On March 30, 2011 an author that I have a great deal of respect for published an article titled "Investors who seek Alpha should seek out dividend stocks". Although I share an appreciation and penchant for owning quality dividend paying growth stocks, I also took exception to the innuendo and conclusions that his article presented. Ironically, the article started out with one of my favorite and most cherished quotes by Thomas H. Huxley:

"The deepest sin against the human mind is to believe things without evidence."

The opening of the article, utilizing this extremely relevant quote, stirred up a great deal of fear on my part. I was fearful because the article suggested that a study, which the article quotes and is primarily based on, alleges to prove that dividend stocks outperform non-dividend stocks. Therefore, at least to my way of thinking, initially suggests that investors who want the best returns should ignore non-dividend paying stocks, and should seek out only dividend stocks. I believe this is a classic example of a "muddy study" and FEAR as I use it here is an acronym for - False Evidence Appearing Real.

Of course, my real fear is that articles and studies like those represented in the above article will mislead prospective investors into ignoring non-dividend paying stocks when developing their investment plans. Later in this article, I will present evidence that the greatest returns and most significant Alpha generation will be earned from fast-growing non-dividend paying stocks. When very exciting and dynamic high quality companies are in the sweet spot of their growth phases, they rarely pay dividends. Moreover, this is also the phase where they make the most money for their shareholders in the shortest period of time, and if the principle of valuation is adhered to, at very reasonable levels of risk.

Earnings Growth and Valuation the True Drivers of Return

In a nutshell, this is my problem: First and foremost, I intend to demonstrate that dividends are not drivers of return. Instead, dividends are a component of return and not a creator. The true drivers and creators of return are earnings growth, but only when purchased at sound valuation. Consequently, the reason that dividend paying stocks tend to produce strong performance is due to the fact that the underlying company paying the dividends generates stable and growing earnings. Dividends come from the company's earnings and are expressed as a payout ratio. But it's the earnings that generate both capital appreciation and dividends and dividend growth.

To clarify even further, two companies generating the same earnings growth will tend to produce similar long-term returns for their shareholders. Of course this is true only as long as valuations are consistent and aligned with the underlying company’s earnings growth. Also, it's important to recognize that the capital appreciation component of return comes from the market capitalizing a given level of earnings. This is expressed as the price earnings ratio or PE. The income component of a common stock, which comes from dividends, will be in addition to the capital appreciation component. The two together make up total return. However, the market tends to recognize the additional return that dividends offer, by applying a higher multiple to the dividend payer. In essence, this can partially mitigate some of the dividend advantage, but usually not all of it.

On the other hand, a company with consistent and very fast-growing earnings will outperform a company with less earnings growth regardless of whether it pays a dividend or not. However, to take this thesis one step farther, it is rare to find a dividend paying stock with super fast earnings growth. For the most part, companies only start paying dividends when the very fast phase of their growth matures into moderate or slower growth rates. With growth slowing, dividends are offered because retained earnings are no longer needed to fund high growth. Therefore, the companies will reward shareholders with dividend income to augment their now muted capital appreciation potential.

The Key Distinguishing Factor

From what has been written thus far, it should be recognized that most dividend-paying companies will generate solid long-term returns through the combination of growth and income. The primary reason for this is, because in order to pay a dividend, the underlying company has to have solid earnings to support the dividend. In other words, dividend paying stocks tend to have good earnings, which as previously stated, is the primary driver of return. Consequently, dividend paying stocks will, as the studies indicate, outperform almost all non-dividend paying companies that have poor earnings. Therefore, on this basis at least, dividend paying stocks will outperform non-dividend paying stocks with lousy business models.

But here is the distinguishing factor, and the reason why we were compelled to author this article. The research will be hard-pressed to find any dividend paying stocks that can outperform a true growth stock. We define the true growth stock as a company that generates consistently strong earnings growth in excess of 20% or greater per annum. Here we would add that although they are very rare, the researcher may find a few dividend paying stocks that have historical earnings growth of 20% or better. More than likely the researcher would also discover that these companies will tend to offer yields in the 1% to 2% category.

However, once the earnings growth of the true growth stock exceeds 25% or better, there will be no dividend paying stocks that could be found with better long-term performance. More simply stated, there are no examples that we can find of dividend paying stocks outperforming very fast-growing true growth stocks.

Therefore, our main point is that, it is erroneous and misleading for anyone to categorically state the position that dividend paying stocks outperform non-dividend paying stocks. This statement can only be justified by grossly over-generalizing this asset class. There are far too many different classifications of common stocks than merely breaking them down into dividend paying or non-dividend paying. If a study is using classifications this broad, then we contend that the results offer no real meaning or insight. We would consider it a travesty of analysis which could mislead investors into ignoring the best-performing category of common stocks (non-dividend paying) high growth stocks.

The Good, the Great and the Ugly

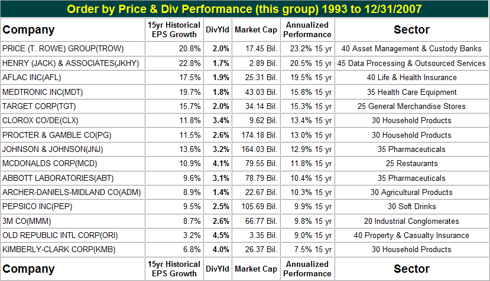

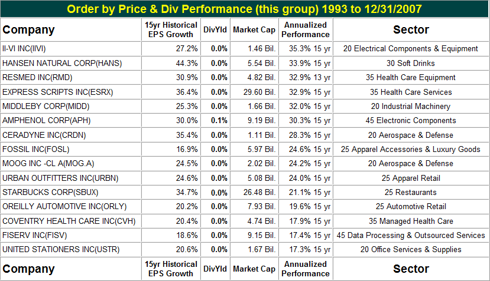

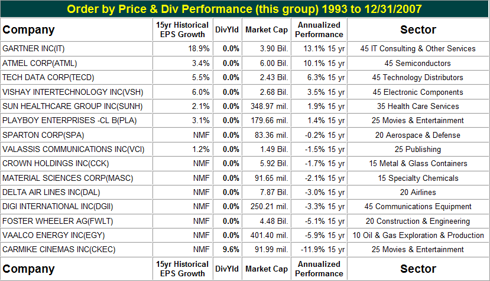

To paraphrase the title of a famous “Spaghetti Western”, we are going to look at three groups of stocks in order to conduct our own mini-study of dividend paying stocks versus non-dividend paying stocks. We're calling these groups the good (dividend paying moderate to moderately high growth), the great (very fast growth no dividend) and the ugly (lousy earnings records mostly no dividends). However, instead of relying on merely crunching a bunch of statistical datasets, we intend to go deeper and faster via our F.A.S.T. Graphs™ research tool.

We have screened our database which is comprised of 10,257 common stocks. Of this group, there are 4051 stocks that pay dividends, and 6206 that do not. In order to offer a fair comparison to the study cited at the beginning of this article, we have calculated performance over the same calendar years 1993 to 2007 time period. (Note that many of the companies in our database were not in business over this entire timeframe and were therefore excluded).

Our first screen was to break the universe down into dividend paying versus non-dividend paying companies. Next, we screened each of these two subsets based on earnings growth, highest to lowest. What we discovered, is also what our common sense indicated. Companies with very poor earnings growth were the worst performers, whether they pay dividends or not. The best performers were the companies that generated the highest historical earnings growth and, contrary to many other studies, paid no dividends. In the middle, was a group of moderate to moderately high earnings generators where the majority did pay a dividend which grew consistent with their earnings growth.

For the sake of brevity the following tables list 15 examples of each of our three categories. We could have produced many more examples of each category, but feel that the examples cited tell the story. Although we believe the tables reflect our point very effectively, at the end of the tables there will be a link to three short videos that we hope you will find both entertaining and enlightening. The videos should crystallize the important concept of performance as it relates to dividend paying and non-dividend paying companies alike. The companies are listed in order of highest to lowest performance for each category.

We have produced three videos that provide a more comprehensive review of this article thesis than the tables above are capable of. The videos will review each of the companies listed. We will go through one company in each category above in the sequence: One good, then one great, and finally one ugly. This will enable the reader to receive a clear comparison of the true performance of each company in each of these categories. The videos look at the companies starting with the lowest returns and moving to the highest (reverse order of the tables). If you only have time to review one video, look at video three.

Conclusions

The author of the article that inspired us to write this retort is one that we admire a great deal. We believe that this author is the genuine article whose objectives are only of the highest order. Moreover, it was not our intent to make him wrong, nor was it our intent to denigrate the well-conducted study that he cited in his work. Our true purpose and goal was to add precision to what we held to be vagaries regarding investment performance and where it comes from. Like the author, and as best we can tell the authors of the study, we are believers in investing in high-quality dividend paying stocks. And, also like the author, we are confident that they represent an asset class capable of generating above-average results at controlled levels of risk. Consequently, we also believe that they can and perhaps even should be a major component of a prudent investor’s long-term investing strategy and plan.

On the other hand, we are concerned that investors seeking maximum total return are not discouraged from investigating attractive growth stocks. High-quality fast-growing companies with good balance sheets and otherwise solid fundamentals are not, in our opinion, the risky investments many people believe them to be. On the contrary most of the examples listed in our category labeled great are good quality companies with long histories of operating excellence and potentially bright futures. There are enough myths floating around the investment community, we should not perpetuate another one.

Dividend paying stocks are typically strong companies with solid earnings and fundamentals supporting them. We agree that generally speaking they produce strong performance at controlled levels of risk. However, they are not the best performing stocks, that title belongs to the high quality fastest growing growth stocks. Our next article will discuss how to identify and build a portfolio of high-quality fast-growing companies.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

No comments:

Post a Comment