The Dividend Champions spreadsheet and PDF have been updated through 2/28/11 and are available here. Note that all references to Champions mean companies that have paid higher dividends for at least 25 straight years; Contenders have streaks of 10-24 years; Challengers have streaks of 5-9 years. Together, all of these companies may be referred to using the abbreviation “CCC.”

This is the third in a series of articles focusing on specific industries and isolating the CCC companies within those industries. The first covered Master Limited Partnerships (or MLPs) and the second covered Real Estate Investment Trusts (or REITs).

What Are Utilities?

Although that question may seem a bit facetious, it's worth asking in view of recent changes, such as the deregulation trend of the 1990s, as well as the diversification into other fields of operation that many traditional utility companies are following. In addition, we have to understand that some industries evolve over time to resemble the widely held image of the utility industry.

We first think of the local electric company or the firm that provides us with water (and sometimes wastewater treatment). Providers of these necessities may also extend to companies that distribute natural gas or other services. So the basic definition includes companies that provide necessary services and are usually regulated by federal, state, and sometimes local governments. These are the traditional “widows and orphans” stocks that are expected to provide a steady, dependable stream of dividend income, largely because of the perception that they are monopolies protected by state governments.

Deregulation may have changed the image of utilities, as protected monopolies to some extent and losses caused by ill-conceived attempts at diversification may have provided a hard lesson in dividend vulnerability. But many of the traditional utilities have managed to continue to extend long histories of dividend increases, and those appear in the table below.

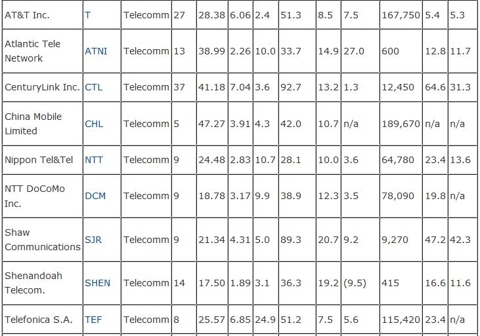

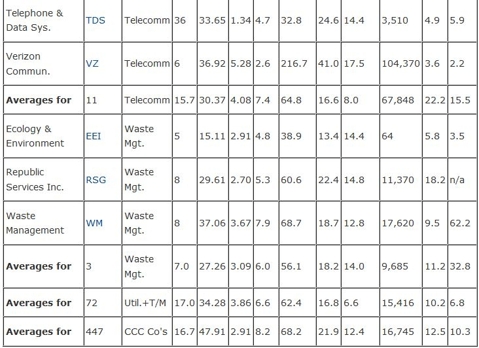

I've expanded the listing to include what might be called “pseudo-utilities,” including telecommunications providers and waste management companies. Some sources exclude the telecom companies, but I think they fit the description well enough to be included. Maybe telephone service was considered a luxury 100 years ago, but it's something few of us would do without today. And because many residential, commercial, and industrial clients have no municipal trash disposal, they are forced by necessity to pay for waste removal, so I'm included those companies as well.

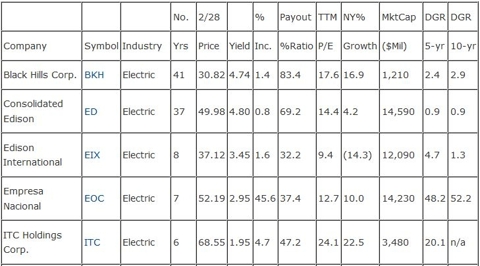

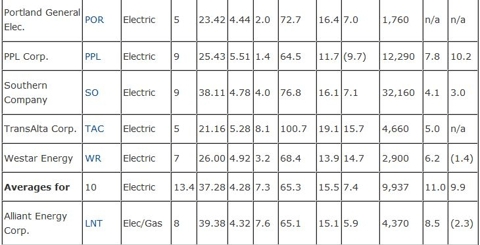

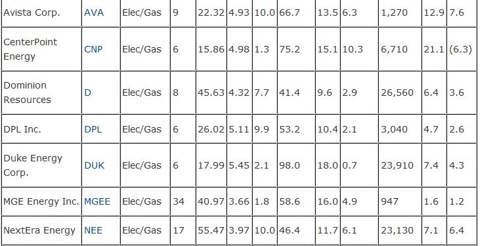

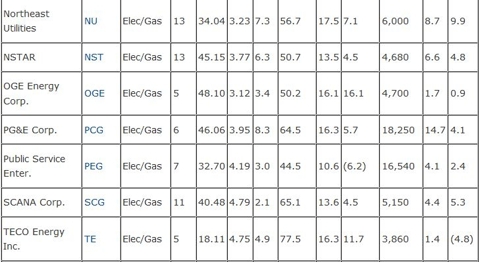

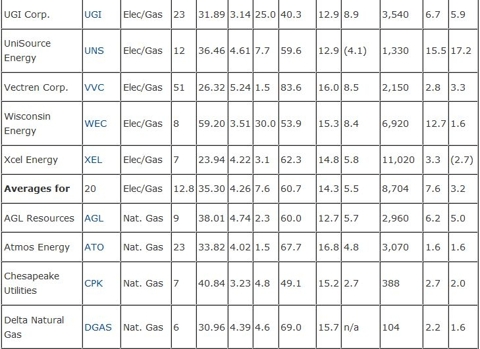

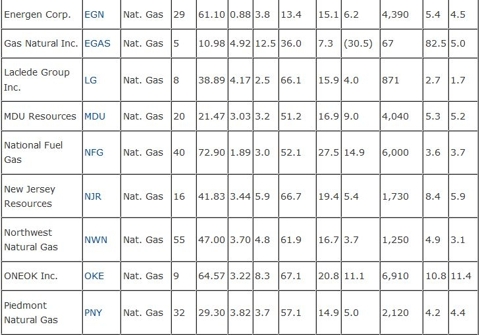

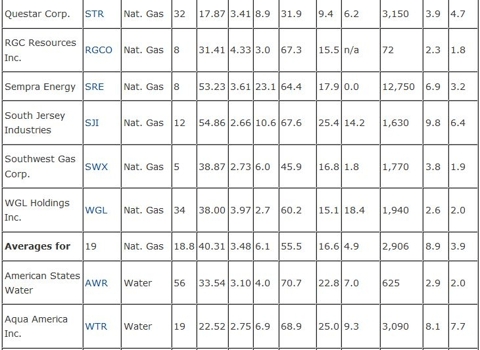

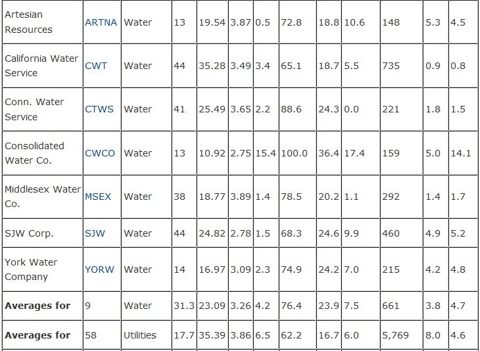

The Companies

Utilities (and pseudo-utilities) make up one of the largest segments of the CCC universe, with 58 traditional utilities, 11 telecom companies, and three waste management firms. These 74 companies have an average yield of 3.86%, well ahead of the 2.91% average for the 447-company CCC list. The electric and telecom companies lead the way, with average yields of over 4%. The trade-off is a slightly lower rate of dividend growth in general, although there is a wide range of DGRs to consider.

For an investor looking to add one or more utilities to his or her portfolio, the table below should provide plenty of good choices. In considering these companies, it's a good idea to think about the role of any non-regulated activities that a company conducts. For example, some of the natural gas distributors also have operations that explore for and produce oil and gas. Others are attempting to develop wind and solar energy that may be sold to other utilities.

So this article should only be considered a starting point for further research, and that is really the focus of this series, isolating industries for potential investors. I'm including as many columns of data as is practical, from a perspective of width and significance. (Click charts to enlarge)

Note that NSTAR has agreed to be acquired by Northeast Utilities. Also, the list of four-year streaks includes CMS Energy, NorthWestern Corp., and NV Energy.

Summary

The Utility industry is a traditional source of above average yields and there are several that have established long histories of annual increases. Unlike the subjects of the first two articles in this series (MLPs and REITs), the taxation on these dividends is fairly straightforward, at the 15% rate until at least the end of 2012. I expect that to be the case with subsequent installments in this series that will focus on other industry/sector groups.

Disclosure: I am long CTL, DUK, EIX, MDU, NEE, NFG, OKE, SCG, T, WTR.

No comments:

Post a Comment