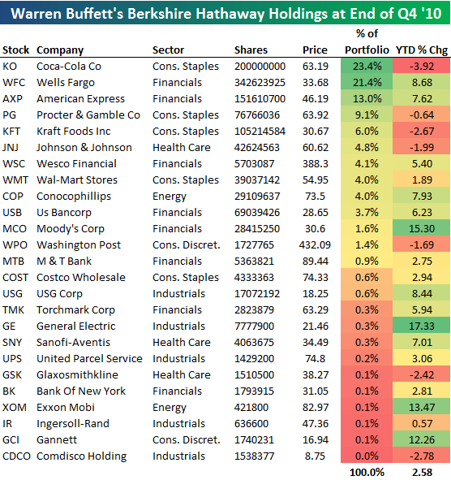

Below we highlight the holdings of Warren Buffett's Berkshire Hathaway at the end of 2010 from the company's recently released 13F. Using these positions, the portfolio is up 2.58% so far in 2011, which is 300 basis points below the S&P 500's year-to-date change of 5.60% (through 2/15). Coca-Cola (KO) has no doubt hurt Buffett's returns this year. KO is not only Berkshire's biggest holding at 23.4%, but it's also the worst performing holding YTD with a decline of 3.92%. Wells Fargo (WFC) -- Berkshire's second biggest holding -- has picked up the slack, however, with a YTD gain of 8.68%. American Express (AXP) is Berkshire's third biggest holding at 13% of the portfolio.

Buffett's best holding year-to-date has been General Electric (GE) with a gain of more than 17%. When was the last time General Electric led any portfolio? Moody's (MCO), Exxon (XOM), and Gannett (GCI) are the only other names in the portfolio that are up more than 10% year to date.

(Click charts to expand)

We also ran Berkshire's holdings through our custom trading range screen which makes it easy to quickly see where the stocks are trading at the moment. The stocks are sorted by their size in Berkshire's portfolio from biggest to smallest. While most stocks in the portfolio are overbought, it's easy to see that some of the bigger names in the portfolio are the ones that have been weak.

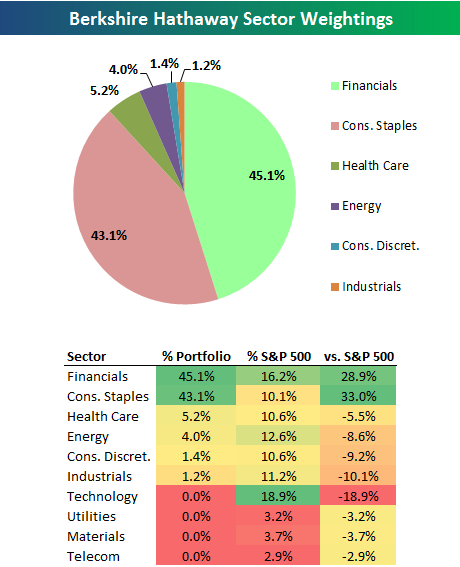

Finally, we put together a sector breakdown of Berkshire's portfolio. As shown, Financials make up a whopping 45.1% of the portfolio, while Consumer Staples make up 43.1%. As shown, Buffett's sector weightings are just a wee bit different from the S&P 500's sector weightings. He's the most underweight the Technology sector since he has no exposure to it even though it's the biggest sector in the S&P 500 at 19%. Buffett has said numerous times in the past that he doesn't invest in what he doesn't understand, and that is one reason he gives for not investing in the Technology sector. In this case, he's putting his money where his mouth is.

No comments:

Post a Comment