Microsoft (MSFT), the developer of the Windows operating systems, Office, and XBox, is one of the leading software companies in the world.

- Sales have grown at 10.5%.

- Net Income has grown at 11%.

- Dividend Yield: 2.37%.

- Five-Year Dividend Growth Rate: 11%.

- Balance Sheet: Very Strong.

With a P/E of only 11.5, a strong balance sheet, and an immense but arguably eroding competitive moat, Microsoft is priced for no growth. If the company can simply maintain current levels of revenue and income from this point forward, an investment would perform reasonably well due to dividends and share repurchases. If, on the other hand, the shift towards cloud computing and mobile computing damages Microsoft revenue and income, then shareholders will likely underperform.

[Click all to enlarge]

Overview

Microsoft is among the largest software companies in the world. With $62.5 billion in revenue and $24.1 billion in operating income in 2010, the company is broken up into five operating segments and the corporate segment.

Windows and Windows Live Division

This segment is responsible for developing the Windows 7 operating system and various other pieces of software such as Internet Explorer. In 2010, revenue from this segment was $18.5 billion and operating income was $13.0 billion, leading to a huge 70% operating margin.

Server and Tools Division

This segment is responsible for server and enterprise systems, including the Windows Server operating system, Microsoft SQL Server, Visual Studio, Silverlight, other services, and the variety of current and upcoming cloud computing systems such as Windows Azure and SQL Azure. In 2010, revenue from this segment was $14.9 billion and operating income was $5.5 billion, leading to 37% operating margin.

Online Services Division

This segment is responsible for online software such as Bing and MSN. In 2010, revenue from this segment was $2.2 billion and operating income was negative $2.3 billion.

Microsoft Business Division

This segment is responsible for Microsoft Office and a variety of other programs. In 2010, revenue from this segment was $18.6 billion and operating income was $11.8 billion, leading to another huge 63% operating margin.

Entertainment and Devices Division

This segment is responsible for the XBox, XBox Live, Windows Phone, and Zune. In 2010, revenue from this segment was $8.1 billion and operating income was approximately $0.7 billion, leading to an operating margin of about 8.5%.

Corporate

The corporate segment accounted for a loss of approximately $4.5 billion in 2010. This is natural, as the corporate segment deals with procurement, legal, IT, human resources, and so forth.

Growth and Metrics

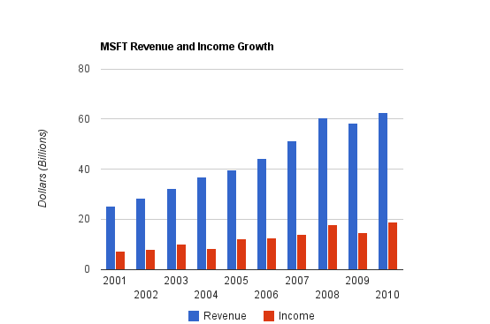

Despite the flat share price, Microsoft has experienced impressive growth in revenue and profits over the last decade. The company used to be highly overvalued, but over time company growth, combined with a diminishing stock valuation, has resulted in a flat share price.

Revenue Growth| Year | Revenue |

|---|---|

| 2010 | $62.484 billion |

| 2009 | $58.437 billion |

| 2008 | $60.420 billion |

| 2007 | $51.122 billion |

| 2006 | $44.282 billion |

| 2005 | $39.788 billion |

| 2004 | $36.835 billion |

| 2003 | $32.187 billion |

| 2002 | $28.365 billion |

| 2001 | $25.296 billion |

Over this period, Microsoft has grown revenue by an average of 10.5% per year. In the trailing 12-month period, revenue is over $66 billion.

Income Growth| Year | Net Income |

|---|---|

| 2010 | $18.760 billion |

| 2009 | $14.569 billion |

| 2008 | $17.681 billion |

| 2007 | $14.065 billion |

| 2006 | $12.599 billion |

| 2005 | $12.254 billion |

| 2004 | $8.168 billion |

| 2003 | $9.993 billion |

| 2002 | $7.829 billion |

| 2001 | $7.346 billion |

Over this period, Microsoft has grown net income by a compounded 11% per year. In the trailing 12- month period, income is up to over $20 billion.

EPS has grown even faster due to large quantities of share buybacks, from $0.69 in 2001 to $2.13 in 2010 and $2.38 over the trailing 12-month period.

Cash Flow Growth| Year | Operational Cash Flow | Free Cash Flow |

|---|---|---|

| 2010 | $24.073 billion | $22.096 billion |

| 2009 | $19.037 billion | $15.918 billion |

| 2008 | $21.612 billion | $18.430 billion |

| 2007 | $17.796 billion | $15.532 billion |

| 2006 | $14.404 billion | $12.826 billion |

| 2005 | $16.605 billion | $15.793 billion |

| 2004 | $14.626 billion | $13.517 billion |

| 2003 | $15.797 billion | $14.906 billion |

| 2002 | $14.509 billion | $13.739 billion |

| 2001 | $13.422 billion | $12.319 billion |

Over this period, Microsoft has grown both operational and free cash flow by a bit under 7% per year.

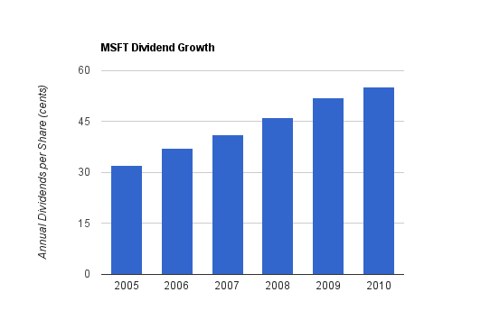

Dividends and Share Repurchases

Microsoft's dividend history is not very long, but combined with share repurchases, Microsoft has returned quite a bit of cash to shareholders over the last several years. The company's dividend history began in 2003, and soon after, a huge special dividend was paid. Since then, Microsoft has been paying regular and growing dividends. The stock currently has a dividend yield of 2.37% with a payout ratio of less than 30%.

Dividend Growth| Year | Dividend | Yield |

|---|---|---|

| 2010 | $0.55 | 2.20% |

| 2009 | $0.52 | 2.10% |

| 2008 | $0.46 | 1.60% |

| 2007 | $0.41 | 1.30% |

| 2006 | $0.37 | 1.50% |

| 2005 | $0.32 | 1.20% |

Dividends in the above chart are based on the calendar year. Microsoft has grown its dividend by an average of 11% over the last five years.

In addition to paying dividends, Microsoft spends a very large amount of cash on share buybacks each year. The company regularly spends over twice as much on share repurchases as it does on dividends.

Balance Sheet

Microsoft is one of the very few non-financial companies with an AAA credit rating. As of the most recent quarter, Microsoft has over $41 billion in cash and cash equivalents. To put that into perspective for scale, that amount of cash is greater than the market capitalization of VMware (VMW), greater than twice the market capitalization of Salesforce (CRM), more than three times the market capitalization of Netflix (NFLX), and equal to nearly half the market capitalization of Amazon (AMZN).

Microsoft has significantly more cash on hand than IBM or Oracle (ORCL) does, more cash on hand than Google (GOOG), but not as much as Apple (AAPL) if Apple's longer-term liquid investments are considered (and MSFT would have more than Apple if not for the dividends and buybacks).

Microsoft used to have no long-term debt, but in the last several years the company has leveraged itself a bit. And when interest rates dropped dramatically, the company took advantage of the low rates it could receive due to its credit rating, and now carries nearly $10 billion in long-term debt. Still, the balance sheet is very strong, with a current ratio of over 2 and a LT Debt/Equity ratio of 0.20. Goodwill accounts for only approximately 25% of equity. The interest coverage ratio is over 100, which is extremely healthy.

Investing Thesis and Risks

Based on the growth over this past decade (including recent years and quarters), the extremely strong balance sheet, the entrenched competitive advantage, the shareholder friendliness of the company, and the very low current valuation, an investment in Microsoft might seem like a no-brainer to those who look past the sideways stock price and into the historical performance of the company. But future performance, rather than historical performance, is what matters to investors, and Microsoft has a huge challenge ahead.

Microsoft is in an intriguing position of having one of the largest economic moats ever constructed (and certainly the largest tech moat ever built) while simultaneously seeing its moat being attacked more ferociously than any other. One needs only to look at its high operating margins on Windows and Office, along with its incredible market share, to see its privileged position. But the company largely dropped the ball when things began shifting towards mobile computing, and the upcoming shift towards cloud computing directly threatens the business end of the most profitable segments of its business.

Cloud Computing and Mobile Computing

Microsoft is facing a large shift in computing. With cloud computing, applications are shifting to a more centralized model, where information is available apart from the client device. This not only threatens Microsoft's moat on both the client and server side, but it also changes the economics of the entire industry, with a move away from capital expenditure towards a leasing-type service. In order to perform well, Microsoft has to effectively oversee a gradual multi-billion-dollar IT industry transition while preserving market share and margins.

Risk One: Market Share

The first key risk is that of market share risk. The company has been unprepared for the shift towards mobile computing in the form of smart phones and tablets, allowing companies like Google and Apple to capture market share. When it comes to cloud computing, the transition gives competitors openings in acquiring market share from Microsoft.

Risk Two: Self-Competition

When it comes to gaining market share, all companies involved with mobile and cloud software have market share risk. But Microsoft is in a position where it not only competes with others, but also competes with itself. Currently, the Windows and Business segments of Microsoft make up approximately 60% of revenue and most of its operating income. If the economics of cloud computing change this situation even moderately (and with operating margins of around 60-70%, there's a lot more downside than upside), then Microsoft's profitability is at risk. It'll either need to continue to develop larger revenue streams from a bigger piece of the IT pie, or it'll have to preserve its high margins.

Microsoft's Strengths

Despite the risks that Microsoft has ahead of it, and the lackluster ability and reputation for innovation, the company is still reasonably well positioned.

In terms of mobile computing, Microsoft has released Windows Phone 7, and has also demonstrated the ability and the plans to put Windows products onto ARM architecture. Windows Phone 7 is linked to XBox Live, which is evolving more and more into a multimedia experience rather than just a gaming experience.

In terms of cloud computing, Microsoft has a variety of solutions that are present and forthcoming. It's got the aforementioned XBox Live, which is now an aspect of both mobile and cloud computing on the consumer side of things, and recently released the well-received Kinect. On the business side of things, it's got Windows Azure and SQL Azure.

All in all, Microsoft's strength is obviously not in its innovation, but in its scale. For cloud computing, Microsoft has and will have market share of software as a service, platform as a service, infrastructure as a service, and has and will have market share of both the business and consumer aspects of the industry. By being on all sides, including both the client and server side and everything in between, it's set up to continue as a leading industry player. But this also means it's got competitors on every side. Oracle competes in the server and tools business; a variety of niche players compete on the business software side; Apple and others outperform on the consumer side; And players like Google and Amazon compete on the online side, among other areas.

Conclusion

In conclusion, I am cautiously optimistic on Microsoft stock at the current valuation. I remain rather neutral for the company as a whole, but at this low valuation, I believe the market is fairly or undervaluing the company.

Microsoft has the massive resources needed for drastic industry change and as a buffer against disruptive innovation by others, but there is substantial uncertainty regarding its future profitability. A lot of things need to go right as Microsoft oversees an industry transition.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment