.

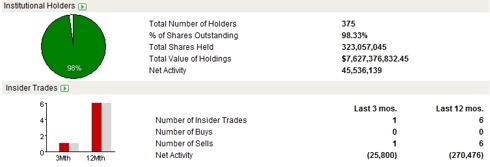

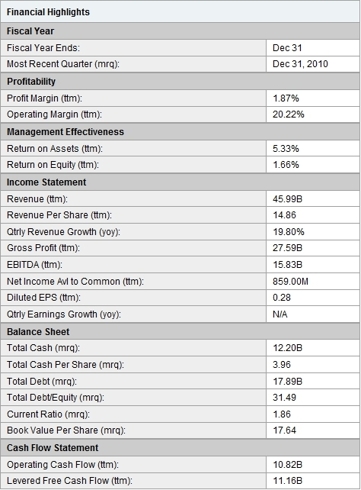

United Continental Holdings (UAL), the $7.6 billion U.S. based airline. UAL recently bought out, and is still merging, Continental Airlines into their company.

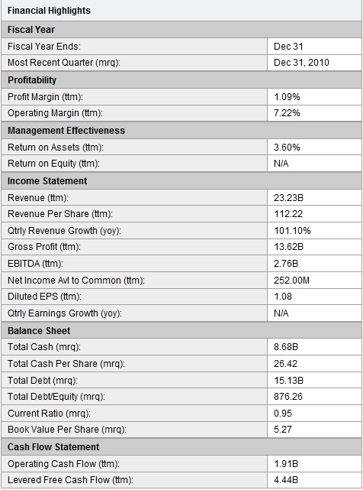

click to enlarge

I believe UAL is poorly managed and will continue to face financial headwinds for investors. As someone who has well over 600,000 frequent flyer miles, I have seen a lot of airline operations from a customer’s point of view. UAL is currently spending millions of dollars in advertising, attempting to attract premium customers and from my experience, failing to execute the ability to service them properly. UAL faces energy price risks, increased competition from better value airlines, as well as a potential global travel slowdown. Even if the airline industry situation improves, I do not believe UAL will be able to capitalize and exploit it.

· First rate management team with a history of performance? No Check.From my experience, and from talking to other frequent fliers, customer satisfaction is not high.

· Dividend yield higher than I can earn in a bank account? No check.

· Growing revenue year-over-year? Check. But from a very small bases.

· Growing earnings year-over-year? No check.

· Book value that demonstrates real assets? No check. The price of the stock is over four times book value.

· Selling at a discount due to reasons that are likely to be temporary in nature and not permanently change the way the company operates? NoCheck. The current P/E ratio is over 20.

· Option trading available for the lowest risk entry possible? Check.Options trade with moderate volume.

· Uniquely positioned in their space? No Check. As a legacy carrier, they are not positioned well to compete against newer airlines in the low revenue consumer travel space.

I have been mostly in cash for the past couple of weeks, but am looking to start buying very soon.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in GE, AMZN, JPM, T, HPQ, MRK over the next 72 hours.

Additional disclosure: I have shorted UAL several times in the past month. I may initiate a short position in UAL and or AAPL over the next 72 hours.

No comments:

Post a Comment