Investing Strategies For Canadian Banks � The Passive Income Earner

Investing Strategies With Canadian Banks

I reviewed the top 6 banks since the beginning of January 2011 highlighting their value from a dividend investment perspective. Most Canadians have faith in the Canadian banks and I hope by now that non-Canadians have gain some belief in their stability. Before you go out and load up on all the banks, I thought I’d share some possible strategies depending on what you are looking for and your investing style. Even dividend investors have a style

Top 6 Banks

Below are the top 6 banks I reviewed sorted in market capitalization.

- Royal Bank (TSE:RY) – 80.86B$

- Toronto-Dominion Bank (TSE:TD) – 71.12B$

- Scotia Bank (TSE:BNS) – 62.58B$

- Bank of Montreal (TSE:BMO) – 35.69B$

- Canadian Imperial Bank of Commerce (TSE:CM) – 32.30B$

- National Bank of Canada (TSE:NA) – 12.19B$

They can be categorized in 3 groups if you wish to look at it differently:

- Very large international banks: RY, TD, BNS

- Medium scale banks: BMO, CM

- Small local bank: NA

They all compete against each other in Canada and since they still heavily rely on their Canadian business, the size of the players doesn’t really matter to some extent. A fee from a customer is still a fee generating profits. Their international growth is what can allow them to grow and expend further.

The Favorite Strategy

This strategy tends to be in line with the herd mentality which isn’t a good thing usually as the stocks tend to have gained by the time the herd comes. When it comes to banks, it may not be a bad thing as we come out of our late financial crisis since the recovery is much slower and the Canadian banks are positioned to profit from it. The current favorites by analysts are:

- Toronto-Dominion Bank (TSE:TD) – 71.12B$

- Scotia Bank (TSE:BNS) – 62.58B$

You get 2 strong banks in Canada with exposure to the U.S. with TD and exposure to South America with BNS.

The Contrarian Strategy

These banks are out of favor at the moment. Mostly because the analysts don’t see a quick buck to be made but this isn’t a sprint, it’s a marathon. The contrarian strategy is the one I tend to look for as it can have the bigger payout over time. Depending on the dividend yield and the ability for the bank to sustain it, being patient with these banks will usually pay in the long run. The banks for the contrarians are:

- Royal Bank (TSE:RY) – 80.86B$

- Bank of Montreal (TSE:BMO) – 35.69B$

The payout ratio of these banks is higher than the favorite banks but it should get in line as they grow their earnings. The big question is if they will keep up with the expected dividend increase by the banks. There is expectation that BNS will increase at the next quarter. Considering they increased bank fees by 20%, I wouldn’t be surprised to see a 5%-10% dividend increase by BNS.

The Wild Card Strategy

With erratic numbers and a lack of consistency, this bank deserves the wild card strategy. It has done well recently compared with the other banks but my review from a number perspective was inconclusive. It’s still a bank and it will probably move along with the other banks but I can’t say if it will do better or not. It currently is last on my list unless I can be convinced otherwise. This bank is:

The Forgotten Gem

I admit, this is not a strategy but I needed to have a section for this bank. It has very strong numbers.

- A P/E of 11.50 below all the other banks

- A dividend yield of 3.52%

- A payout ratio of 40% below all the other banks by nearly 10%

- 1st bank to increase dividends

It’s mostly operating in Quebec and expending in Ontario. It has much growth potential. The bank is:

- National Bank of Canada (TSE:NA) – 12.19B$

Summary

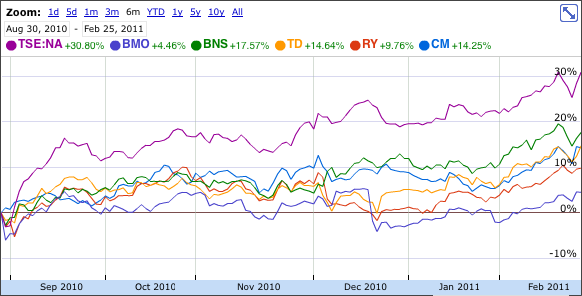

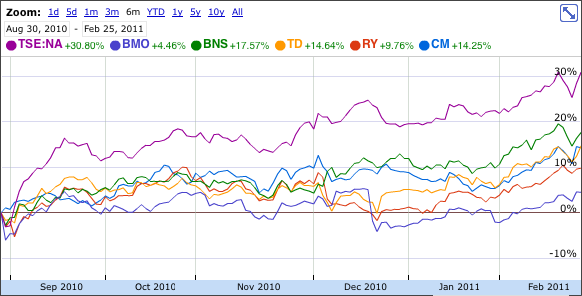

Those are strategies that I thought could work well depending on what you are looking for with your portfolio. I am particularly found of the contrarian strategy. Here is a little graph on how they compared in the last 6 months. As you can see, the forgotten gem takes the lead.

Readers: What strategy do you prefer? Does it matter when it comes to banks?

No comments:

Post a Comment