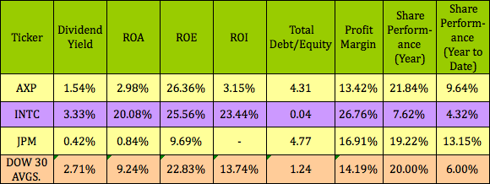

Looking for blue chip dividend paying stocks with a decent dividend yield? As the rally continues, and share prices climb, many dividend yields aren't keeping pace, posing an ongoing challenge for income investors. If you want to earn higher yields over the next few months, here are 3 Dow dividend stocks that all have double-digit high options yields on covered calls and cash secured puts:

American Express (AXP). Intel (INTC), and JP Morgan Chase (JPM).

click to enlarge

Not surprisingly, JP Morgan has the weakest management metrics due to hangover from the financial crisis, but it does have a higher profit margin than American Express. However, JPM has appreciated the most year-to-date, up 13.15%. JPM has also talked about raising its dividend in the future, as conditions approve. Currently, Intel (INTC) has the best dividend yield of these 3 stocks, and is above the Dow 30 2.71% average. We've added INTC to the tech section of our High Dividend Stocks by Sector Tables.

Intel's higher dividend yield hasn't translated into higher share performance yet in 2011, as it's up only 4.32%, due to analysts' concerns over slower growth in 2011, after 2010's record earnings. Thus far, JPM has the lowest 2011 PEG ratio, but Intel may very well keep surprising to the upside, if tech spending continues to pick up in 2011:

You'd think that American Express would be poised to capitalize on rising consumer spending, but pending legislation on credit card fees is holding back EPS growth forecasts. However, the Fed just weighed in on possible fallout from this bill so things may change:

The Dodd-Frank Act enacted in July requires the Fed to establish the cap on so-called interchange fees charged to merchants. The central bank proposed in December to set the limit at 12 cents per transaction, setting off a lobbying battle between retailers who favor the rule and lenders, who stand to lose more than $12 billion in annual revenue if the proposal as written becomes final.

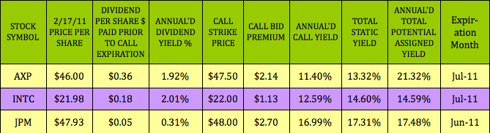

Here's how covered calls stack up vs. the dividends for these stocks:

As none of these stocks boasts a huge dividend yield, their call options yields easily outstrip their dividends by at least 6 to 1. These are allrelatively short-term 4- to 5-month trades, expiring in June and July. There are more details about these and other trades in our Covered Call Table.

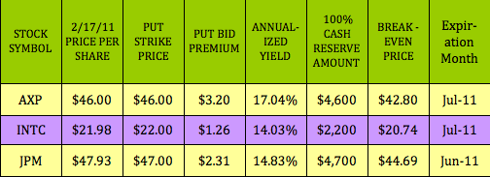

For investors looking for a lower entry point, selling cash secured puts also offers double-digit annualized yields:

Intel has the least volatility of this group at under 14 over the past few months, hence its put options yields trail AXP and JPM, both of which have 20-plus volatility. You'll find more details about these and other options trades in our Cash Secured Puts Table.

Disclosure: I am long INTC. Author is short JPM puts, INTC calls, and long INTC shares

No comments:

Post a Comment