Investors have been taken on a roller coaster ride over the last several days. Starting with turmoil in the middle east, then an earthquake and tsunami in Japan, and now continuing fears of a nuclear meltdown have sent global markets reeling. Where are investors to turn?

One tried and true method of investing is to hold a basket of quality stocks for the long-term. Over time this method has proved to be an effective method of riding out stock market volatility. With that said, I am not advocating a "set it and forget it" strategy. Investors should actively monitor all holdings for fundamental changes to the business landscape or health of the organization. There are few stocks that measure up to the quality of a true long-term holding. The following are three stocks that I believe have the ability to ride out the market storms.

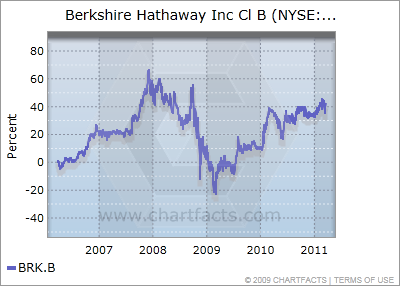

Berkshire Hathaway (BRK.A), (BRK.B)

Who wouldn't want the world's greatest investor, Warren Buffett, managing their money? Well, the good news is that investors need only to buy shares of Berkshire Hathaway. Berkshire Hathaway, originally a textile mill purchased by Buffett in the 1960's, is a conglomerate holding company. Buffett manages the investments of Berkshire, which include several wholly-owned insurance companies (including GEICO), retail businesses, manufacturers, a railroad, a natural gas pipeline, NetJets, and shares of many publicly traded companies.

Berkshire Hathaway has a market cap of $120 billion. The company reported revenue of $136 billion and operating cash flow of $17.9 billion in 2010. Shares trade at 18.46 times forward earnings. Berkshire has both class a and class b shares. Class B shares are affordable for the average investor and still carry voting rights.

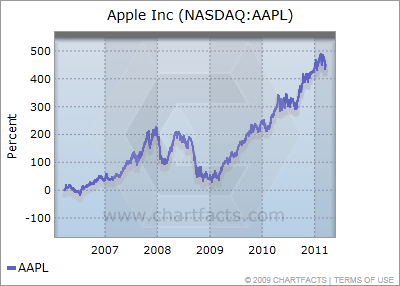

Apple (AAPL)

Apple may not be the first stock that comes to mind when investors think of riding out market storms. Many people consider Apple a consumer discretionary company, therefore sensitive to changes in the economy. Though Apple is a consumer discretionary stock, it is also a technology stock. No other company has made consumer discretionary items that transcend generations and cultures like Apple products. Apple sold 16.2 million iPhones in the fiscal first quarter alone. The company's iPad has been a hot seller, and the recent iPad 2 release should fuel further growth.

Apple trades at less than 15 times forward earnings. Its annualized five year revenue and cash flow growth are 36% and 58%, respectively. The company has nearly $60 billion in cash on its books and no debt.

Apple has an extremely talented management team that continues to turn out products that people love. What's more, is that it seems when people purchase one Apple product they quickly purchase more Apple products. For example Mac sales grew 23% YOY in the first quarter, fueled in part by iPhone and iPad sales. I recently wrote an articleentitled "Finding Deep Value in Apple," arguing that Apple's stock is undervalued. Since then shares are slightly lower, possibly giving investors a better buying opportunity.

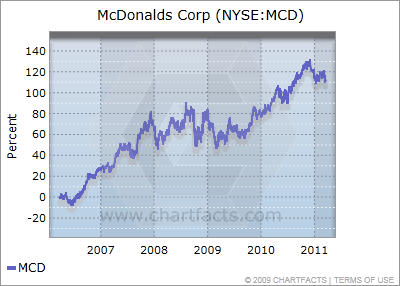

McDonald's (MCD)

Shares of McDonald's have been relatively flat through the first quarter of 2011. However, the company keeps churning out higher profits and higher dividends. McDonald's is somewhat economically sensitive, however the company often benefits when consumers trade down from higher priced restaurants. McDonald's coffee beverage lineup has been fueling growth in the United States, where it proved it can compete with Starbucks (SBUX).

Shares of McDonald's trade at a reasonable 14.6 times forward earnings. The company has grown revenues at an annual rate of 4.7% over the past five years. This is solid growth when you consider the major recession we came through in that time span. McDonald's has grown its dividend at an annual rate of 27% over the past five years and currently yields 3.3%. The payout ratio is still a reasonable 49%.

McDonald's has plenty of room to grow overseas. The company is far behind competitor Yum! Brands (YUM) in China, providing it a nice future growth story. The company realizes the opportunity in emerging markets and is opening new restaurants around the world.

Below are the key metrics for all three stocks.

| Metric | BRK-A | AAPL | MCD |

| Market Cap | $120.5 B | $312.6 B | $77.0 B |

| Recent Price | $127,776.00 | $339.30 | $73.76 |

| Forward PE | 18.46 | 14.72 | 14.64 |

| Dividend Yield | N/A | N/A | 3.34% |

| 5 Year Div. Growth Rate | N/A | N/A | 27.50% |

| Payout Ratio | N/A | N/A | 49.00% |

| Price/Book | 2.62 | 6.49 | 5.26 |

| Price/Cash Flow | 16.53 | 20.34 | 12.67 |

| Price/Earnings Growth | N/A | 0.9 | 1.56 |

| Price/Owner Earnings | 25.3 | 22.5 | 25.43 |

| Return on Equity | 15.19% | 35.14% | 40.07% |

| Debt/Equity | N/A | N/A | 0.96 |

| Revenue TTM | $136.19 B | $76.28 B | $24.07 |

| Operating Cash Flow FYE | $17.9 B | $18.6 B | $6.34 B |

| Capex FYE | $5.98 B | $2.12 B | $2.14 B |

| Capex/Cash Flow FYE | 0.33 | 0.11 | 0.34 |

| 5 Year Rev. Growth Rate | 10.80% | 36.20% | 4.70% |

| 5 Year Cash Flow Growth Rate | 13.90% | 58.20% | 10.20% |

| 5 Year Earnings Growth Rate | 7.40% | 57.80% | 17.70% |

| Net Profit Margin | 7.16% | 21.48% | 20.55% |

| Current Assets | N/A | $43.93 B | $4.37 B |

| Return on Assets | 2.71% | 18.64% | 15.47% |

| Long-term Debt | N/A | N/A | $11.50 B |

These three stocks are not what I would consider undervalued. They are not overvalued either. When considering whether to buy these stocks, remember what you are buying them for, long-term growth. I have no idea how these stocks will perform this year or even next. I believe that these are three great companies that over time will reward investors.

Disclosure: I am long BRK.B, AAPL.

No comments:

Post a Comment