Introduction

Conventional wisdom advocates an asset allocation mix between stocks, bonds and cash. Many professional investment advisors go as far as to offer age-based formulas to determine what the appropriate allocation between bonds versus stocks should be. These little pet formulas often go something like this; take the number 100 and subtract your age to determine what percentage of your portfolio should be in stocks. A more modern version says take 110 or 115 and subtract your age to determine your stock allocation. Using the 110 formula, the stock allocation for a 65-year-old today would be 45% stocks and 55% bonds.

We have never embraced this approach to asset allocation, because we believe it to be too simplistic to be of value. To us, a true asset allocation strategy should be well thought out, taking into consideration numerous factors that could ultimately determine the success or failure of the proposed investment strategy. These would include the time horizon, risk tolerance and income and lifestyle needs of the individual that the plan is being designed for. Moreover, the asset allocation plan needs to be practical and realistic enough to meet each respective investor’s goals and objectives.

This implies having an appropriate understanding of the risk reward profile of each asset class, and yes, a rational forecast of future potential returns for each asset class. Therefore, before we provide our asset allocation recommendations between stocks and bonds and cash, the following positioning statements are in order. Beyond providing simple rules of thumb, we want to provide the reader a foundation of logic underpinning our current views. It's not just what we recommend that's important to us, it's the “why” behind the “what” that matters most.

Asset Class Biases

We believe that there is an enormous amount of risk versus return bias built into the conventional wisdom revolving around appropriate asset allocation strategies. More clearly stated, many consider bonds safe investments and stocks risky. We would agree that there is, under normal circumstances, generally a high degree of truth behind these views. However, we would also argue that they are not failsafe concepts. In other words, there are possible situations that include market forces and levels that could turn these risk reward relationships upside down where bonds could actually be riskier than stocks. We believe the bond market is in that very situation today.

Much of the idea that bonds are safe investments revolves around what we call the stability factor. Bonds are typically issued with a fixed coupon and maturity. Of course, of all bonds types available, Treasury Bonds are considered the safest of all. Therefore, it is no wonder that investors have recently flocked to Treasury Bonds after being traumatized by the recession of 2008 and its disastrous impact on the stock market. After stock prices fell 35% to 50% in 2008 and 2009, investors sought the refuge of safe stable Treasury Bonds where the disastrous principal losses suffered, theoretically at least, couldn't happen to them again. Ironically, we intend to build a case that suggests they may just be jumping out of the frying pan and into the fire.

And to further ingrain this notion of bond safety deeply into the minds of investors is the evidence that bonds have outperformed stocks over the last couple of decades. This type of statistical reference tends to carry a lot of weight with investors attempting to make prudent, sound and hopefully successful investing allocation decisions. So the reasoning must be; why bother owning stocks at all, when bonds are not only safer and more reliable, but also produce better returns? However, this line of reasoning fails to take into consideration why and how recent historical stock and bond returns were generated. This is an important consideration, because it also provides important clues as to why and how future returns are going to be generated.

To simply state that something outperformed or underperformed the other, without understanding why it occurred, can be very dangerous if extrapolated into future outcomes. We believe that there are two primary reasons why bonds have outperformed stocks over the past two decades. But more importantly, we believe that these same factors promise to turn the tables over the next two decades. First, interest rates have steadily fallen since 1992 (actually since 1981). When interest rates fall, the prices of existing bonds increase.

Therefore, we believe you could call the last two or three decades the “Golden Age” for bond returns. Interest rates were exceptionally high since the early 1980s, but have steadily been falling ever since. Consequently, the returns on bonds have been abnormally high. Most previously issued intermediate to long-term bonds command a premium price today because their coupons are high. However, because these premiums will disappear if these bonds are held to maturity, their yields to maturity are low.

The second reason why bonds outperformed is because many stocks were overvalued in 1992. In the same vein that abnormally high interest rates led to outperformance in bonds, excessive overvaluation in stock prices lead to poor performance in stocks. But today, stock price valuations are in line with historical norms, and conversely, bond yields are at all-time lows. These metrics auger very well for future stock returns and paint a dismal picture for future bond returns.

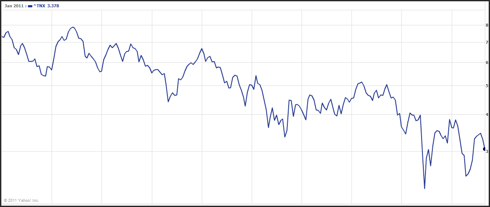

Ten-year Treasury Bond Rates Since 1992

Ten-year Treasury Bond yields have fallen from over 7% in 1992 to just under 3% on June 1 of 2011. When interest rates fall, the price of existing bonds (previously issued) will increase. Conversely, when yields go up, bond prices will go down. With inflation looming large in our futures, the Federal Reserve’s traditional inflation fighting weapon is raising interest rates.

When interest rates rise, the prices of bonds being issued today at these low rates will fall dramatically. If today's 3% rate on the 10-year Treasury went to a more normal 6% rate, the current market price of currently issued 10-year Treasuries could fall by as much as 40% to 50%. Contrary to what some people believe, the prices of bonds can be just as volatile as stocks when market environments become extreme. Today's interest rate levels on 10-year Treasury Bonds are clearly extreme. Click to enlarge:

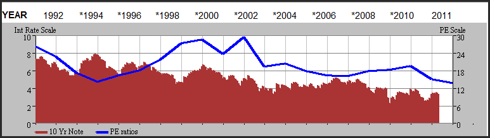

S&P 500 PE Ratios Since 1992 vs 10-year Treasury Interest Rates

Looking at the right scale on the following graph (click to enlarge) courtesy of F.A.S.T. Graphs™ shows that the PE ratio for the S&P 500 (blue line) has fallen from a high of over 26 in 1992 to a current PE of approximately 15. Overvaluation has been a primary determinant of poor stock market returns since 1992. Even higher valuations during the " irrational exuberance" period 1995 to 2000, created even worse returns over the past decade or so.

This is the opposite of what should usually occur. When interest rates are high, PE ratios typically fall because bonds are more competitive to stocks when yields are high. Therefore, investors should consider that these past two decades have been aberrant. Basing future long-term investment decisions on abnormal market actions seems dangerous and illogical. Click to enlarge:

Historically Safety Has Only Been the Second Best Reason to Own Bonds

Although safety has historically been an important consideration and argument in favor of owning bonds, we believe that it has only been the second best reason. In normal market environments, the best reason for owning bonds has been the higher income they generated relative to the typical dividend yields available from dividend growth stocks. In more normal times, investors needing income looked to bonds for their higher yields. Blue-chip dividend paying stocks have normally offered yields that were significantly less than the current yields available on bonds.

When the stock and bond markets are at historically normal levels, and even when growth yield (yield on cost) is factored in, bonds blow away dividend growth stocks for generating income. Therefore, investors needing current income from their investment portfolios to live on, or even to supplement their income, were both wise and forced to own bonds. Dividend growth stocks historically have simply not been able to get the job done. However, as we will soon see, that may no longer be true today. Under normal market scenarios, we believe that the bond allocation determination should be based more on income needs, instead of diversification purposes.

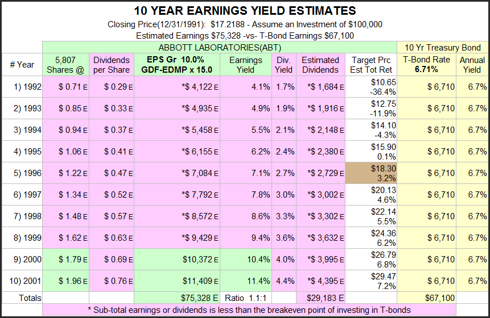

A Historical Look at Abbott Labs versus 10-year Treasury Bonds 1992

At the end of 1991, or the beginning of 1992, Abbott Labs (ABT) was trading at an overvalued PE ratio of approximately 27. Due to this overvaluation, Abbott Labs offered the dividend growth investor an entry yield of approximately 1.7%. In contrast, the 10-year Treasury Bond offered a riskless interest yield of just over 6.7%, or just shy of four times higher. The following historical 10-year earnings yield estimator (click to enlarge) compares the future income streams on equal $100,000 investments in Abbott Labs versus the same investment into a 10-year Treasury Bond on January 1, 1992. During this historical period, 1992- 2001, Abbott Labs (ABT) grew earnings and dividends at approximately 10% per annum. (Note that the graph marks dividends and earnings with a capital “E” for estimate, however, when generated historically the numbers are actual results).

You'll notice that the estimated dividends column on the graph is pink, which indicates that the cumulative dividend yield from Abbott Labs never meets or exceeds the yield generated from a 10-year Treasury Bond (the yellow columns). When the cumulative dividend return is higher than that paid by the 10-year Treasury Bond the column will turn blue. In this real life historical example, the Treasury Bond threw off 2.3 times more riskless interest than Abbott Labs’ cumulative total dividends paid to shareholders. The Treasury Bond paid $67,100 in riskless interest versus Abbott Labs’ dividends of only $29,183.

Clearly, for investors needing current income, 10-year Treasury Bonds were the wisest choice. On the other hand, the Treasury Bond only returned the $100,000 initial investment at year-end 2001, while Abbott Labs’ $100,000 stock investment grew to $323,796. From a total return perspective, Abbott Labs (ABT) was the better investment, but from a spendable income perspective (no harvesting), the 10-year Treasury Bond was the clear winner.

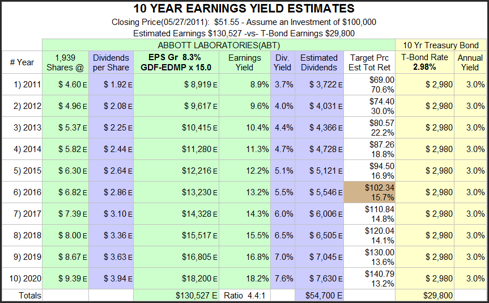

Abbott Labs versus Ten-year Treasury Bonds in Today's Market Environment

As of yesterday, June 1, 2011, the traditional relationship between bond interest from a 10-year Treasury Bond and dividend income from Abbott Labs (ABT) is upside down. Today, Abbott Labs offers shareholders a dividend yield of 3.7% versus 10-year Treasury Bond interest of only 2.98%. Therefore, notice that the estimated dividends column is blue, which indicates dividends are higher than 10-year Treasury Bond interest from the onset.

Based on consensus analyst estimates of future earnings growth of 8.3%, the potential dividend income from Abbott Labs’ stock would be just over 1.8 times the riskless interest available from a 10-year Treasury Bond today. Therefore, the normally superior yield differential of the 10-year Treasury Bond does not exist today. Consequently, one of the most important advantages of diversifying a portion of your portfolio into bonds is gone, or at least severely curtailed. Click to enlarge:

Conclusions

After more than four decades as an investment advisor, calendar years 2010 and 2011 represent the only years where we have recommended a zero asset allocation to bonds. Most importantly, this is not a position that we expect to take on a permanent basis. When interest rates return to more normal levels we would be happy to once again utilize a well-designed bond strategy. In the past we managed and designed balanced accounts that we believed could realistically achieve the goals and objectives of our clients.

Our primary strategy was to ladder bonds according to where we felt the interest rate cycle made the most sense. When rates were on the low side of normal, we would shorten our ladders in order to mitigate potential bond price erosion from longer maturities. When rates were on the high side of normal, we would extend our maturities to lock in the higher yields and perhaps some capital appreciation if bonds went to premiums. But most importantly, as rungs of our bond ladder matured, we had the flexibility to reinvest our maturing bonds either longer or shorter term, once again, according to where we were most comfortable regarding the then level of interest rates.

Additionally, we had the option to allocate maturing debt into equities if valuations and yields made the most sense to us. But the most important point we are trying to make is that to us, diversification is not just about throwing a bunch of different kinds of mud on the wall and hoping that some will stick. We believe that investors should only diversify into an asset class when the underlying economics behind the asset class are prudent and make good business sense. Otherwise, we see it as an exercise in "Di-worse-ification." Considering today's interest rate levels, we are happy to own a well diversified portfolio of blue-chip dividend growth stocks across varying business sectors while avoiding bonds altogether until the interest rate environment stabilizes.

In part 2, we will review 20 blue-chip dividend paying growth stocks with yields greater than is currently available from a 10-year Treasury Bond. Additionally, we will offer further thoughts on asset allocation to include cash reserves.

Disclosure: I am long ABT.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

No comments:

Post a Comment