In the previous three installments of "Best in Breed Dividend Stocks," we discussed what constitutes a best in breed dividend stock. Again, without regurgitating the entire article, the key investment metrics I focus on are: consistent long term dividend payments, dividend growth rate, a low dividend payout ratio, above average return on equity, above average sustainable growth, and a durable competitive advantage.

So far we have focused on 10 sectors:

Basic Materials: Freeport-McMoRan (FCX)

Consumer Staples: Pepsico Inc. (PEP)

Energy: Chevron Corporation (CVX)

Financial: Bank of Hawaii (BOH)

Healthcare: Johnson & Johnson (JNJ)

Industrial: Norfolk Southern Corporation (NSC)

Services: McDonald's Corporation (MCD)

Technology: Intel Corporation (INTC)

Telecoms: China Mobile Limited (CHL)

Utilities: Southern Company (SO)

Today we are going to stray from the sector theme and address a question that has been raised by many readers:

Where’s the yield?

As I have stated in previous articles, I'm a dividend growth investor, not a yield chaser. I believe in investing in undervalued companies, with moderate dividend yields, good dividend growth rates, low payout ratios and long-term sustainable business models. For younger investors, a disciplined dividend growth Investing plan is a sure fire path to financial freedom.

That being said, there is something attractive about stocks with substantial dividend yields. The idea of gaining 6-14% annually on a stagnant investment is hard to pass up. The problem with these investments is yields as lofty as these are rarely sustainable. When the dividend goes, so does the multiple the market has placed on the stock. Most of the time, the dividends you’ve accumulated on these high yielders will pale in comparison to the stocks decline when the dividend is compromised.

Still, there is a place in a well diversified dividend portfolio for the companies with abnormally high yields. These high yielders help smooth out the yield curve of a portfolio and push it above the 3% minimum yield I use as my benchmark. This allows us to take on companies with smaller yields and high growth rates, while keeping the income flowing.

Before we get to the picks, I am going to forewarn you that many of the metrics you are accustomed to reading about in my articles, such as Return on Equity, Sustainable Growth, EPS Growth Rate, and Dividend Payout Ratio have little, or nothing to do with the companies we will discuss. This is part of the reason I don’t usually invest in these companies. I don’t invest in equities I can’t accurately value. Master Limited Partnerships, Real Estate Investment Trusts, ETFs, and the like, play by their own rules.

Telecom: AT&T (T), Current Yield 6.20%

AT&T Inc. provides telecommunication products and services to consumers, businesses and other telecommunication service providers under the AT&T brand worldwide. The company’s wireless segment offers wireless voice communications services, including local wireless communications, long-distance and roaming services with various postpaid and prepaid service plans.

Obviously, we all know what AT&T does ... besides dropping calls in major markets. AT&T is a premier Dividend Champion, increasing dividend payments for 27 straight years. Its seven-year average Payout Ratio of 72.9% is acceptable for a telecom company. AT&T's lofty yield of 6.20% is about safe as they come.

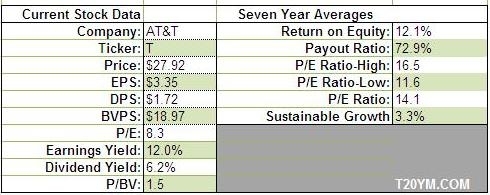

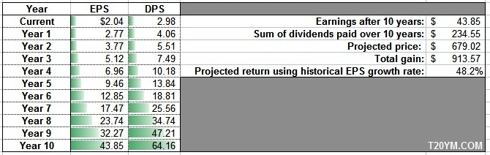

The fundamentals are consistent but not overwhelming:

AT&T ROE of 12.1% is slightly above the American Equity average. Its Earnings Yield of 12% is considerably greater than AAA Grade government bond yields. Furthermore, it is trading at a huge discount to its historical P/E Ratio. For a company with 6.2% dividend yield these metrics are intriguing.

Modeling AT&T future earnings using its 10-year EPS Growth Rate we arrive at a very acceptable return:

Click to enlarge

When we take into account that the AT&T dividend is still growing (over 5% in the last three-year period) this should be a yield boosting stock in any dedicated dividend portfolio. The loss of iPhone exclusivity will hurt, but AT&T functioned well without the device and will function well in the future. AT&T is a solid Dividend Champion and a worthwhile addition to any portfolio.

Master Limited Partnerships: Kinder Morgan Energy Partners LP(KMP), Current Yield 6.20%

Kinder Morgan Energy Partners L.P. owns and manages energy transportation and storage assets. Its Products Pipelines segment delivers gasoline, diesel fuel, jet fuel and natural gas liquids to various markets through approximately 8,400 miles of refined petroleum products pipelines, and 60 associated product terminals and petroleum pipeline transmix processing facilities. The company’s Natural Gas Pipelines segment gathers, transports, stores, processes and sells natural gas through approximately 15,500 miles of natural gas transmission pipelines and gathering lines, as well as natural gas storage, treating and processing facilities.

When it comes to MLPs, Kinder Morgan Energy Partners is a safe and boring pick. That’s precisely why I made it. When investing for high yield, I want something consistent and quantifiable. Kinder Morgan Energy Partners has increased its distributions for 15 years and counting. Its yield has increased at an 8% clip over the last 7 years. For a company with such a wide competitive moat as Kinder Morgan Energy Partners these are very impressive numbers.

Click to enlarge![]()

Kinder Morgan Energy Partners trades at a well deserved premium to its peers. Its geographic domination of the U.S. market is amazing. The barrier of entry for start up companies wanting to compete with KMP would be nearly impossible. When playing for dividends, why not take the best in breed.

Real Estate Investment Trust: Annaly Capital Management Inc. (NLY), Current Yield 14.30%

Annaly Capital Management, Inc., a real estate investment trust, engages in the ownership, management and financing of a portfolio of investment securities. The company invests primarily in mortgage pass-through certificates, collateralized mortgage obligations, agency callable debentures and other mortgage-backed securities representing interests in or obligations backed by pools of mortgage loans.

Annaly borrows money at low interest rates, and reinvest the capital into securities that pay higher interest rates. The majority of Annalyinvestments are either directly or indirectly backed by the U.S. government. Since Annaly is classified as a REIT it is required to return 90% of profit to its shareholders.

I realize that Annaly has been written about ad nauseam, but when it comes to relatively secure high yielders it is the creme de a creme of the sector.

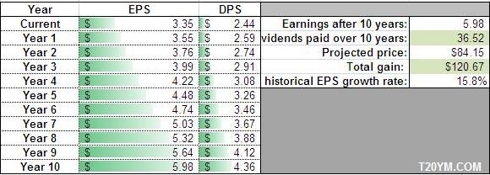

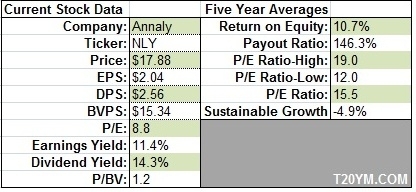

Using the standard T20YM metrics Annaly holds up fairly well:

Being a REIT, the payout ratio is obviously outside of my norm. The Sustainable Growth is also skewed by this ratio. But with an Earnings Yield over 11, and a Dividend Yield of 14.3%, it still has a lot to offer.

Modeling Annaly’s 10-year return using its EPS growth rate offers a fantastic investment.

Click to enlarge

Now obviously, there are a lot of things that can go wrong with Annaly. Interest rates can/will go up. New government regulations on Mortgage Back Securities are all the rage. Plus, the model itself is heavily leveraged. This is not a buy and forget investment, you must be prepared to get out and get out fast if things turn south.

Now I realize Annaly’s dividend has not been a model of consistency. But its average yield over the last five years is over 9% ... You can have your consistency. I’ll take the 9%. If you want the yield, you have to be willing to take the risk.

If you are comfortable with Annaly Capital Management's risk and model, take a look at its younger brother Chimera Investment Corporation (CIM). Chimera has a very similar model and is managed by some of the folks atAnnaly. To be honest, Chimera’s valuation is more attractive with a 16% yield, but with its lack of history I will allocate my capital elsewhere.

Preferred ETF: iShares S&P U.S. Preferred Stock Index (PFF), Current Yield 7.38%

The investment seeks to track the price and yield performance before fees and expenses of the S&P U.S. Preferred Stock index The fund invests at least 90% of assets in securities that comprise the index. The underlying index measures the performance of a select group of preferred stocks listed on the New York Stock Exchange, NYSE Arca Inc, NYSE Amex, NASDAQ Global Select Market, NASDAQ Select Market, or NASDAQ Capital Market. It includes preferred stocks with a market capitalization over $100 million that meet minimum price liquidity trading volume maturity and other requirements determined by the index provider. The fund is non-diversified.

For this series I was staying away from ETFs (even though I do use them heavily in my own portfolio), but rather than picking out individual preferred shares of companies that are often very illiquid, I would much rather trade a basket of strong American Preferred Stocks with PFF.

iShares S&P U.S. Preferred Stock Index (PFF) operates with an annual yield of 7.38%. Its expense ratio is a meager .48%. Its net assets are well over the 6 billion dollar mark. It trades on average over 1,000,000 shares per day. This is a safe and secure ETF.

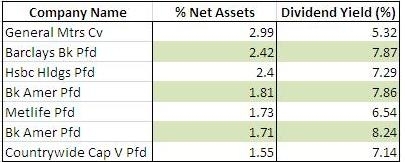

The top holdings of PFF are as follows:

As I’ve stated in previous articles, I don’t believe bonds are good investments for young investors. I do understand the idea of diversifying the asset classes in your portfolio but I would MUCH rather own Preferred Shares than bonds. One of the main issues I have with Preferred Shares is their low liquidity. PFF solves that problem with a bonus of broad diversification. As I mentioned in my last article PGF would also be a viable alternative to PFF.

Well there you have it, four high yielding options that can boost the overall income of your portfolio. Annaly Capital Management is obviously the outlier in risk, but with that risk comes a substantial yield. AT&T andKinder Morgan Energy Partners offer yields north of 6% with continuing growth. Finally, iShares S&P U.S. Preferred Stock Index (PFF) gives you broad exposure to high yielding preferred shares with a hefty 7% dividend.

As always, comments and ideas are welcomed. The next article will be the summation of the portfolio, and then I plan on taking on sectors individually with side by side comparisons of companies.

Disclosure: I am long PFF.

No comments:

Post a Comment