Going for Growth: A Methodical Approach to Identifying Growth Stocks - Seeking Alpha

My last article provided a historical analysis of how performance is generated, and which equity class, dividend paying stocks versus non-dividend paying stocks, produced the best performance historically. The article stimulated many thought-provoking comments and ideas to include a challenge to address the issue of how investors could identify and select true growth stocks going forward and not just by the rearview mirror. If you missed the article, and are interested, the following link will lead you to it. Want to Seek 'Significant' Alpha? Look Beyond Dividend Stocks

Introductory Positioning Statements

Before I go on, I want to clearly establish that the method of selecting and identifying growth stocks for above-average potential return is a method that I use and am comfortable with. It should be no surprise to regular readers of my work, that a lot of my methodology is assisted by the utilization of our F.A.S.T. Graphs™ (Fundamentals Analyzer Software Tool), which has been developed and evolved over the past four decades. On the other hand, we developed this "powerful tool to think with" in order to assist us in conducting what we consider to be essential preliminary research. We believe that our tool provides "essential fundamentals at a glance," which almost instantly enables us to determine the quality of the company being graphed, and how well it's been managed. For investors who don't have the advantage of our tool, the same work can be done through other sources of information, just not as easily.

But most importantly, I want to be clear that I am not arrogant enough to state that this is the best or only way to get the job done. However, I do consider the process that follows to be an intelligent and practical approach. I offer this strategy in the spirit of articles “as pointing the way to becoming a better investor” as fellow Seeking Alpha author David Van Knapp so eloquently described it in one of his comments on the article cited above. The reader is free to agree or disagree, offer suggestions and modifications, and accept or reject any or all of the process to their liking. But in the end, I am hopeful that what follows can change the perspective that I find many investors have regarding the risk associated with investing in growth stocks.

The benefits and rewards of owning and investing in true growth stocks can be extraordinary, but unquestionably the risks can be high. On the other hand, I intend to illustrate strategies that can mitigate the risks of investing in true growth stocks to a manageable and reasonable level. Diversification across various companies and industry sectors represents a key element of risk control. Consistency of the companies’ operating history is an attribute that we covet, which I believe also speaks to risk management. The level of debt a company has is an example of other quality characteristics that I feel must be exceptional before taking the risk of investing in a high-growth stock. Also, the individual investor's perspective on price volatility, how they look at it, and how they deal with it, can have a huge bearing on perceived risk versus real risk.

An essential component of our process relates to historical perspective, which we like to refer to as "learning from the past." However, I believe the most important component, and the most difficult one to execute, deals with forecasting future earnings. My approach is predicated on the fact and principle that forecasting future earnings and cash flows is the key to long-term investing success, for all equity asset classes, but applies most significantly to investing in true growth stocks.

It all starts with an achievable goal

I've long held and believe that a successful long-term investing strategy needs to start by establishing an achievable goal. For a goal to be achievable, it needs to be realistically based on real-world objectives. Although I believe in evaluating history, and taking advantage of the opportunity by learning from the past, I don't believe in looking back too far. In other words, I feel that more modern history, for example, the last 15 to 20 years, is a more relevant, and therefore, adequate time period to look back on. The growth rate of earnings for the average company, as measured by the S&P 500 (SPY) since 1992, has been 9.4% per annum. Since 1997, the average earnings per share growth rate of the S&P 500 has been approximately 6%. Therefore, I feel that 6% to 10% earnings growth represents a good proxy for a reasonable range of average earnings growth. (Note that I am not referring to stock market price performance here, only earnings or business growth).

Since I base my entire investing rationale upon the undeniable fact that earnings and cash flow determine market price and dividend income in the long run, then an understanding of normal or average earnings growth establishes a relevant baseline from which to establish future return goals. My thesis is that if you buy a business (stock) at a sound valuation, then earnings growth and long-term returns will closely correlate. I feel it makes no sense to engage in the amount of work and effort necessary to conduct effective research if your goal is to only do average. If it’s only average you seek, then the arguments favoring investing in index funds would apply.

But, since 6% to 10% represents average growth, my first criteria is to identify quality businesses that I believe not only have grown faster than that in the past, but most importantly are capable of growing faster than that in the future. Therefore, my foundational criteria for finding true growth stocks, is to screen for growing businesses that have grown earnings at an above-average rate of 15% per year or better, over a minimum timeframe of at least 3 to 5 years, but preferably 10 years or more.

I do not like to invest too early because of high risk, but I want to be early enough to participate in an achievable above-average growth cycle. The 15% or better goal is not merely pulled out of my hat, 15% or better is a number that years of research has shown to be achievable. In other words, there are numerous examples of companies that have achieved that level of growth over long periods of time, sometimes spanning decades or more. (As an interesting aside, the gap between 10%-15% is where most blue-chip dividend growth stocks can be found).

My goal for growth stocks, which I believe to be achievable, based on what has been stated regarding average, is for a total portfolio return objective of 15% to 20% or better. However, the specific goal that I apply to the component of true growth stocks is for 20% or better. I expect to achieve this number through a blend of companies achieving different growth phases. For example, there are 15% growers that also pay dividends, typically in the 1% to 2% range, where the growth yield over a market cycle, combined with a capital appreciation component, can help me get to the 20% number. These moderately high growers will be blended with very fast growers of 25% or better, where no dividend is being paid. This is also another way in which risk can be mitigated. Blending very high-growth with moderate growth that may even pay a dividend.

There were many comments expressed in my last article, and many other articles by yours truly and other authors, which spoke to the prudence of a diversified portfolio. In my personal case I am willing to commit 30% to 40% of my total portfolio to true growth stocks. For others this may be too high an allocation, but it suits me. The more conservative among you, may well limit your exposure to true growth stocks to 20% or 10%, or even none. The choice is personal, and should be based on your own appetite for risk, desire for return, and perhaps most importantly, willingness to work hard at continuing research.

Individual Stock Selection Criteria-Screening for Growth Candidates

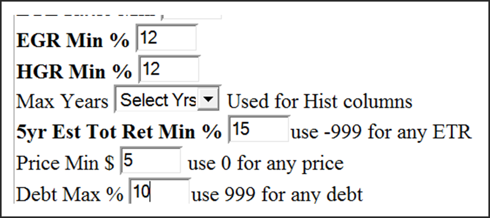

The first step in my approach to identifying potential high-growth candidates is to go to our research tool, which offers a screening function. The screenshot below illustrates the gray screen button (red circle) at the top left where this function is found. By clicking on that button I get a prompt that allows me to input criteria that I am searching for.

(Click charts to expand)

Below is a partial screenshot that is prompting me to input some of the key items I look for when searching for true growth stocks. In the example below, notice that I have asked the software to search for estimated earnings growth (EGR Min %) of 12% minimum, historical earnings growth (HGR Min %) of 12% and a five-year estimated total return minimum % of 15. I input returns slightly below my minimum 15% expectation in order not to exclude stocks based on data issues. In this example I've also looked for a minimum stock price of five dollars (no penny stocks) and a maximum debt level of 10%.

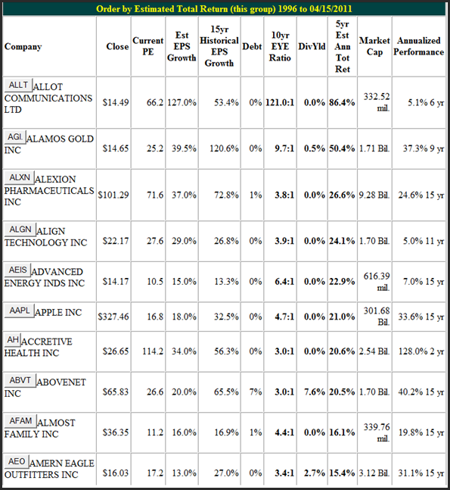

This first screen covered approximately 1,500 of the more than 16,000 available symbols. I simply keep hitting the screen button until the total data base is exhausted. This first go round produced the following example list of 10 possible candidates. At this stage, this is not a list of companies that I will actually consider for further research. The actual candidates that I'm willing to research further, require one additional filter that I consider mandatory. Even though this screen has given me exactly what I asked for statistically, this list also illustrates what I consider to be a major flaw or blind spot of statistics. As you will see, when I dig deeper, I find that some of these candidates do not fit my criteria for consistency.

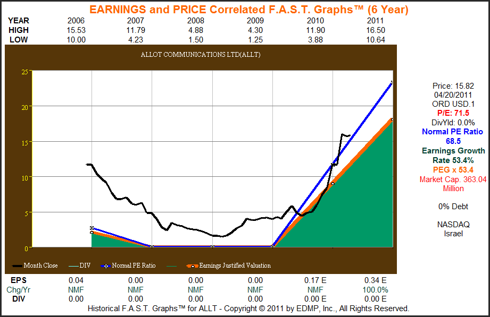

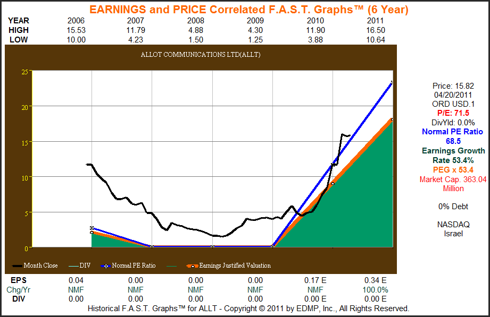

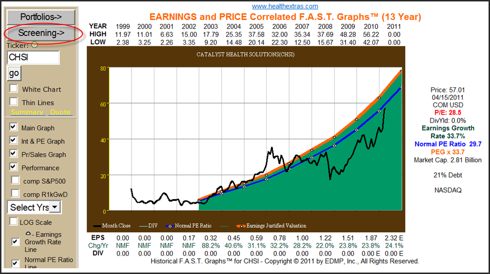

The next step in my process is to click on the first symbol on the list and draw a graph, which gives me a picture providing an instant determination whether I want to include the company in my further research, or not. I continue to produce a graph on each company on this first screen rejecting the ones that don't meet my criteria for consistency, and adding the ones that do, to a portfolio list for further study. The two examples listed below do not meet the criteria for the following reasons:

Allot Communications Ltd. (ALLT) does not possess a long enough history of consistent growth. I would require at least two more years of consistent earnings growth before I would consider further research.

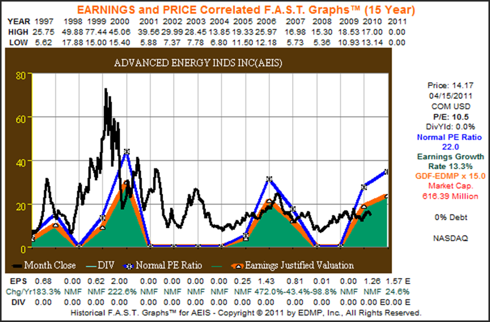

Advanced Energy Industries Inc. (AEIS) has a long enough history, and technically earnings growth that met my search criteria of 12% or better. However, the high cyclicality of their historical earnings record cause this candidate to be rejected.

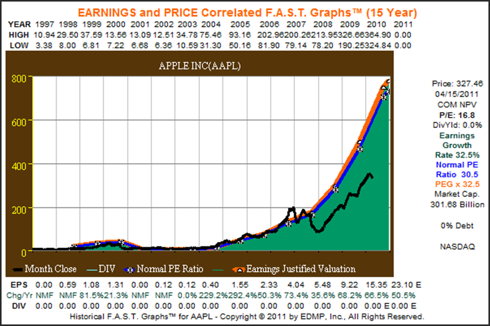

Apple Inc. (AAPL) becomes the first candidate from this first list of 10 that meet the criteria for further study, and it is added to the prospect list. You can see from the graph, Apple's earnings have been very consistent since calendar year 2001.

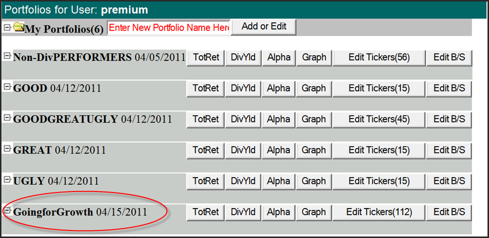

When I have completed this process I start over by raising the debt limit to 20%, then 30%, etc., up to 50% maximum. After going through this process until I have exhausted all the symbols of our database up to my maximum debt limit, I have created a “GoingforGrowth” (red circle) research portfolio list of 112 companies as seen below. (Note that the other portfolios on this list of portfolios were created for the previous article linked at the beginning of this one). Importantly, this is still not a list of companies that I would be willing to buy. Instead, it represents a list of companies that I'm willing to research deeper.

Conclusions (Part 1)

In part one of Going for Growth, I focused on selection criteria for prospective candidates based solely on historical earnings growth and other fundamentals. It's very important to state that valuation and price have not entered the equation at this stage of the process. However, these are extremely important components that must be at attractive levels before investment would ever be made. On the other hand, companies that meet all the criteria except fair value would be continuously monitored and reconsidered, if and when, price came into attractive valuation at some future time.

In part 2, my focus will move to looking to the future, and specific candidates will be reviewed. This will be where a clearer perspective of the features and benefits of true growth stocks will come to light. Although, as I have previously stated, historical perspective is an extremely important part of the selection process, it is only the first of many steps. Furthermore, since you can never invest in the past, but only in the future, forecasting future potential is the key. In part two we look to the future.

>> Continue to Part II

Disclosure: I am long CHSI.

Disclosure: I am long CHSI.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

No comments:

Post a Comment