Last week we went over a few reasons why I think the market could be at or approaching a short term top. Give it a read. It's a quick article that looks at how some of the internals are flashing yellow have diverged with the rest of the market. Since then a couple more indicators have starting flashing yellow, particularly a rolling-over in emerging markets. And if the psychology of this whole rally has you bewildered, perhaps this might bring you some peace.

Today we're going to use all this knowledge to design a simple strategy that will get you some more bang for your buck out of the section of your portfolio that you've carved out for income investing.

Step one is to sell all your dividend stocks.

I know. Calm down. It's OK. If you really don't want to sell them or you've owned them for a long time and are worried about the taxes or are emotionally attached to them, then it's cool. You're an adult and you can accept responsibility for your actions.

Sell some of them.

Don't worry, we're not going to cash. (Though I continue to think it's fine to hold a big pile of cash, piddly yields and all, for tactical opportunities down the road.)

We're going to Treasuries!

(Click to enlarge)

The 10-year yield stalled out in December but lately it's broken out a bit. 3.6% isn't too bad -- much more attractive than the 2.5% it was yielding last year. And 3.6% is probably in line with what a lot of your dividend stocks are giving you. That yield might drift a little higher, so feel free to adopt your own timetable for this strategy. But don't wait too long.

Once you've sold some of your equities, get your bond exposure via the Barclays 7-10 Year Treasuries ETF (IEF) or the 10-20 Year Treasuries ETF (TLH), which is yielding around 3.7%. If you want more oomph, there is TLT which is yielding closer to 4.3%, but I think that might suffer from a bit more duration risk than we might be comfortable with for a shorter-term strategy like this.

In bonds you've got two nice tailwinds at your back for the next six months. The first is the Fed's QE purchases; don't forget there's still another $500 billion or so to go. Every major central banker in the world is doing everything they can to drive down interest rates right now. The "don't fight the Fed" rallying cry is usually used in conjunction with stocks. But why fight them in the bond market? That's where they can actually do some direct damage.

The other nice thing about owning bonds for the next couple months is that you'll get some capital appreciation if the economic data slows down, or some geopolitical event rocks the markets, or if we get another deflationary mini-panic. There are a lot of risks in the first half of the year and the market is very complacent right now. We wrote about some of these in our "Predictions for 2011."

If any of that stuff actually transpires, you'll see a flight to quality, a drop in rates, and some nice capital gains on those bonds you bought.

Step two is to just hang out.

Just hang out until the shakeup happens. Don't worry, it will happen. The market's not going to stay on this momentum-driven trajectory forever. History suggests that these things correct with disturbing regularity. Markets go up and up, and then they freak out for a bit and go down againn, if only for a little while.

Warning: you might be tempted as you sit on these boring old bonds to do something exciting. Try and resist. Hit the slopes for a weekend or go to the gym. Go drinking with your buddies at the club.

When we do get that correction the stock market will pull back. Then it's time to go shopping! And it will be nice because your buying power will have increased because your bonds, under this scenario, will have appreciated in value. Had you held on to all those original stocks you might not have had as much capital to redeploy.

Step three is to go back to those dividend stocks.

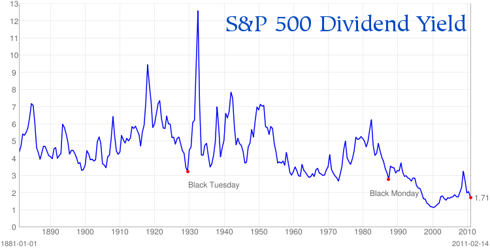

The cool thing about going shopping for dividend stocks after a pullback instead of in the late stages of a giant rally is that you get a whole lot more yield.

You probably have your own list of dividend stocks. But I'll give you 10 of my favorites from different sectors that you might want to consider:

Altria Group (MO) - The classic dividend champ. It's yielding 6.3% right now and still has a pretty good medium-term chart. If stocks sell off a bit, you could lock down a dividend at or around 7%. Awesome. In the words of Walter Sobchak, "Dude, let's go bowling!"

American Electric Power (AEP) - Currently yielding over 5% and trading a 11x this year's earnings. Not a bad deal if you can scoop some more up on a dip.

Consolidated Edison (ED) - Who doesn't love Big Ed? (I mean, aside from all those people who buy their energy from them.) It's yielding 4.8% at a sensible multiple and they have a long history of stability and keeping their dividend strong. ED is a cornerstone of any serious dividend portfolio.

Exelon (EXC) - As you can tell, I like all sorts of kinds of energy stocks. Especially nuclear power, which I think we may be forced to get serious about in this country at some point. Their dividend is just under 5%, but they're a wild card in that if alternative energy takes off again or crude oil gets super expensive, they could benefit from some outside speculative forces. it's fairly valued at around $40/share.

ExxonMobil (XOM) - Another granddaddy of dividends. They might be a bit expensive right now after this recent run up and the dividend is only about 2%. But there's probably no better company in the world to buy on a dip than Exxon.

Intel (INTC) - Intel has made, in my opinion, a simply beautiful transition from exciting growth stock to predictable, boring, dividend staple. It hasn't been much fun owning Intel in the last decade, but I think Intel will be tremendously rewarding to own in the next decade. They're yielding 3.3% right now and are doing all sorts of shareholder friendly things like this latest buyback.

Kraft (KFT) - Hey, I told you I like boring. A 3.8% dividend competes with the 10-year Treasury, but I'd much rather own a company like Kraft for the next few years than U.S. Treasuries, especially if I can buy it in a dip when the yield is a little higher.

McDonald's (MCD) - A 3.2% dividend is OK. But who would have thought that McDonald's would have these kinds of growth prospects? This is another fantastic company to own for the long run and to buy on a dip, maybe after a China-panic, where a lot of their current growth is coming from.

Pfizer (PFE) - This is one that I just have to hold my nose and buy on the belief that this is the end of their long, slow march lower. A 4.2% dividend is attractive and Pfizer is still a relevant company that isn't going anywhere in the next decade.

Plum Creek Timber (PCL) - This is a fun, different one. Timber! If you're a Jeremy Grantham disciple, you know that he loves timber for the next decade and I do too. PCL is a leader in this space and wood is a much more awesome resource than you might be aware of. We extolled the virtues of that right here. A 4% yield ain't bad either, even if their earnings multiple is a bit rich.

Verizon (VZ) - Verizon is going to be a very boring company with less prospects for growth than many are thinking now that they have the iPhone. A 5.4% dividend is nice, but if you can pick this up on a dip and a yield closer to the 6-7% we saw last summer, that's the kind of thing you'll want to lock down for the next several years.

Waste Management (WM) - A 3.3% yield is nice, but this is another fundamentally sound company that will be with us for a long time to come. And seriously, is there an industry with more inelastic demand than waste disposal?

(Click to enlarge)

A final caveat

There is risk in this strategy. The risk is an opportunity loss that you might experience if the stock market keeps on running higher for longer than you or I expect. You'll miss out on that capital appreciation of your equities, and the rising yields that will most likely accompany that environment will be a drag on your bonds.

Personally, this is risk I can deal with. I can deal with not making as much on my investment as my buddies at the golf club. Your mileage may vary. Maybe you have to be the guy who always makes the most on your investments. (But seriously, if you are, why are you reading an article about dividends?)

The kind of risk that I can't deal with is the risk that a whole bunch of my stuff goes "poof." I do not want to be the guy at the clubhouse bar who lost 15 or 25% on his portfolio, crying in his gin and tonic. I don't care that all my other buddies would be commiserating with me, I want to be the guy who says "Hey, I came out of this thing even stronger." These buddies, by the way, were the same ones telling me to load the boat with dot-com stocks in 1999 and were all urging me to go in with them on a couple of spec homes in 2005.

So you can hedge this risk a few ways if you want.

First, you can write some puts on something like the S&P SPDRs (SPY). That'll help you keep up with the yield. Or you can write cash-secured puts on the dividend stocks that you someday want to own. You can also own a teensy bit of something that's levered to a rising market, (SSO) maybe? Or high-end retailers perhaps. That way you'll have some positions that are still thriving if the market runs higher. You can also use some other options strategies like a bull call spread that help you participate if the market goes way up but don't cost you much to put on.

This is both flexible and robust strategy.

In case you were daydreaming while you scrolled to the bottom, I'll recap:

- Switch to bonds for a little while. Sooner is probably better.

- Wait for the shakeup and the market correction we all can feel coming.

- Reload your dividend portfolio with great companies at higher yields.

- Go brag to your friends a the club about how you made money and boosted the income power of your portfolio. Buy them all gin & tonics. They'll probably need them.

If that's not exciting enough for you, I suppose there's always gold.

Disclosure: I am long XOM, AEP.

No comments:

Post a Comment