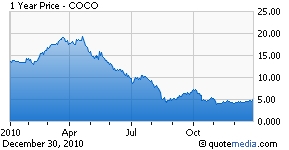

I actually started writing about COCO over a month ago and planed on finishing my work with COCO within a few days. Days turned into weeks and there I was on Thursday watching COCO move up about 10% without my write up about the company completed. So in order to get this done and out there and on the record, I am going to shorten up the commentary and just give the facts on why I believe COCO is a must own, the most important long, and if you only had one stock to pick going into the new year why COCO is it. In fact, COCO is the only stock I currently am long with. I own the stock, and I am also short puts, in the money and out of the money. I have been long for well over two months, and if we are including my trading COCO (to the long side) - over three months.

Based on my reading of the latest 10-Q filed with the SEC (quarterly earnings and financial reports) as well as numbers listed on Yahoo Finance, COCO is a stock that has a P/E of about 3 and a forward P/E of less than 15 (which I believe is incorrect, and too high because I believe profits will be higher than many are expecting).

Based on my reading of the latest 10-Q filed with the SEC (quarterly earnings and financial reports) as well as numbers listed on Yahoo Finance, COCO is a stock that has a P/E of about 3 and a forward P/E of less than 15 (which I believe is incorrect, and too high because I believe profits will be higher than many are expecting).

COCO has what I can only accurately call a massive short interest (somewhere north of 30% based on the NASDAQ website for a settlement date of 12/15/10). In fact, it is one of the highest shorted stocks based on market capitalization, volume, and percentage of the float.

Without anything else, COCO could see large moves resulting from a short squeeze. Add in that mix a surprise in earnings, which is very possible, and we could see a fuse to a very large rocket going off, sending the price of the stock into a spike higher. For me, a surprise in earnings would not be a surprise at all, and with the stock priced for failure, just about anything other than failure in my opinion will get the shorts running for cover. As someone who shorts over 95% of my trades, I know all to well what a short squeeze feels like and this in my opinion has the makings for a grand one.

The next reason and this is the biggie. Legislative change happened that I believe has not yet been priced into the stock. We already know from words by Senator McCain and others that many of the Education department's gainful employment criteria as well as default rate, and amounts in percentage of revenue that schools may get from the government, are going to be addressed again and likely in my opinion to be watered down at a minimum. The for profit schools (which I guess makes the states schools “for loss”) have lined up many hired guns in Washington to battle and twist arms to keep the money flowing into the for profit schools' top and bottom lines.

I feel that one should never underestimate the willingness of Washington to spend taxpayers' money. This situation is one that both parties will love to fund. Much of the money goes to fund minorities to go to college which the left loves and the free enterprise nature of the schools is something that the right loves to fund. This to me appears to be something that is not about to run into trouble anytime soon, regardless of what some in the Education department had in mind when they tried to knee-cap the for profit schools. Betting against continued funding by the Federal government as the shorts have with COCO is akin to betting against the nature of how Washington works, and that's a bet I think many COCO shorts will wish they never made. As the new congress starts its new business in the next few weeks I expect there will be much less bad news and much more good news for the for profits.Headline risk thus is much lower now than a year ago, in my opinion.

COCO is one of the smaller schools compared to the bigger names LikeAPOL, DV and EDMC. With its healthy balance sheet, positive cash flow and future prospects receiving a buyout from another school or another that would like to add COCO to the portfolio seems to have a better than average chance of happening. While buyout rumors have come and gone in the past few months, it seems to always move the stock and a buyout can not be reasonably dismissed without something changing the future prospects of COCO. While the P/E and balance sheet look great, if you remove “goodwill” and other non assets in a fire liquidation, you still have a lot of assets to back up the price of the stock. It would appear that COCO agrees with this as well as they have been buying up their own stock and have authorized a lot more shares to be potentially repurchased then they have already taken off the market. COCO is big enough to get attention and small enough to be bought out.

I view COCO as the most important stock to own going into 2011 and the most likely to at least double in price within the next 12 months. While COCO doesn’t currently pay a dividend, ways to gain exposure to COCO and get paid for the time include selling in the money puts and / or buying the stock and selling calls (covered calls).

Another way I have looked into COCO was to buy Jan 2012 7.50 calls and to sell Jan 2012 12.50 calls for a cost of about 40 cents and a possible gain of about $4.60 if COCO moves above $7.50 before the third week Friday Jan of 2012. What is nice about using options is a stock can be leveraged for the upside and still limit the downside. In this case, only about 40 cents is risked per share controlled, and the time period to get there is a whole year. Of course, if the stock is the same price as it is today, all the investment would be lost so COCO does have to move up to break even or make money. I am using the stock and options to take advantage of what I believe is a mis-pricing by the market. I am also looking to add during pull backs in price. I have written about LVS and GEand been along for the ride with both while they were kicked around only to rebound and take off again.

I believe COCO will move up from the abyss much like they did before, and have people wondering why they didn’t buy when it was bargain priced.

Disclosure: I am long COCO. No positions currently in LVS, GE. Currently long COCO in trading account as well as IRAs.

The main reasons I am long is the PE due to uncertainty (market hates uncertainty) the balance sheet, the change in Washington coming up after the last election, and buyout potential. There are indeed other reasons but these are the most important. A large short interest can light a fuse and send the price higher very quickly but I give that less importance (due to being a long term holder, If I was simply trading it short int would be much more important to my reason why I believe the price will go higher)

Best to you

I dont understand this seeking alpha thing as news, instead of trader commentary.

Can somebody explain Yahoo's news policy?

I used to work at a corporation and we hired a U of P grad. She was one of the hardest working persons there. It took her years to graduate cause she was finishing her degree, working full-time and supporting two kids by herself.

Education is our future. Of course we don't want a boiler room situation where people are signing up people to go to school with absolutely no competence. But, these schools should be supported and in no way should the fed gov cut any funding these schools. Just because there are rich folks sending their kids to state schools, and non-profit private institutions, doesn't mean we can't offer the opportunity for someone to better themselves at these for-profit institutions. $1 spent at these colleges is infinitely better in my opinion than $1 spent for military purposes. I guess that is debatable but that is my opinion.

For-profit college revenue already is being threatened by slowing new-student enrollment amid government investigations of sales practices and the use of federal funds. The companies are lobbying Congress to strike down the revenue cap, called the 90/10 rule, or extend an exemption that would help them comply for the next fiscal year. Changing the rule will be the industry’s most important battle in Congress, said Jarrel Price, an analyst with Height Analytics in Washington."

I wouldn't count on federal funding. Corinthian Colleges doubled their lobbying budget this year and hired Richard Gephardt to lobby for them for one reason. They are terrified of losing federal funding. Not saying they will lose it but I suggest people look before they leap into this stock.

Here's the link for the rest of the story from Bloomberg. www.businessweek.com/n...