PepsiCo, Inc.(PEP) manufactures, markets, and sells various foods, snacks, and carbonated and non-carbonated beverages worldwide. The company operates in four divisions: PepsiCo Americas Foods (PAF), PepsiCo Americas Beverages (PAB), PepsiCo Europe, and PepsiCo Asia, Middle East and Africa (AMEA). The company is a dividend aristocrat which has increased distributions for 38 years in a row.

Over the past decade this dividend stock has delivered an annualized total return of 4.90% to its loyal shareholders.

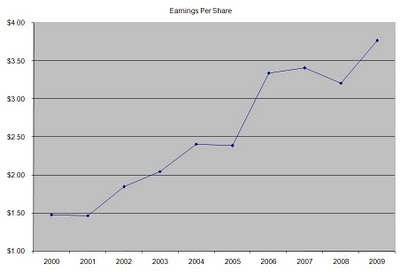

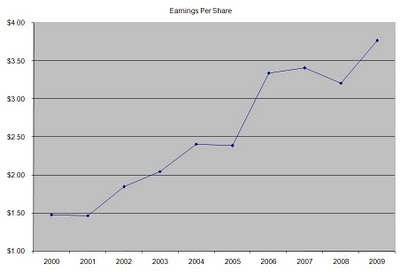

The company has managed to deliver an average increase in EPS of 10.90% per year since 2000. Analysts expect PepsiCo to earn $4.12 per share in 2010 and $4.61 per share in 2011. This would be a nice increase from the $3.77/share the company earned in 2009. The company has recognized that carbonated drink sales are not going to grow significantly in the future, which is why it has focused on fast growing non-carbonated soft drinks. The company’s innovation in the area has been successful with the introduction of Aquafina , Gatorade and Propel, Lipton teas and Tropicana. Pepsi has also started to emphasize on health and wellness, and has worked to minimize the amount of trans fats in its snack foods. Future earnings growth could also come from synergies associated with the acquisitions of its bottlers, streamlining of operations and cost cutting. The distribution networks of the bottlers acquired could be used to push some of PepsiCo’s non-beverage products such as snacks and other foods. Earnings growth could also come from strategic acquisitions, as well as product innovations in health and wellness food and beverage section. The company has recently announced its plans to acquire the leading Russian food and beverage company Wimm-Bill-Dann (WBD), in an effort to position itself in the growing emerging market in Russia and to build its nutrition business.

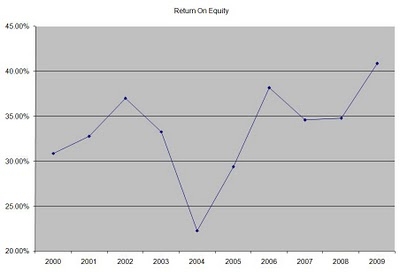

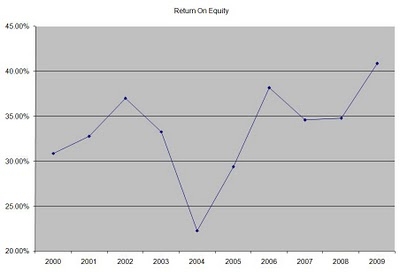

The company has a high return on equity, which has remained above 30%, with the exception of a brief decrease in 2004. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

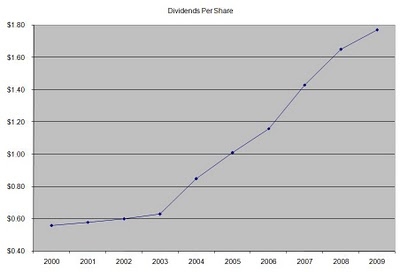

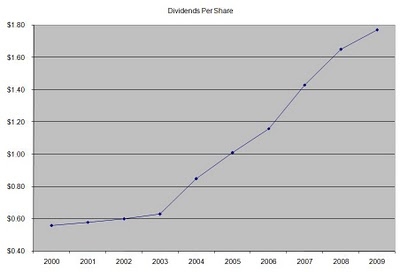

The annual dividend payment in US dollars has increased by 13.70% per year since 2000. A 14% growth in distributions translates into the dividend payment doubling every five years. If we look at historical data, going as far back as 1978, we see that PepsiCo has actually managed to double its dividend every six and a half years on average.

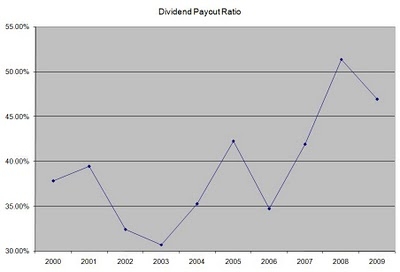

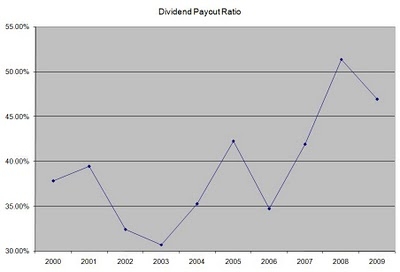

Over the past decade the dividend payout ratio has remained above 50% only in 2008. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently, PepsiCo is attractively valued at 16.50 times earnings, yields 2.90% and has a sustainable dividend payout. In comparison Coca Cola (KO) yields 2.70% and trades at a P/E of 20. I would continue monitoring PepsiCo and will consider adding to my position in the stock on dips.

Disclosure: Long PEP and KO

Over the past decade this dividend stock has delivered an annualized total return of 4.90% to its loyal shareholders.

The company has managed to deliver an average increase in EPS of 10.90% per year since 2000. Analysts expect PepsiCo to earn $4.12 per share in 2010 and $4.61 per share in 2011. This would be a nice increase from the $3.77/share the company earned in 2009. The company has recognized that carbonated drink sales are not going to grow significantly in the future, which is why it has focused on fast growing non-carbonated soft drinks. The company’s innovation in the area has been successful with the introduction of Aquafina , Gatorade and Propel, Lipton teas and Tropicana. Pepsi has also started to emphasize on health and wellness, and has worked to minimize the amount of trans fats in its snack foods. Future earnings growth could also come from synergies associated with the acquisitions of its bottlers, streamlining of operations and cost cutting. The distribution networks of the bottlers acquired could be used to push some of PepsiCo’s non-beverage products such as snacks and other foods. Earnings growth could also come from strategic acquisitions, as well as product innovations in health and wellness food and beverage section. The company has recently announced its plans to acquire the leading Russian food and beverage company Wimm-Bill-Dann (WBD), in an effort to position itself in the growing emerging market in Russia and to build its nutrition business.

The company has a high return on equity, which has remained above 30%, with the exception of a brief decrease in 2004. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

The annual dividend payment in US dollars has increased by 13.70% per year since 2000. A 14% growth in distributions translates into the dividend payment doubling every five years. If we look at historical data, going as far back as 1978, we see that PepsiCo has actually managed to double its dividend every six and a half years on average.

Over the past decade the dividend payout ratio has remained above 50% only in 2008. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently, PepsiCo is attractively valued at 16.50 times earnings, yields 2.90% and has a sustainable dividend payout. In comparison Coca Cola (KO) yields 2.70% and trades at a P/E of 20. I would continue monitoring PepsiCo and will consider adding to my position in the stock on dips.

Disclosure: Long PEP and KO

Add Your Comment

Track new comments on this article

4 Comments

Add a comment- Great analysis as usual.

The Ex-div date is 3/2, the share might be more volatile than usual.

PEP is a great company for the long term at a good price today.

I already hold a very good position but might initiate a Div capture strategy if the price goes to around $63.50. - Wouldn't it unlock the value of the franchise if the drinks portion (the Pepsi portion) were separated from the Frito-Lay portion? There's nothing that inherently ties these two together and they would certainly be worth more as two companies. Further, I question whether Pepsi's management is as good as that of Coke. Time will tell, I suppose, but some of the analysts who follow the drink industry believe that Coke is eating Pepsi's lunch. I love Pepsi, a great North Carolina company that has outgrown its roots. I hope this Wimm-Bill-Dann deal helps it in worldwide sales.