How to reach $1 million in three easy steps - Mar. 21, 2011

(MONEY Magazine) -- Remember that old Steve Martin joke about the secret formula for becoming a millionaire?

"First, get a million dollars ..." Lever 1: How Much Time You Allow

Okay, getting the odometer on your investment portfolio to click over into seven digits isn't quite that easy. Only 7% of American households ever manage it, according to research firm Spectrem Group -- though it's certainly not for lack of desire.

While $1 million may not be worth what it was back when Martin was a wild and crazy guy in the late '70s, achieving that iconic number still has profound allure. It means that you're ahead of the game. You're assured a baseline retirement security. You've arrived.

Martin may have oversimplified, but the reality is that getting your portfolio to the $1 million mark is not nearly as difficult as you may think, even if you've managed to put away only a fraction of that amount so far. You just have to understand how to operate the three basic levers of wealth building: how much time you have to work with, how much you save, and how you invest that savings.

The slightest tug on one or two of these levers can dramatically affect your path to $1 million. Use ourcalculator to pinpoint when you're likely to become a millionaire based on your current situation and investing returns.

Lever 1: How Much Time You Allow

When you think about getting rich, what jumps to mind? Saving more money? Getting that money to work harder for you? Sure, those are critical elements. But they're not nearly as important as time: How long you allow dictates how you pull the other two levers -- which is why you want to estimate your schedule before going on to the next sections.

Sometimes you can't play with the time lever -- your kids will go to college when your kids go to college. But in certain cases, it's possible to control the clock.

Say you're now 45, want to retire at 62 with a million bucks, and have $250,000 saved. You've got 17 years. If you were saving $15,000 a year, adjusting for 3% inflation (meaning you put away $15,000 in year one, $15,450 in year two, and so on), and were able to earn 4% a year in real terms (7% before inflation), you wouldn't get there.

But if you delayed retirement by just two years, you'd hit the mark. As Chris Dardaman, head of Brightworth, a financial planning firm in Atlanta, says: "It's not the end of the world if you can't save as much or invest as well as you want -- as long as you save and invest longer."

In part, how long it'll take to become a millionaire depends on where you are now. If you already have $500,000 saved, it might take only 10 to 15 years, in inflation-adjusted terms, provided you sock away $10,000 to $15,000 a year and your investments outpace inflation modestly.

But even if you're only a tenth of the way there -- like the typical worker who's been investing in a 401(k) for 10 to 20 years, according to the Employee Benefit Research Institute -- you can make it in two decades or less, if you save a good chunk of income or earn a decent return.

Of course, that's the dilemma. While the ability to save more is within your control, the ability to generate a certain return isn't 100% in your hands. And as your time horizon shrinks, so too will your ability to accurately predict how your investments are likely to perform. So let time determine which of the two other levers -- savings or investing- -- you pull harder.

If you want to get to seven figures in 10 years or less: Seriously ramp up savings

With only a few years to invest, there's a significant risk that even a seemingly safe investment strategy could fall short of your expectations, because of the wide range of possible outcomes.

For example, according to computer models run by Ibbotson Associates, a moderate 60% stock/40% bond strategy could result in annualized returns of as much as 16% over the next 10 years, but it could also result in worst-case losses of nearly 1% a year. While that gain would certainly speed things up, a sustained loss -- even a modest one -- could be devastating given your time frame.

So if your self-imposed deadline for achieving $1 million (or any financial goal) is tight, instead of banking on optimistic returns, you're better off trying to boost your savings as much as possible. Then invest in a balanced mix of 50% stocks and 50% bonds that can be expected to beat inflation by a modest two or three percentage points a year.

If you're willing to wait more than ten years: Invest more aggressively

The longer you have to invest, the greater chance you give the market to smooth out any ups and downs. Back to that 60%/40% portfolio: Over 20 years, the annualized spread could narrow to gains between 2% and 14%. So you could even take on a little more risk -- increasing your equity exposure, say -- for the possibility of better returns.

The single most important thing you need to know about building wealth: You're far better off being a dogged saver who's a mediocre investor than being a below-average saver who can knock the socks off the S&P 500.

Lever 2: How much you save

"It's sort of like exercising," says Stuart Ritter, a financial planner with T. Rowe Price. 'You can devise the most optimal splits between cardio and weight training. But if you only go to the gym for six minutes, it won't really help you that much."

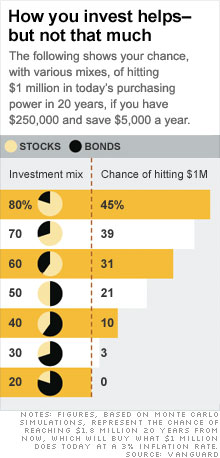

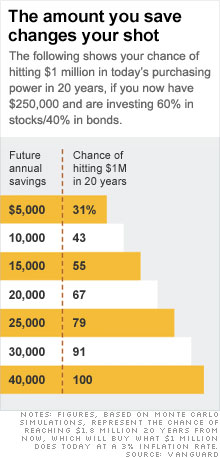

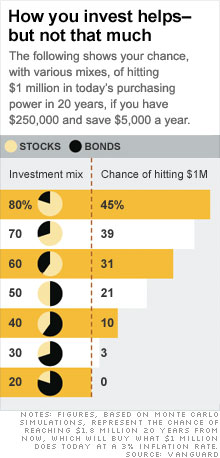

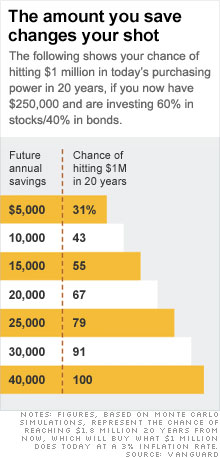

Let's say you have 20 years to invest and $250,000 already amassed. You can see from the table at right that boosting your annual savings from a modest $5,000 to an aggressive $20,000 could increase your chances of hitting $1 million in today's dollars -- $1.8 million nominally in 2031 -- from 31% to 67%, assuming a 60% stock/40% bond portfolio. If instead you kept your savings rate the same but upped your stock allocation to 80%, your chances of success would be less than fifty-fifty.

Savings may be the safer bet, but it's often the tougher task. Here are four ways to crank up the amount you're banking per year, in ascending order of difficulty.

EASY: Use other people's money.

You've heard this before, but it bears repeating: The simplest way to boost your savings is to max out your 401(k) match, since that's a hand-out from your employer. Say you make $100,000 and save 3% of pay. If you're eligible to receive 50¢ on the dollar for the first 6% of salary deferred a common match you'd be leaving $1,500 a year on the table.

Tax-advantaged accounts like 401(k)s and IRAs also allow you to build wealth faster, in that case by putting Uncle Sam's money to work for you. On the same salary, by contributing $10,000 annually to a 401(k), you'd immediately reduce your income taxes by $2,800, assuming you are single and in the 28% bracket.

For now you can think of it as saving the equivalent of $10,000 while ponying up only $7,200. But even after paying taxes at withdrawal, you'd still come out ahead in most cases thanks to tax-deferred compounding at a 6% annual return, you would be up by $1,600 a year if you'd been socking away $10,000 for 15 years.

(This is why we assume that you'll use tax-deferred accounts as well as tax-efficient investments such as index funds to avoid the drag of taxes on your returns.)

A LITTLE HARDER: Bump up savings systematically.

"The easiest way to save is to put as much of your savings on autopilot as you can," says Shlomo Benartzi, chief behavioral economist for Allianz Global Investors.

A decade ago he and University of Chicago economist Richard Thaler devised a 401(k) plan feature that allows workers to preset future contribution hikes -- that is, it lets them specify in advance how much they want to ratchet up savings. A 2007 study found that those who used this option boosted contribution rates from less than 4% to nearly 14% in about 3½ years' time. Those who didn't barely changed their deferrals.

Today half of large employers offer this type of feature, reports Hewitt Associates. If your company is among them, use the tool to step up contributions.

A $2,000 bump will feel like only $55 more per biweekly paycheck thanks to the tax benefit. And with the money tucked into savings, you'll be forced to adjust your spending. Your plan doesn't offer this option? Partner up with a co-worker, put a date on your calendars, and remind each other to call HR that day.

HARDER STILL: Live on last year's budget.

After the market crashed in 2008, retirees were commonly advised to forgo inflation-adjusting withdrawals on their nest eggs for a few years, to give their accounts time to heal. People who are working can adopt the same strategy with savings rates.

Say you earn $90,000 a year and save $9,000 of it. That means you "spend" $81,000 a year on discretionary items (such as entertainment and travel), nondiscretionary items (mortgage, utilities), and taxes. Let's also assume your pay climbs 2% annually for the next five years. Your $90,000 salary will rise to more than $99,000. But if you were to increase your "spending" each year only enough to cover the additional taxes you'd owe, you'd be able to save an increasing amount every year -- for a total of $15,000 by year five.

The challenge here, and the reason this falls under "harder still," is that if inflation rises faster than the long-term historical average of 3% -- as some economists fear -- you'd really have to trim your spending.

This plan may not be feasible in any case if you have a medical condition, what with health care costs expected to continue outpacing income growth for the next several years.

HARDEST: Boost your income.

There's only so much you can save on a given salary. At some point, the limits of austerity (you have to buy new clothes sometime!) and the impact of inflation will make it impossible to squeeze more out of your budget. When that happens, your only option is to increase your income.

Landing a higher-paying job would be one way to up your income. But since that promises to be challenging in today's tight labor market, bringing in income beyond your full-time job may be a more optimal choice.

If you have the capacity to do consulting work in the evenings or on weekends, even a small project could help you boost yearly savings by $10,000 or so. Plus, this would allow you to save more tax-deferred: You could contribute 25% of freelance pay up to $49,000 to a SEP IRA.

You might go further by taking steps toward starting a small business while still employed a path about half of entrepreneurs have taken, says the Kauffman Foundation. Or, with housing prices down in most markets and mortgage rates near historic lows, you could take a calculated risk on real estate, investing in rental properties to boost income.

True, improving your investment results may not speed you to $1 million as quickly as jacking up your savings rate. But it can help.

Lever 3: How you invest

Say your goal is to have a million in less than 20 years, that you have $250,000 put away and that you are taking great pains to save $30,000 a year. Even at that aggressive pace, you wouldn't hit your deadline if your portfolio simply kept up with inflation. However, if you earned a modest 1% a year after inflation, you'd get to the equivalent of $1 million today in 18 years ($1.7 million in nominal dollars). Every percentage point shaves off a little more time.

Of course, the strategies that promise the greatest potential returns also present the greatest potential for loss so you'll want to avoid serious long shots like buying manganese futures or trading the Thai baht. A few saner strategies, in ascending order of risk:

SAFE BET: Cut your costs.

The returns you collect from mutual funds will always be hampered by the expenses you pay. Don't think reducing costs makes much of a difference?

At MONEY's request, Vanguard ran a series of simulations to see how various asset mixes are likely to perform over the next 20 years.

Turns out, a typical 60% stock/40% bond portfolio, charging 1.25% a year, has a great probability of generating at least 5% annually over the next two decades. At that rate -- assuming 3% inflation, current savings of $250,000 and additional contributions of $15,000 a year -- you'd get to a million in 23 years.

But if you were able to boost those returns to 6%, which you could do by reducing portfolio costs to 0.25%, you'd make it in 20 years.

You can easily create a 60/40 portfolio with an overall expense ratio under 0.25%. For example, put 40% in Schwab Total Stock Market Index (SWTSX) (expense ratio: 0.09%), 20% in Vanguard Total International Stock (VGTSX) (0.26%) and 40% in Vanguard Total Bond Market (VBMFX) (0.22%). All three are on the MONEY 70, our list of recommended mutual funds and ETFs.

Wondering if you couldn't achieve similarly positive results simply by picking better funds? Good luck consistently finding managers that will consistently outperform the market, says Thomas Idzorek, chief investment officer for Ibbotson Associates.

LESS SAFE BET: Tilt toward small bargains.

In this strategy, you would keep your overall stock-to-bond split the same. You'd just move some of your equity allocation out of big blue chips and into small-cap value stocks -- shares of small companies that are being overlooked or once-larger companies that have fallen on hard times and are selling at attractive prices.

Between July 1927 and the end of last year, the average small-cap value stock gained more than 14% annually, according to Ibbotson Associates, vs. 9.8% for the S&P 500.

It's not all roses, however: Such stocks tend to be more volatile than your garden-variety blue chip because they've either been battered or lack competitive advantage.

Also, there have been long stretches when they have been out of favor, such as the mid- to late 1990s. Finally, since these shares have returned nearly three times as much as the broad market over the past decade, it's hard to imagine they can keep churning out outsize gains -- at least in the short run.

But in the long term "there's no reason to believe small-cap values won't sustain their advantage," says Paul Merriman, founder of Merriman Capital Management.

So if you have at least two decades to invest, gradually shift small amounts from large-caps into small value through a fund like T. Rowe Price Small Cap Value (PRSVX), which is on the MONEY 70. Do so until the shares are a quarter of your equity allocation, and history says you'll see a real impact. Since the late 1920s, a 60% stock/40% bond portfolio with this small-cap value tilt returned 9.7% a year, while a traditional 60/40 index portfolio returned 8.7%. With that edge, in 25 years you'd turn $200,000 into $970,000 in today's purchasing power vs. $770,000 without the small-cap bent.

RISKIER BET: Step up your stock stake.

History shows that the simplest thing you can do to boost long-term investment performance is to dial up your equity exposure. Since 1926, the average 50% stock/50% bond portfolio gained 8.2%, according to Vanguard. Raising the stock stake just a bit, to 60%, would have resulted in annualized gains of 8.7%.

There's a trade-off, of course: The more you tilt toward stocks, the higher your chances of losing money in a single year. A 50/50 portfolio has lost value in 17 calendar years since 1926; a 60/40 has fallen 21 times; a 70/30 sank in 22 years; and an 80/20 dipped in 23.

You'll suffer the most if the market dives near the end of your time horizon, since you won't have a chance to recover. For example, if you entered 2008 the last year the market suffered losses -- with $1 million, you'd have had $798,000 at the end of the year with a 60/40 mix.

Were your portfolio instead invested at 50/50, your million would've ended up at $840,000. So even if you think you can handle a greater stock exposure now, be sure to reduce the percentage as you approach your goal date.

RISKIEST BET: Leverage your equities.

Yale professors Ian Ayres and Barry Nalebuff think there's a problem with how we invest. When you're young and can tolerate being all in equities, you don't have much money. When you're older, you may want to be only 50% in stocks, but in dollar terms that dwarfs how much you had in the market in your youth.

Therefore, the duo have controversially posited that young investors -- those in their twenties and thirties -- should leverage their equity positions, sometimes by as much as 2 to 1. In other words, if you have $20,000 to invest, not only should all of that go into stocks, but you should borrow an additional $20,000 so you have $40,000 in equity exposure.

Ayres and Nalebuff crunched the numbers going back to 1871 and found that over a lifetime this strategy consistently beat the traditional 110-minus rule (where you subtract your age from 110 and put the resulting percentage in stocks). Their method resulted in accounts 14% larger, on average. Even in the worst case, their approach came out ahead by 3%.

These professors aren't talking about taking a flier on a single stock. They recommend investing in the broad market, which you can do using a margin account at your brokerage to buy an index fund or ETF.

Or you can leverage your bets through options contracts that give you the right to buy or sell an index, such as the S&P, in the future. You'd reduce your stock exposure as you age. In fact, the extra risk you take in your twenties and thirties would allow you to be even more conservative -- possibly keeping as little as 20% in equities -- toward the end of your career.

There are, of course, caveats: While the profs say that someone in his forties could still benefit by leveraging -- say, 1.2 to 1 -- older folks or those with a time horizon of less than 20 years should think twice about trying this strategy. Leverage will magnify any losses you suffer in equities.

And that could put you in dire straits if your brokerage issues a margin call, meaning it requires you to sell some of your holdings because your account value is too low. (This is also a risk for young people, but less dire.)

Finally, if you work in a volatile industry where your future income looks shaky, you can't afford this type of risk. But if you've got a stable job and decades to invest? It may just make you a million bucks.

No comments:

Post a Comment