Dividend Paying Stocks: Why This Chart Says It All… Plus Seven Ways to Invest by Dr. Mark Skousen, Advisory Panelist, Investment U In doing research for my latest book, Investing in One Lesson, I came across an incredible chart that took my breath away. It revealed what I now believe is the single best strategy for investors – investing in dividend paying stocks – doing this will:

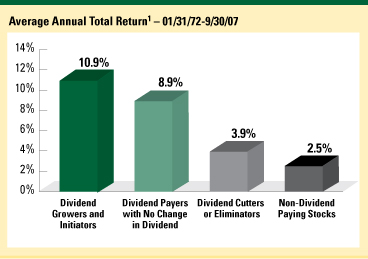

Just look at the chart below, courtesy of Ned Davis Research.

According to the most recent studies, dividend-paying stocks outperform non-dividend paying stocks by a wide margin. Over the past 35 years, non-dividend paying stocks have gained an average annual return of 2.5%. That’s less than T-bills… The Power of Dividend Paying Stocks But dividend-paying stocks have averaged an annual return of between 8.9% and 10.9%. That’s a huge difference. Look at it this way…

Why is this shocking? First, because most investors and analysts think that dividend payers are stodgy, conservative companies in mature industries that can’t possibly grow rapidly like the technology stocks. According to this traditional view, paying dividends is a sign of weakness, that the company has nothing better to do with its profits than return it to the shareholders. Second, most fundamental analysts consider earnings, not dividends, the key indicator of success. Avoid “The Growth Trap” Brokers usually tantalize their clients with hot tips about new and bold technology breakthrough stories, and investors bite. Big mistake. The fact is, most technology “growth” stocks fail to deliver. Jeremy Siegel, the Wizard of Wharton, calls it the “growth trap” in his book, The Future for Investors… “The most innovative companies are rarely the best place for investors,” he boldly declares. Why? Because investors invariably overpay for tech stocks. And Peter Lynch, the legendary money manager of the Magellan Fund, confesses, “I note with no particular surprise that my most consistent losers were the technology stocks.” Well, it’s a surprise to me. Dividend Paying Stocks: The Safest, Best Performing Strategy Where can one consistently find value in quality companies that are likely to succeed? The answer is simple: Buy a portfolio of stocks that pay rising dividends, or that start paying dividends. There’s plenty to choose from…

There are several Exchange-Traded Funds (ETFs) that specialize in rising stock dividends. My favorite is the Morningstar Dividend Leaders Fund (FDL), with a yield of 3.6%. I also like the WisdomTree International Top 100 Dividend Fund (DOO) – a great way to diversify internationally and get paid while you wait for stocks to go up. Good trading, Mark Today’s Investment U Crib Sheet We’ve covered quite a few ETFs recently. Here’s a recap, with articles in which they’ve been mentioned:

|

This blog is my archives of good papers,articles about investing and personal finance, aiming to financial independence.

Saturday, March 26, 2011

Dividend Paying Stocks

Dividend Paying Stocks

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment