Going for Growth (Part 2): What to Buy, When to Buy and When to Sell - Seeking Alpha

Introduction

In part one, I talked about creating a list of potential candidates of high-growth stocks based on finding companies with extraordinary historical records. I also talked about establishing realistic goals based on investing in companies whose track records would have achieved those goals. But more importantly, I am now going to focus on those companies that should be capable of continuing to generate significant above-average growth going forward. Perhaps, as you will soon see, not at exactly the same rate as they have historically, but still continuing at a future earnings growth rate high enough to meet our goals.

In my opinion, there seems to be a great deal of confusion and misunderstanding about growth stocks. Many investors automatically equate high risk and high volatility (high betas), which many equate with risk, as unavoidable components of growth stocks. Unfortunately, jaundiced views like these can scare people away from the often unbelievable benefits and rewards that growth stocks can offer. However, in reality, and when you think about it, a high beta is a prerequisite to above-average performance. We contend that fuzzy and inconsistent definitions of what growth stocks even are is a major contributing factor to this problem.

Our definition of a growth stock is straightforward and precise. First of all, a growth stock represents the common stock of a company whose business is consistently growing at a significantly above-average rate. In other words, a growth stock is a company whose earnings are consistently increasing at a minimum rate of change of earnings growth of 15% or better. However, a hyper growth stock is one that I define as growing earnings at a rate of change of 25% or better. Admittedly, although both categories are rare, there are more 15% growers than there are companies growing earnings at 25% or higher. In between these broader gradations of growth are additional growth categories such as a high grower at 20%, etc.

On the other hand, there are numerous examples of companies that achieve both of these broader levels over decades and decades of time. However, it's important to point out that companies capable of generating the growth rates described in our definitions above are very rare. In our experience, most “studies” will include more growth stocks in their universe than actually exists. Obviously, this will dilute the results. Therefore, it logically follows that the first step in building a portfolio of pure growth stocks is through the determination of a clear and precise definition of what one actually is.

Now that I have provided my definition, let's look and see if there are any real life examples that can stand up to my standards regarding earnings growth, past, present and future. I am going to go through these examples in alphabetical order, my initial focus will be on earnings growth, but the important principle of valuation will be highlighted and elaborated on as I move through the list. In random order, some of these names will be reasonably priced, some will be overvalued and a few will be somewhere in between. But most importantly, these are offered as potential research candidates, and no buy or sell recommendations are offered. These important decisions are left up to the reader to decide for themselves. The purpose of this article is to highlight a method of analyzing growth stocks and is therefore hypothetical in nature and substance.

Specific Growth Stock Examples

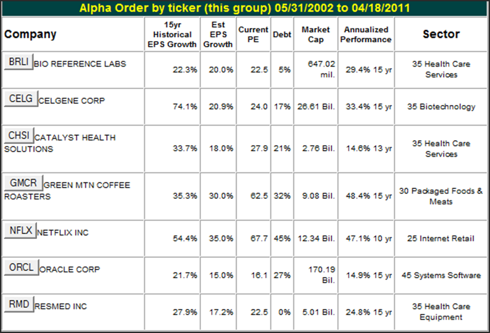

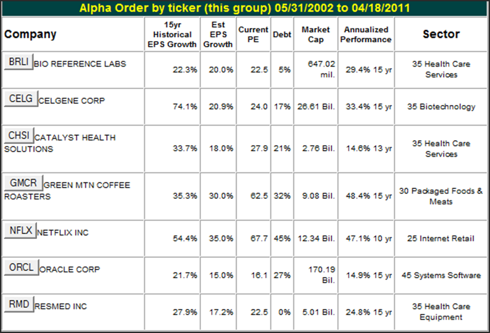

For brevity sake I am going to review seven example companies. They will range in size from large-cap to small-cap. My purpose is to illustrate that growth stocks come in all sizes and shapes. The following table provides a summary of the seven companies to include the fundamentals that will be elaborated upon.

The following analysis will include a series of F.A.S.T. Graphs™ on each of the seven sample true growth stocks. My idea is to hopefully provide thousands of words through pictures that will illustrate not only the true nature of growth stocks, but how and when to buy and sell them based on fundamental values. This was the challenge that was laid down, and I accepted. However, as I have worked to meet the challenge, I quickly discovered that one article, or even a series of articles, could not do justice to the task at hand. But I am hopeful that this exercise can at least lay a solid foundation of understanding regarding growth stocks, their potential benefits and risks. I do ask that the reader keeps in mind that this is an intellectual exercise, and should not be considered as a specific buy or sell recommendation.

Sample 1: Bio Reference Labs (BRLI)

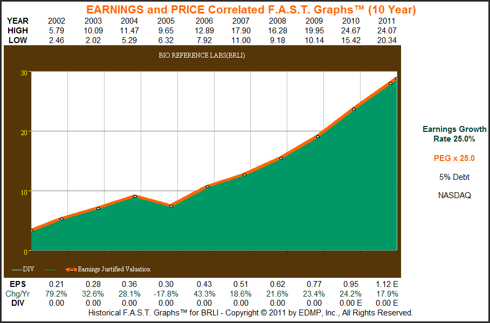

My first example is a small-cap growth stock in the healthcare services sector. From the first graph below, you can see that the company meets the criteria laid out in Part 1 of this series. This exciting small-cap has strung together a very consistent record of earnings growth (orange line) averaging 25% per annum. The company has very little debt, which is an important consideration for a small-cap growth stock.

Click to enlarge

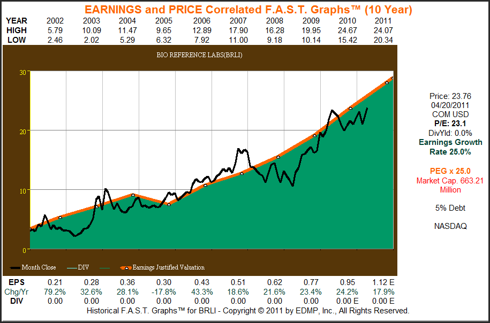

In my next graph, I overlay monthly closing stock prices. Here, the earnings and price correlation becomes vividly exposed. The black price line clearly tracks earnings, and periods of overvaluation, undervaluation and fair valuation are easily recognized. Attractive buying opportunities existed at any time the price line was touching the earnings line or below it. In contrast, the least attractive buying opportunities were manifest when the price line was above the earnings justified valuation line.

Click to enlarge

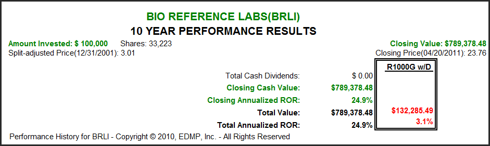

When reviewing the performance associated with the earnings and price correlated graph above, we discover that shareholders were rewarded almost in perfect proportion to earnings growth. Attractive starting valuation and only a very modest undervaluation at the end allowed shareholders to reap their just reward generated by earnings growth. This performance is in stark contrast to the performance of the Russell 1000 growth with dividends.

Click to enlarge

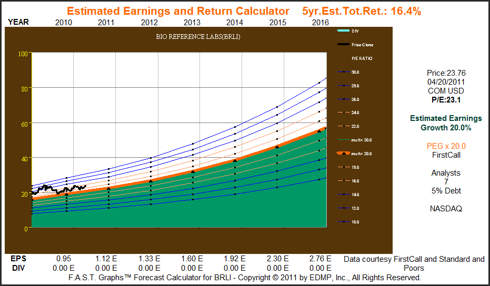

With my next graph I introduce the estimated earnings and return calculator based on consensus earnings estimates of seven leading analysts reporting to FirstCall. With this graph we learn that expectations are this small-cap growth stock should continue to grow earnings at a future rate high enough to maintain its status as a true growth stock. We also see that the stock is fairly valued to slightly overvalued based on those estimates. The five-year estimated total annual return of 16.9% assumes that the company grows earnings at the 20% forecast, and that the PE ratio falls from its current 22.5 to a PEG ratio PE of 20 by fiscal year-end 2016.

Click to enlarge

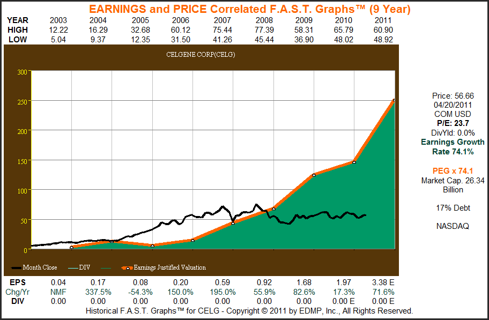

Sample 2: Celgene Corp. (CELG)

Celgene Corp. is a large-cap biotechnology company, which was originally spun-off from Celanese Corp. in 1986. They generated no earnings or earnings growth until calendar year 2004. However, since calendar year 2005, Celgene has generated earnings growth in excess of 74% per annum. Therefore, the company meets our minimum criteria of five years of above-average consistent earnings growth. Note that prior to the recession of 2008, Celgene was awarded a price earnings ratio significantly above its 74% growth rate (the orange line PE ratio is 74). In 2008, the stock price did fall precipitously due to overvaluation and the general pessimism that prevailed at that time. However, price volatility for this extremely fast-growing hyper-growth stock was not out of line with many dividend paying blue chips at the time. Companies like Procter & Gamble (PG), Colgate-Palmolive (CL), PepsiCo (PEP) and many others experienced price action that was very similar. But most importantly, Celgene’s earnings growth has remained extremely strong, illustrating a great deal of recession resistance.

Click to enlarge

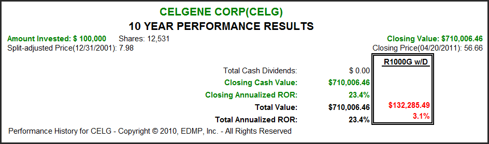

From the associated performance results shown below, Celgene shareholders have been amply rewarded by the company's extraordinary earnings growth since calendar year 2002. On the other hand, since calendar year 2008, shareholder returns have only averaged a modest 6.2% even though earnings continued to grow in excess of 50% year.

Click to enlarge

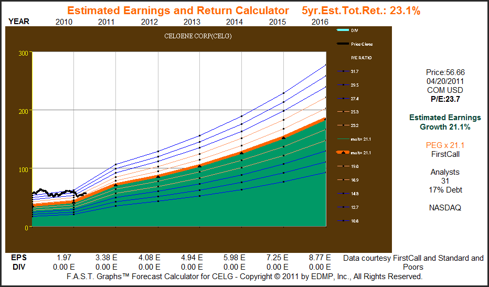

The consensus of 31 leading analysts expects this large-cap biotech stock to grow earnings in excess of 20% per annum over the next five years. Therefore, the current price earnings ratio of 24 appears modestly high. In theory, my discipline dictates that I would only be willing to invest when the price-earnings ratio is equal to or less than my expected earnings growth rate. Consequently, I would not yet be an investor. However, a more aggressive investor willing to take slightly more risk might consider this a reasonable price or valuation.

Click to enlarge

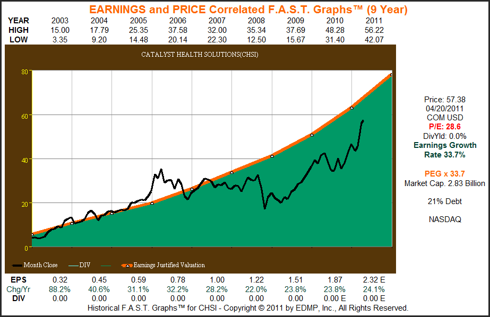

Sample 3: Catalyst Health Solutions (CHSI)

Catalyst Health Solutions is a major healthcare services company with a niche approach to pharmacy benefit management. As the graph below clearly depicts, this high quality company has generated an impressive string of consistent earnings growth for the past eight years which exceeded 33% per annum. Although stock price has tracked these impeccable earnings very nicely, the company was clearly overvalued in 2006, and has been undervalued since 2007 based on earnings. When viewed in this way, it is clear that a good buying opportunity exists anytime the stock price coincides with the orange earnings justified valuation line, the least attractive time to buy is when price is above earnings, and the most attractive time to buy is when price is below earnings.

Click to enlarge

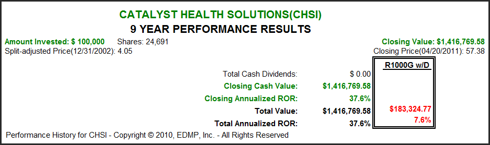

Once again we see a strong correlation between earnings growth and shareholder returns in the long run. The benefits of consistent and strong earnings growth are clear, and overcome short-term bouts of volatility.

Click to enlarge

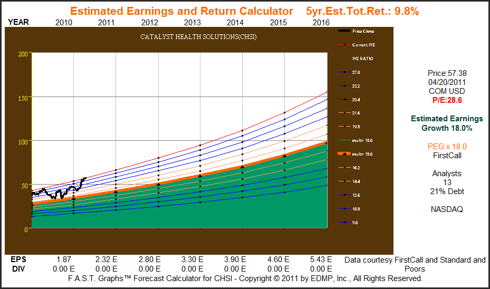

The consensus estimates of 13 analysts expect Catalyst Health Solutions to continue growing earnings at a rate of 18% per annum over the next five years. However, if those estimates prove correct, then this quality healthcare company is technically overvalued at just under 28 times earnings. Although this would still be a strong rate of earnings growth, the prudent growth stock investor would patiently wait for a better entry point, like the ones that existed in July or October of 2010.

Click to enlarge

Sample 4: Green Mountain Coffee Roasters (GMCR)

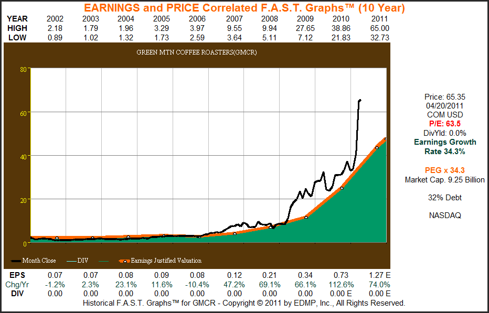

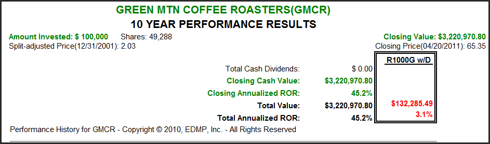

Here we find an example of a high-quality growth stock with an impressive earnings record and an irrationally exuberant stock price. I believe it is situations like this (and Netflix, our next example) that have given growth stocks a bad name. By reviewing the earnings and price correlated graphs below, and the accompanying performance results, we see that stock price has exceeded earnings growth and therefore, shareholder performance of over 45% per annum is greater than the rate of earnings growth of 34.3%.

Click to enlarge charts

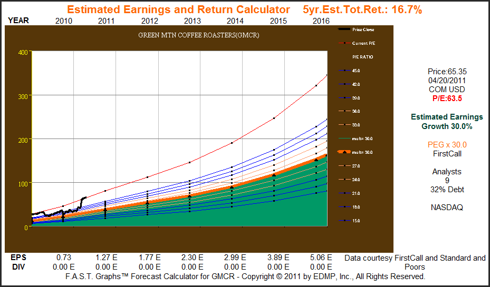

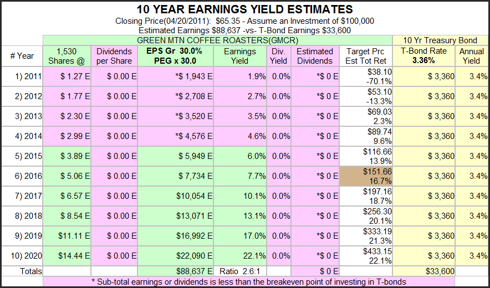

The consensus of nine analysts expects Green Mountain Coffee Roasters to continue growing earnings at 30% or better for the next five years. However, the current PE ratio of 62.5 is more than twice this expected growth rate which I feel significantly expands the risk while simultaneously lowering the return potential. My rule of thumb self-discipline is to consider selling when the stock price rises to the extent that it is more than two years ahead of the earnings justified level. Green Mountain Coffee Roasters’ stock price exceeds that boundary; therefore, if I owned it I would consider selling it here.

Click to enlarge

The following graph represents the current and future estimated earnings yield for this company over the next 10 years assuming earnings growth of 30%. The 10-year timeframe is used in order to compare the equivalent investment in 10-year treasury bonds. The pink shaded area implies that this company's earnings yield would be less than the interest yield on the 10-year treasury bond for the next four years (calendar year 2014). This is a simple valuation check that illustrates overvaluation.

Click to enlarge

Sample 5: Netflix (NFLX)

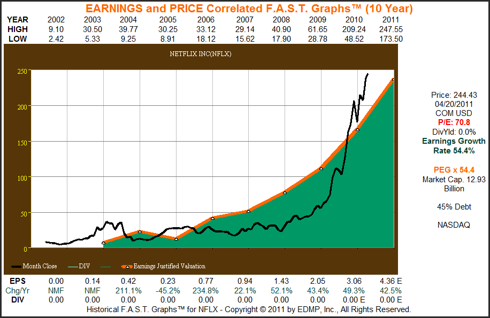

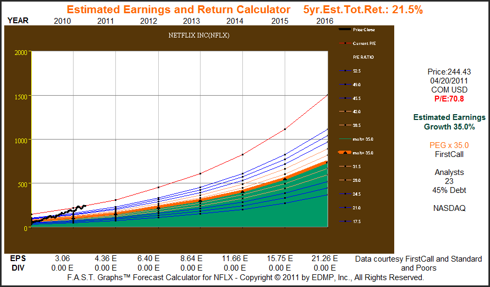

The following graphs on Netflix tell a very similar story to what we saw with Green Mountain Coffee Roasters. We see an impeccable earnings history that has created an exuberant stock price valuation. Although expectations for future earnings growth are extremely high at over 35% per annum, the current PE of 67.7 significantly overvalues that potential future performance. As a growth stock investor, I limit the price earnings ratio I am willing to pay to 35, even for companies like these last two examples that are growing much faster than that.

Click to enlarge

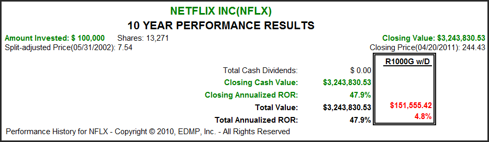

Netflix’s exceptional earnings growth record has generated outstanding shareholder returns. But from the graph above, it’s clear that price is currently extended.

Click to enlarge

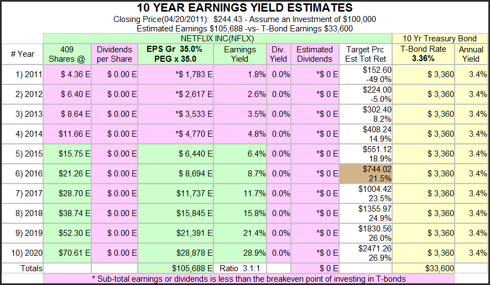

Continued growth of over 35% a year is expected by the consensus of analysts. However, with the PE over 67, the stock price is clearly more than two years ahead of expected earnings justified levels.

Click to enlarge

The current earnings yield on Netflix is less than the interest you could earn on the 10-year treasury bond. And even at 35% expected earnings growth, it would stay that way until late 2014.

Click to enlarge

Sample 6: Oracle (ORCL)

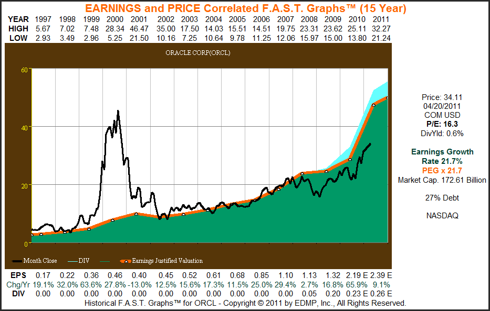

The following graphs on Oracle teach several very interesting lessons on growth stock investing. First of all, as can be clearly seen in calendar years 1999 and 2000, the stock market can often totally and even outrageously incorrectly price a stock. With Oracle, in 1999 and 2000 we saw a quintessential example of not only irrational exuberance, but a bubble as well. Then from 2002 through 2007, we see a true picture of stock price tracking earnings and we're given a good perspective of the volatility of a growth stock. Then in 2008, we see a sharp falloff in stock value even though earnings held up. Finally, as is currently true with most of the big technology names, we see the initiation of Oracle's first dividend (light blue shaded area).

Click to enlarge

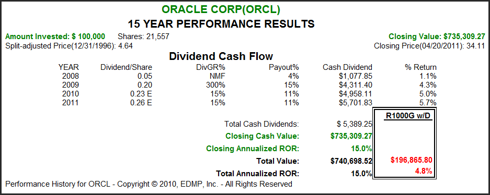

When we review the associated performance of the above graph we see the effects and the importance of valuation. Modest overvaluation at the beginning of 1997 coupled with historical low valuations currently leads to shareholder returns that are lower than earnings growth. On the other hand, the power of earnings can also be appreciated when this performance is compared to the Russell 1000 growth.

Click to enlarge

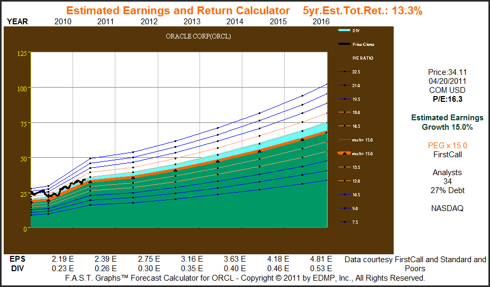

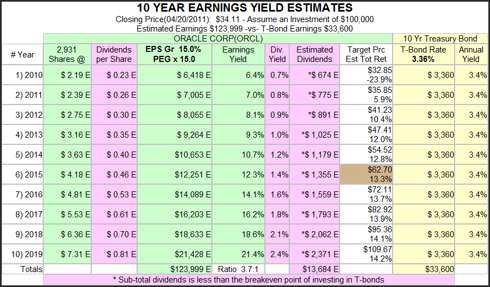

With the consensus of 34 analysts expecting future earnings growth of 15%, Oracle appears fully, but perhaps still reasonably valued at 16 times earnings. For the disciplined growth investor, waiting for a minor correction that could bring the PE ratio back to 15 or below might be a reasonable idea. On the other hand, with the company now paying a dividend that logic would expect to grow with earnings, today's valuation may make sense.

Click to enlarge

In contrast to Green Mountain Coffee Roasters and Netflix, we see that the earnings yield for Oracle exceeds what is available from the interest yield on the 10-year treasury bond. As previously stated, I consider this a good valuation check. It never makes sense to me to invest in a stock and take the associated risk when it would offer me less return from earnings than I can get from interest on the 10-year treasury bond.

Click to enlarge

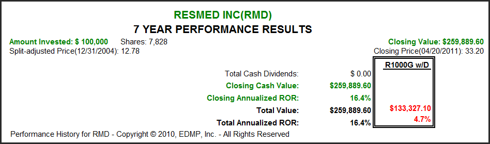

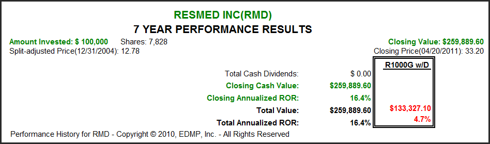

Sample 7: Resmed (RMD)

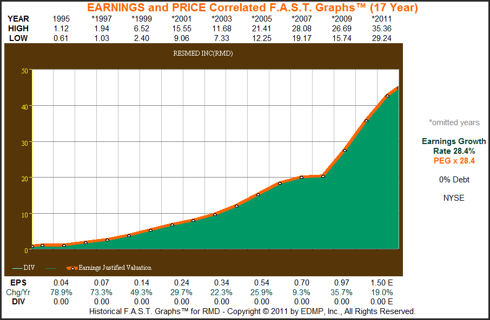

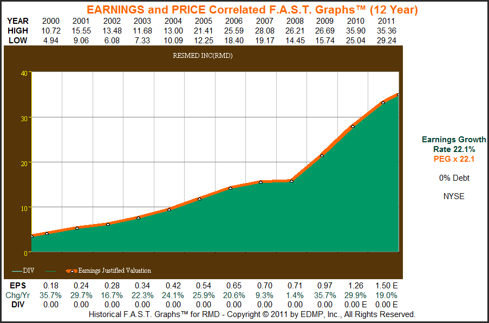

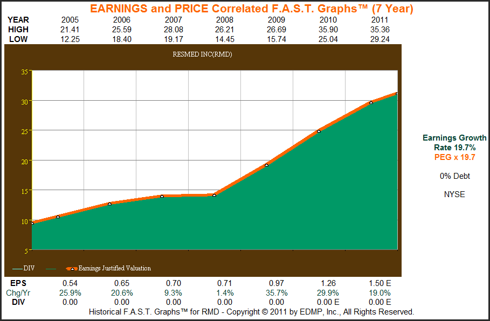

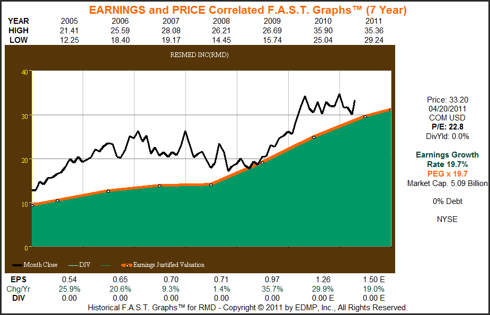

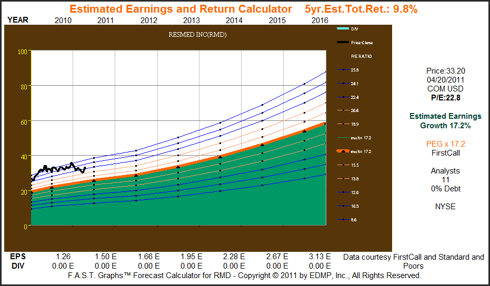

With my last example I want to interject another tactic or strategy that I apply when evaluating prospective growth stocks utilizing our F.A.S.T. Graphs research tool. I will often start by drawing a long-term graph and then cutting five years off consecutively and re-drawing the graph. The F.A.S.T. Graphs is a dynamic tool that automatically recalculates all the data. Therefore, by drawing shorter and shorter graphs, I can determine whether earnings growth is decelerating, accelerating or staying basically the same. As you might suspect, with most companies earnings growth tends to slow as the company gets bigger. From the next three graphs below you will discover that Resmed’s earnings growth rate was 28.4% per annum since 1995 (17 years), which dropped to 22.1% since calendar year 2000 (12 years) which fell to 19.7% since calendar year 2005 (seven years). Through this analysis I have determined that although the earnings growth rate has lessened, when you consider this includes the great recession, it has remained quite robust.

This is also where the estimated earnings and return calculator, or as I like to call it my forecasting tool, comes into play. Although I feel that a review of the recent past can provide significant insight into the strength of the business and how well it has been managed, I can only invest for the future. Therefore, although I feel I learned from the past, I always focus my decisions on my best expectations of the future earnings growth of the business. Consequently, based on this preliminary research up to this point, my confidence in strong above-average future earnings growth is high. This confidence motivates me to consider a more comprehensive research effort, as long as current valuation also coincides and make sense.

Click to enlarge charts

Based on the consensus estimate of 11 analysts, the future earnings growth of Resmed seems both attractive and reasonable. However, with earnings growth estimated at 17.2%, the current PE ratio of 22.6 seems high. As a result, I will refrain from investing the time and effort of looking deeper into this company until the valuation is more attractive. Thankfully, my graphs automatically keep track of valuation and therefore will alert me when valuation becomes in-line. At that time I would institute a more comprehensive analysis with a high confidence that this effort will lead to an attractive purchase.

Click to enlarge

(Follow this link to a short video providing a more comprehensive and dynamic review of the seven potential growth stock candidates.)

Concluding Remarks

In part one of this three part series, the focal point of my strategy behind putting together a growth stock portfolio has been a consistent above-average history of earnings growth. The central idea is where better to look for future growth than from where it has already been consistently achieved. A long history of consistently above-average growth seems unlikely to be accidental. In this, part two, the focal point was on identifying prospective growth stocks where the consensus expected future growth rate was at a rate high enough to meet my definition of a growth stock.

In part three, the focal point will be on the vitally important task, and I believe key, to investment success with growth stocks. Part three will deal with a more comprehensive look at forecasting future earnings.

Disclosure: I am long ORCL, CHSI, PG, CL, PEP.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation

No comments:

Post a Comment