You worked hard over your lifetime to build a nest egg in order to fund your retirement. Doesn't it make sense that now that you're retired your money should work as hard for you as you worked for it? When you were working, you were accustomed to receiving a raise in pay each year. Why should that end now, just because you are retired? It doesn't have to, because investors today have the good fortune and opportunity to invest in blue-chip "Dividend Champions" (companies that have increased their dividend every year for at least 25 years) which are trading at historically low valuations.

You Deserve a Raise Each Year!

Even though you're retired, you still deserve a raise in pay each year. However, because you're retired, your willingness to take risk is not as high as it once was. On the other hand, not being willing to take any risk at all can be a very risky strategy in its own right. The looming threat of inflation would be devastating to a fixed income portfolio. The loss of purchasing power, with no ability to counteract it, would expose you to a diminishing standard of living. In addition to purchasing power shrinkage due to inflation, a fixed income portfolio also faces interest rate risk. The Fed fights inflation by raising interest rates, which causes the principal value of previously issued bonds to drop.

With interest rates at historic lows today, long-term bonds could face price drops as great as we saw when stock prices fell during the great recession of 2008. Shorter term bonds provide no refuge, because their rates are currently too low to provide a meaningful level of income for the average investor's asset base. As of March 15, 2011, the following yields on treasury bonds, the safest of all fixed income instruments, says it all. A two-year Treasury Bond yields .55%, a five-year Treasury Bond only yields 1.86% and the 10-year Treasury Bond yields only 3.21%. To put this in perspective, the 10-year Treasury Bond is extremely expensive today with a price to interest ratio of 31.15 (cost of 100 divided by 3.21% = 31.15). This high price should serve as a warning sign to investors.

Therefore, assuming a certain amount of risk is both necessary and unavoidable. The key is to manage the level of risk you take in an intelligent and prudent manner. Risk has many faces, and the prudent investor understands this, and considers them all when they attempt to build a properly structured investment portfolio. In our way of thinking, a properly structured investment portfolio is one that is designed to protect principal on the one hand, and purchasing power on the other. Therefore, the well-structured portfolio should contain a capital appreciation component and an increasing income component as well. Holding low-yielding bonds to maturity may protect nominal principle, but not purchasing power.

Five Dividend Champion, Blue-chip Stalwarts - On Sale

High-quality, blue-chip, dividend-paying stalwarts are an asset class that prudent income seeking investors should carefully consider. We have chosen five which we believe possess the quality characteristics to reduce risk, while simultaneously offering the opportunity for above-average long-term returns, to include an increasing dividend income stream. Since our emphasis was on safety, high-quality was not enough, each selection also had to be available at an historically attractive valuation.

As we will illustrate, valuation risk is a major risk that is often ignored. Simply stated, we contend that high valuation increases risk, while low valuation reduces it. But even more importantly, the principles of valuation defy the maxim that higher returns can only be achieved by taking higher risk. When the principles of valuation are adhered to, the lower risk assumed with low valuation actually increases future return potential. Lower risk with higher returns is the "Holy Grail" for prudent investors.

Selection Criteria

In order to make our list, each company had to possess the following criteria:

- Industry-leading enterprise, a top-five company

- Long and consistent record of earnings growth

- History of low volatility (Beta below 1)

- Value Line highest-quality rating (A++)

- 25 or more years of consecutive dividend increases (Dividend Champion)

- Debt less than 50% of capital

- Calculated double digit returns based on consensus analyst earnings estimates

- Valuation significantly below historical norms

- Dividend yield 3% or better

Fabulous 5: Dividend Champions on Sale

Five high-quality blue chips made the cut as follows: Abbott Laboratories (ABT), Kimberly-Clark Corp. (KMB), Sysco Corp. (SYY), PepsiCo Inc. (PEP) and Procter & Gamble Co. (PG)

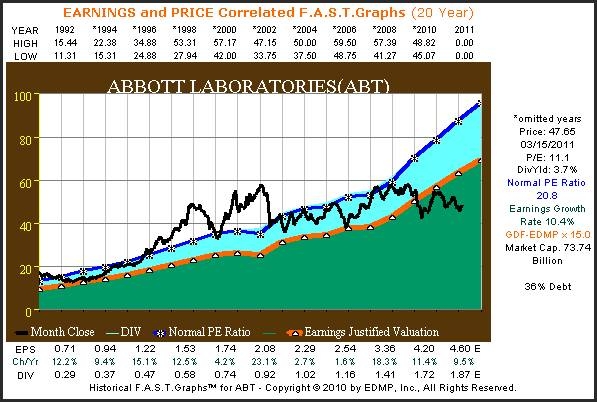

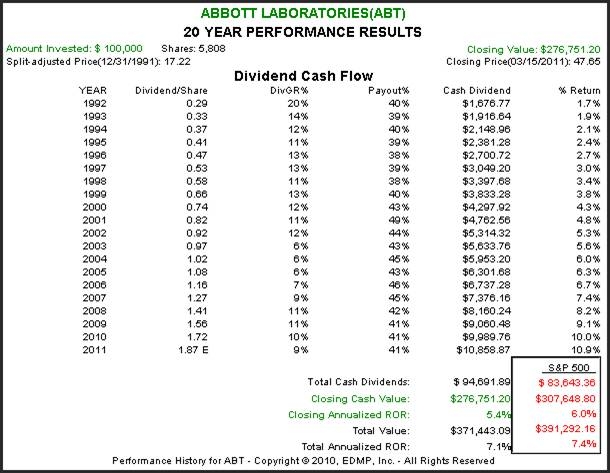

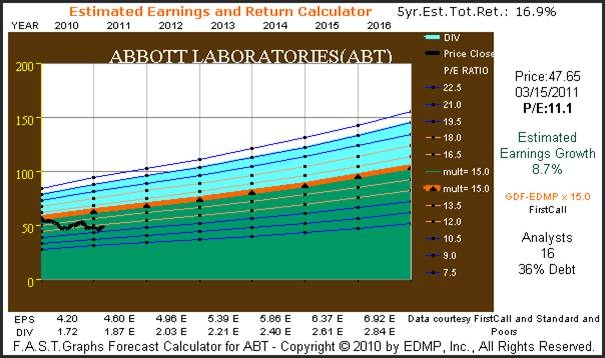

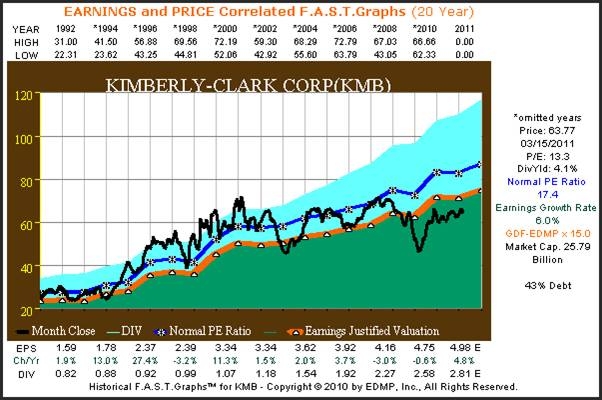

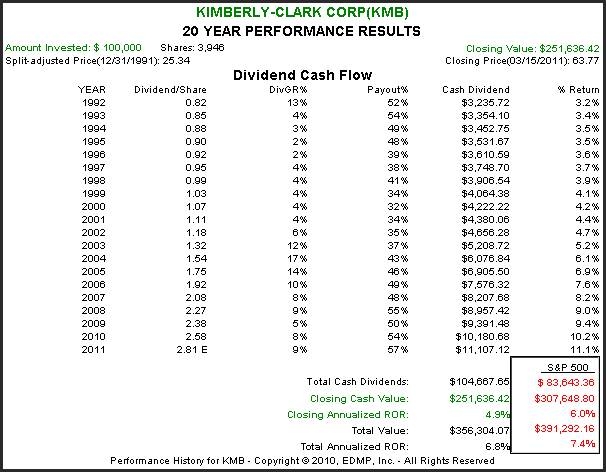

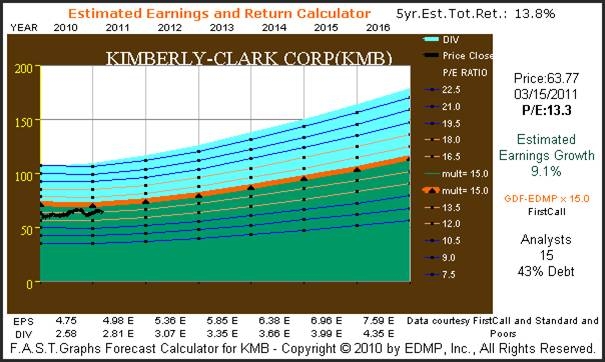

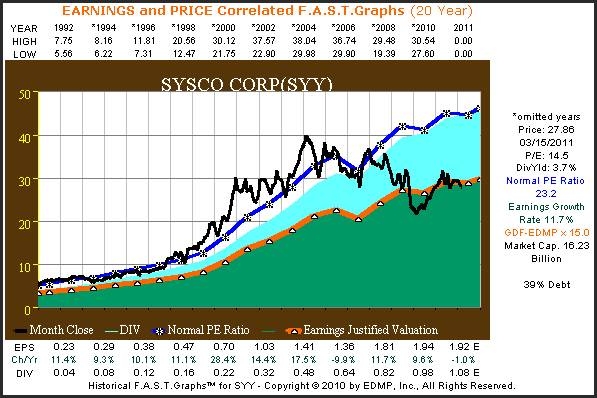

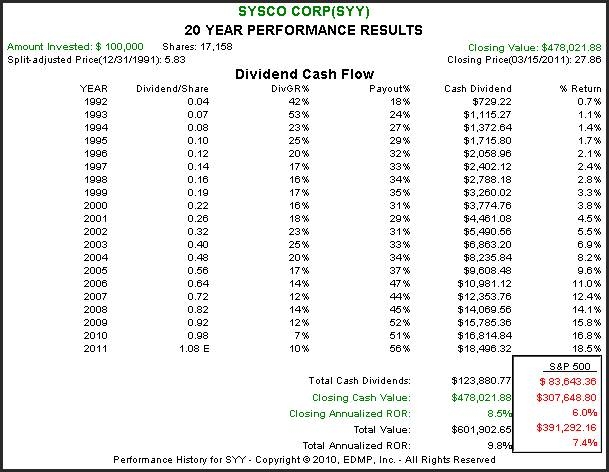

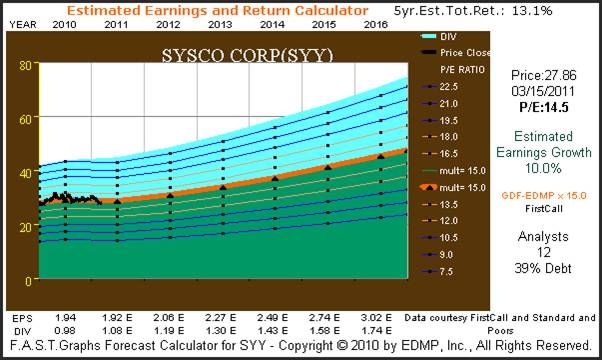

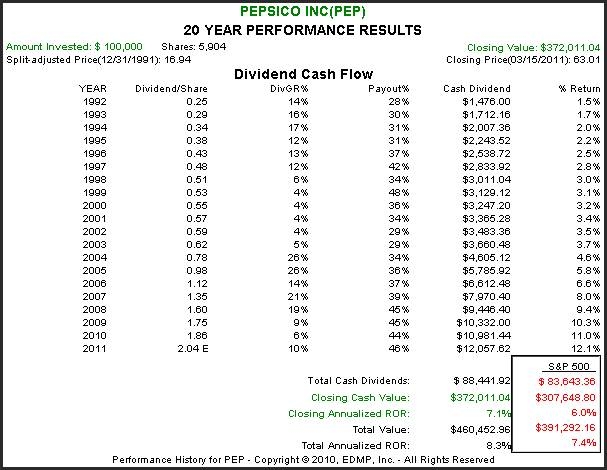

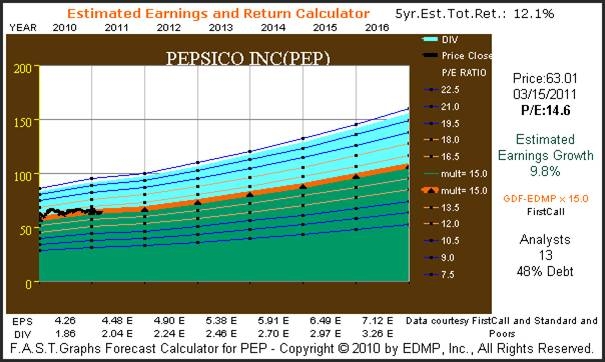

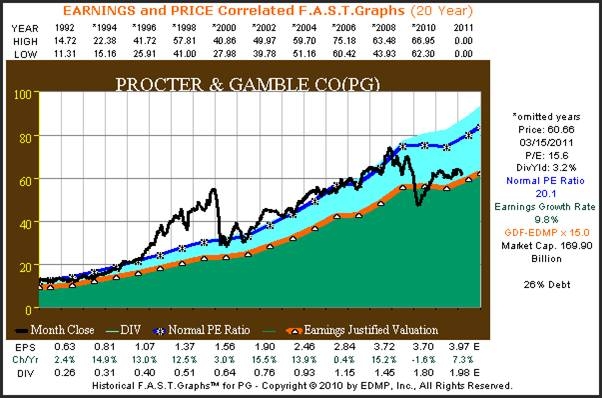

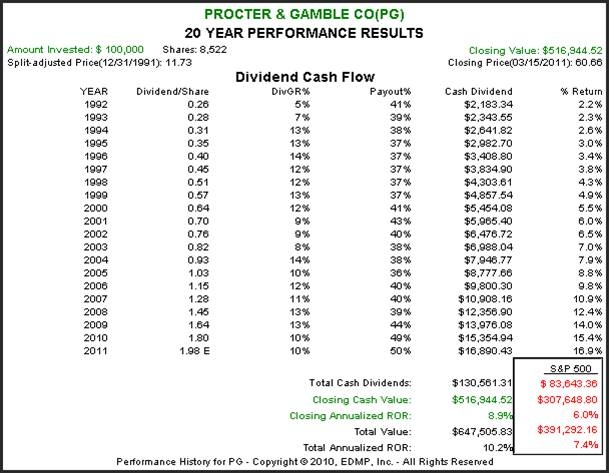

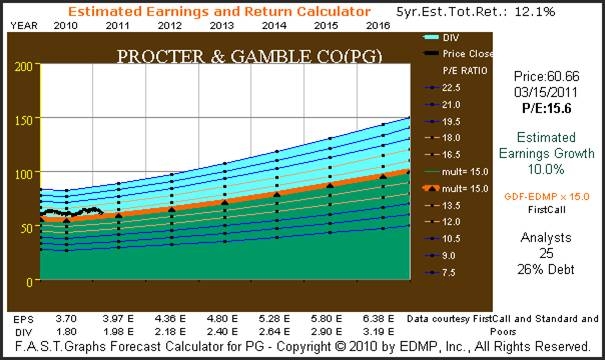

Since these are all high profile companies that are well known, we will spare the reader any long discourse on each. Instead, we will provide a short introductory description followed by three key F.A.S.T. Graphs™. Two of our graphs will deal with a review of history; a 20-year earnings and price correlated graph followed by the calculated historical performance. The third graph will represent our estimated earnings and return calculator based on the consensus analyst estimates for the next five years earnings growth rate for each company. (For those readers desirous of a more detailed analysis, a link to a short F.A.S.T. Graphs™ Alive™ video will be provided on each company).

There are key takeaways that each reader should focus on as they review the various graphs. When reviewing the historical earnings and price correlated graphs, note how the marketplace has traditionally priced each of these high-quality companies significantly above their earnings justified valuations (the orange line). But most importantly, note how earnings have remained relatively strong even through the great recession of 2008, yet price has fallen dramatically below historical normal valuations. Therefore, you will find that each of these selections are currently trading at valuations that are historically low, especially considering their long-term operating excellence.

When reviewing the historical performance associated with the earnings and price correlated graph, note the effect that beginning and ending valuation have on long-term capital appreciation. Otherwise notice how capital appreciation will closely correlate to earnings growth adjusted for these valuation discrepancies. But most importantly, notice how the dividend has increased each year in close correlation to earnings growth, regardless of stock price volatility. Also notice that dividends are assumed paid so that the reader can ascertain the true and specific impact and contributions that dividends provide.

Finally, when reviewing the estimated earnings and return calculator note how each of these companies is currently at fair value or below (stock price touching or under the estimated earnings justified valuation orange line) based on consensus analyst earnings estimates. As you review the calculated return expectations based on the analyst estimates, consider that the market has historically priced each of these companies higher than earnings justified levels. Consequently, it would be reasonable to assume that the market has typically applied a quality premium to these high-quality stalwarts.

Abbott Laboratories (ABT): "is a broad-based global health care company devoted to the discovery, development, manufacture and marketing of pharmaceuticals and medical products, including nutritionals, devices and diagnostics."

(Follow this link for a short F.A.S.T. Graphs™ Alive video on Abbott Laboratories)

Kimberly-Clark Corp. (KMB): "Kimberly-Clark and its well-known global brands are an indispensable part of life for people in more than 150 countries. Every day, 1.3 billion people - nearly a quarter of the world's population - trust K-C brands and the solutions they provide to enhance their health, hygiene and well-being. With brands such as Kleenex, Scott, Huggies, Pull-Ups, Kotex and Depend, Kimberly-Clark holds No. 1 or No. 2 share positions in more than 80 countries."

(Follow this link for a short F.A.S.T. Graphs™ Alive video on Kimberly-Clark Corp.)

Sysco Corp. (SYY): "Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments and other customers who prepare meals away from home. Its family of products also includes equipment and supplies for the foodservice and hospitality industries. The company operates 180 distribution facilities serving approximately 400,000 customers."

(Follow this link for a short F.A.S.T. Graphs™ Alive video on Sysco Corp.)

PepsiCo Inc. (PEP): "PepsiCo offers the world's largest portfolio of billion-dollar food and beverage brands, including 19 different product lines that generate more than $1 billion in annual retail sales each. Our main businesses -- Quaker, Tropicana, Gatorade, Frito-Lay, and Pepsi Cola -- also make hundreds of other enjoyable and wholesome foods and beverages that are respected household names throughout the world."

(Follow this link for a short F.A.S.T. Graphs™ Alive video on PepsiCo Inc.)

Procter & Gamble Co. (PG): "Four billion times a day, P&G brands touch the lives of people around the world. The company has one of the strongest portfolios of trusted, quality, leadership brands, including Pampers(R), Tide(R), Ariel(R), Always(R), Whisper(R), Pantene(R), Mach3(R), Bounty(R), Dawn(R), Gain(R), Pringles(R), Charmin(R), Downy(R), Lenor(R), Iams(R), Crest(R), Oral-B(R), Actonel(R), Duracell(R), Olay(R), Head & Shoulders(R), Wella(R), Gillette(R), Braun(R) and Fusion(R)."

(Follow this link for a short F.A.S.T. Graphs™ Alive video on Procter & Gamble Co.)

Summary and Conclusions

We believe that the five companies covered in this article represent an unusual and rare opportunity for investors seeking a safe and reliable growing income stream, coupled with the potential for capital appreciation. Keep in mind that dividends come from earnings, and a growing dividend can only result from growing earnings. Therefore, we feel it defies logic to find these companies remaining at such attractive valuations considering the two-year rally in the general stock markets. There are many lesser companies that do not possess the attributes of quality and growth that these do, yet command much more lofty valuations.

In truth, there are other equities that offer a higher starting dividend yield than this group of five. However, we believe that prospective investors will be hard pressed to find investments that possess the total package of the quality characteristics and growth prospects that this group does. Since safety, or risk aversion, was a major concern of this article, we sought dividend paying companies where their blended yield was close to, but exceeded the 3.21% yield available from a 10-year Treasury Bond. The blended yield from an equal investment in each of these five blue chips exceeds 3.5%, and based on the consensus of leading analysts estimates for growth, could potentially increase at the rate of 9 3/4% per annum (average estimated earnings growth rate). These estimates are based on these companies continuing to trade at fair value, and does not consider the possible PE expansion if they were to return to their historical normal valuation levels.

Therefore, we believe that these selections represent a strong foundation for further research by investors seeking safety, capital appreciation and a growing income stream. There are many other companies that possess most of the rigid selection criteria that this article required. However, other than this group of five, we found no others that met them all. Many were close, lacking only one or two of the criteria. Nevertheless, we encourage a comprehensive research effort on each of these names before investments are made. But hopefully, we have presented a sound starting point.

Disclosure: I am long ABT, KMB, SYY, PEP, PG.

No comments:

Post a Comment