Road Map for Managing a Dividend Growth Portfolio - Seeking Alpha

The article on my real-world Dividend Growth Portfolio earlier this month generated more interest than I expected. So I decided to write about an important part of the portfolio’s construction and maintenance: portfolio management.

I divide stock investing into three phases: stock selection, stock valuation, and portfolio management. I do this whether I am investing for dividends or for capital gains. Portfolio management includes everything that takes place after you have stocks in a portfolio. It covers important areas such as how much of the portfolio is allowed to be in any one stock; when and why to sell; when and how to reinvest dividends; and the like.

Portfolio management is best done, I feel, according to rules that you create before you create the portfolio itself. The rules are embodied in its constitution: the highest-level statement of your vision, goals, strategies, and expected results. Many people call this document their Investment Policy Statement or something like that. It doesn’t matter what you call it. It matters very much that you have it.

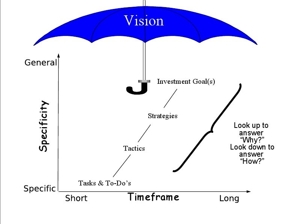

I dug back into my corporate consulting career for the following slide, which I have modified to illustrate the strategic planning process in investing (click to enlarge):

Your vision is your long-term aspiration, where you want to be years from now. My vision is to have a financially secure retirement. Maybe that sounds unimaginative…more on this at the end of the article.

In a few months, I'll be off to Las Vegas to pursue one of my items: To compete in a couple of events at the World Series of Poker.

After your vision comes investment goals: What objectives you must achieve in order to make your vision come true. Your goals should be specific, measurable, and attainable. For example, what investment accomplishments do you want to be celebrating 3, 5, or 10 years from now? What difficulties or issues must you eliminate to achieve success? What, if you don’t do it, will cause failure?

Next come your strategies: High-level steps to reach your goals. Strategies state your approach for achieving your objectives. They establish guidelines and boundaries for your investment activities:

- How you will identify the best stocks

- How many and what variety of stocks you will hold

- How you will recognize a good entry point for each stock

- Your rules for portfolio makeup (number of stocks, diversification, maximum size of any one holding, etc.)

- How you will know when to sell

- What you will do with incoming dividends

- How you will measure performance

Notice that your strategies do not tell you which stocks to purchase, nor when. Those are tactics, the activities needed to accomplish your strategies. They usually don’t belong in this document.

Here (with a few omissions for brevity) is the constitutional document for my public, real-world, real-money Dividend Growth Portfolio:

Goal:

The goal of the Dividend Growth Portfolio is to generate a steadily increasing stream of dividends paid by excellent, low-risk companies.

Broken down, the goal is to create and maintain a portfolio of dividend stocks:

- purchased at favorable prices;

- of companies with sound business models and solid financials;

- that consistently raise their dividends;

- that is reasonably diversified;

- that have a combined beginning yield of at least 3 percent;

- whose yield on cost steadily grows to 10 percent within 10 years of inception, and then continues to grow beyond that as long as the portfolio exists;

- whose dividend growth is accelerated by regularly reinvesting the dividends; and

- whose total return beats inflation over long periods of time.

Strategies to Attain the Goal:

- Use the current Top 40 Dividend-Growth Stocks as the Shopping List.

- Buy only stocks with “Fair” or better valuations. All else equal, favor stocks whose most recent dividend increases have been the healthiest.

- Reinvest dividends, but not automatically in the company that issued them. Rather, collect the cash and reinvest when it accumulates to $1000, selecting the best candidate at that time.

- When reinvesting dividends, always try to improve the portfolio along some dimension: yield, dividend growth, diversification, and the like.

- Limit the number of stocks owned to about 10 to 15, maximum 20.

- Aim for well-roundedness in the portfolio. Diversify across sectors, industries, geographies, and different ranges of yields and growth rates.

- Hold no more than 20 percent of the portfolio’s value in a single stock. If a position exceeds 20 percent, sell the excess and re-deploy the proceeds. [Note: I recognize that this is a higher percentage than many would tolerate for one stock.]

- Make opportunistic switches from one stock to another if such a swap will upgrade the portfolio. The expected frequency of such exchanges is low.

- Since the major focus is on dividends and not share prices, the portfolio will usually be 100% invested (except for accumulating dividends). Don’t “sit out” bear markets so long as the dividend stream is intact. Cash does not generate dividends.

- Seriously consider selling any stock for these reasons:

(1) It cuts, freezes, or suspends its dividend.(2) It bubbles or becomes seriously overvalued.(3) You receive news of significant changes impacting the company.(4) It is acquired.(5) Its dividend rises above 9 or 10 percent.(6) It underperforms the market in total returns (price + dividends) for three years running.

- Conduct a thorough Portfolio Review twice per year.

- Review this constitution once per year and adjust it for changed circumstances, new knowledge, and the like.

Don’t do the following:

- Use margin.

- Use options, futures, or other “derivative” investments.

- Invest in mutual funds or ETFs.

- Use trailing sell-stops.

Refer to your constitution from time to time for guidance, especially if you find yourself in a perplexing or ambiguous market situation. It will remind you of how you analyzed things when you were thinking broadly and clearly.

Once written, your constitution need not be rigid or unchanging. It can be amended. Review it annually. Make adjustments as your life circumstances change, you learn more, and you become a better investor. Review your actual stocks twice a year, and review any individual stock immediately when you hear significant news about it. BP's dividend cut in 2010 should not have caught any serious Dividend Growth Investor by surprise. That dividend was in peril as soon as the rig blew up, and you couldn’t miss the news. Don’t play the victim card when things like that happen, because they do happen. Instead, be proactive. As has often been noted, dividend-growth investing is not buy-and-ignore. It is buy-and-monitor.

I mentioned my unimaginative vision earlier: To have a financially secure retirement. What does that mean? For me, it means not only a secure but an exciting retirement.

An article on MarketWatch on Tuesday by Robert Powell addresses the idea of a bucket list. Powell speaks of a former colleague—who he admired greatly—that died at the age of 63, while another friend posted a notice on Facebook that’s he’s leaving for a three-week trip to Africa. A financially secure retirement is not boring—it’s the ticket to doing exactly what you want to do.

An article on MarketWatch on Tuesday by Robert Powell addresses the idea of a bucket list. Powell speaks of a former colleague—who he admired greatly—that died at the age of 63, while another friend posted a notice on Facebook that’s he’s leaving for a three-week trip to Africa. A financially secure retirement is not boring—it’s the ticket to doing exactly what you want to do.

According to the article, almost everything about a bucket list can be boiled down to three questions:

- What makes you happy?

- What are your interests?

- How much do your interests cost and do you have the money and time to pursue the things that you are interested in and that make you happy.

So my “financially secure retirement” vision is critical to exploring my interests and doing what makes me happy.

Art Koff, founder and CEO of RetiredBrains.com, says identifying your passions and interests are the key ingredients of building a bucket list. The items on many bucket lists are somewhat common. The things that make most people happy center on travel, spending time with family and friends, and going back to school.

Spending time with family and friends is among the most common items on bucket lists. Social connections—including family and friends—have been shown to add to longevity. Items like travel, gardening, or playing a musical instrument come up often. But unless you have a plan and the money to pursue your interests, the bucket list is unattainable. Financial independence is one key to being able to accomplish the items on your bucket list.In a few months, I'll be off to Las Vegas to pursue one of my items: To compete in a couple of events at the World Series of Poker.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment